Two Trades To Watch: DAX, Gold - Wednesday, May 25

DAX rises after GDP upgrade. Gold awaits the Fed minutes.

DAX rises after GDP upgrade

DAX is rebounding after booking losses of 1.8% in the previous session (DAX). Fears over slowing global growth, high inflation, and ongoing supply chain disruptions hit market sentiment yesterday, pulling shares lower.

Today the DAX is attempting a rebound after an upward revision to Q1 GDP data and as consumer sentiment appears to stabilise. Although the market mood remains cautious, limiting gains.

German GDP was revised higher to 3.8% YoY, up from 3.7%. On a quarterly basis, growth was confirmed at 0.2%.

The data confirms that the German economy grew slightly in Q1 as Russia invaded Ukraine.

Separately the latest consumer confidence data shows that morale steadied near record lows reached in May.

Where next for the DAX?

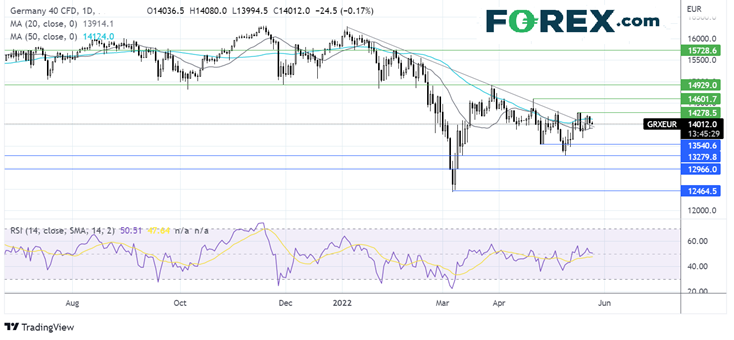

The DAX rebounded from 13280, the May 10 low, rising over the falling trendline, and is currently consolidating, caught between the 20 and 50 sma. The RSI is neutral at 50.

Buyers will look for a move over the 50 sma at 14150 to test resistance at 14280. A move above here would create a higher high and brings 14600 into focus, the April high.

Meanwhile, sellers would look for a move below 13900 the 20 sma to test support at 13550, the April low. It would take a move below 13280 to create a lower low.

Gold awaits the Fed minutes

Gold (GLD) prices are edging lower, falling from a two-week high on modest USD strength and as investors await the minutes from the May Fed meeting.

The downside in the precious metal could be limited as gold is supported by recession fears amid the worsening global economic outlook.

Fears of an aggressive Federal Reserve have eased slightly as data shows a rapid deterioration in the macroeconomic climate, prompting speculation that the US economy will fall into recession if the Fed moves too hard and fast to tighten monetary policy.

Attention turns now to the release of the minutes from the May FOMC meeting when the Fed hiked rates by 50 basis points and announced the start of the QT program.

The market is pricing in an 80% probability of two 50 basis point rate hikes over the coming two meetings (June and July). Powell has said that 75 basis points is off the table. Attention will be on the conversation surrounding the QT conversation.

Should the minutes show, a reluctance of policymakers to plan for further tightening could boost Gold.

Where next for Gold prices?

Gold extended its recovery, closing above the 20 SMA and above the multi-month rising trendline at 1853, which is now being tested as support. The RSI has just turned below 50 supporting further downside.

A break below 1853 could open the door to 1840, the 200 sma, and 1810 the May 18 low.

Meanwhile, should the support hold, buyers could look for a move towards 1890, the March low, ahead of the 1900 round number.