Tuesday Talk: Doing The Suez

As the Ever Given was finally freed toward the end of the market day in the U.S., on Monday markets in New York barely moved. The S&P closed at 3,971, down 0.09%, the Dow closed at 33,171, up 0.3% and the Nasdaq Composite closed at 13,060, down 0.6%.

Robert Schwemmer for NOAA's National Ocean Service, Wikipedia

Currently market futures for all 3 indices continue to inch between green and red. Aside from Apple (AAPL) Monday's most actives were not in the Technology sector.

Source: The New York Times

TalkMarkets contributors continue to look for positive signs in the markets as well search for low spots, many related to the continued lockdowns in Europe.

Contributor Ivan Kitov in his article Economically, Italy Dropped Into The Mid-1990s drops an additional "bombshell" of an idea suggesting that both France and Italy also, exit the EU. In particular he charts how "bad" the EU has been for the Italian economy since inception.

"Since the introduction in the EU of a monetary union (around 1995), Italy has been suffering the worst period with several consecutive economic falls. In this blog, I recommended France and Italy to leave the EU as Germany squeezes them like a python. The 2020 COVID-19 pandemic for Italy was much worse than for Germany...The COVID-19 situation in 2021 is not promising with the third wave coming before the end of the second wave. Therefore, the Italian economy has clear long-term economic and financial problems...The trend in the rate of economic growth is negative since 1970, but the years after 2000 are the worst – just above or below the zero line."

Check out the full article for Kitov's detailed charts which draw a grim picture.

John R. Mousseau in his article The Bond Market’s “Return To Normalcy” which is also a primer in bond yields, recalls how President Harding coined the term "Normalcy" and ends with a very positive list of financial indicators. The very educational heart of the article about the current and historical behavior of government and municipal bonds merits reading.

"President Warren G. Harding made the term “return to normalcy” famous in the 1920 presidential election when he used the phrase as a campaign theme, promising to bring America back to what it was prior to World War I and the Spanish Flu pandemic, which gripped the nation and the world from 1918 to early 1920. Some people said that Harding should have used the word normality instead of normalcy; but Harding, a former newspaper editor, stuck to normalcy; and the catchphrase entered the pantheon of American political slogans."

"We are “returning to normalcy” on multiple counts: in terms of overall yield, in terms of the STEEPNESS of the yield curves, in terms of getting back to positive REAL yields, and in terms of positive real yields and how tax-free bonds are being priced relative to Treasuries. We think that as we get more people vaccinated, the degree of normalcy increases...We note that while President Harding died suddenly in 1923 from cardiac arrest brought on by pneumonia, the country continued to return to normalcy under President Calvin Coolidge; and the “Roaring 20s” were born."

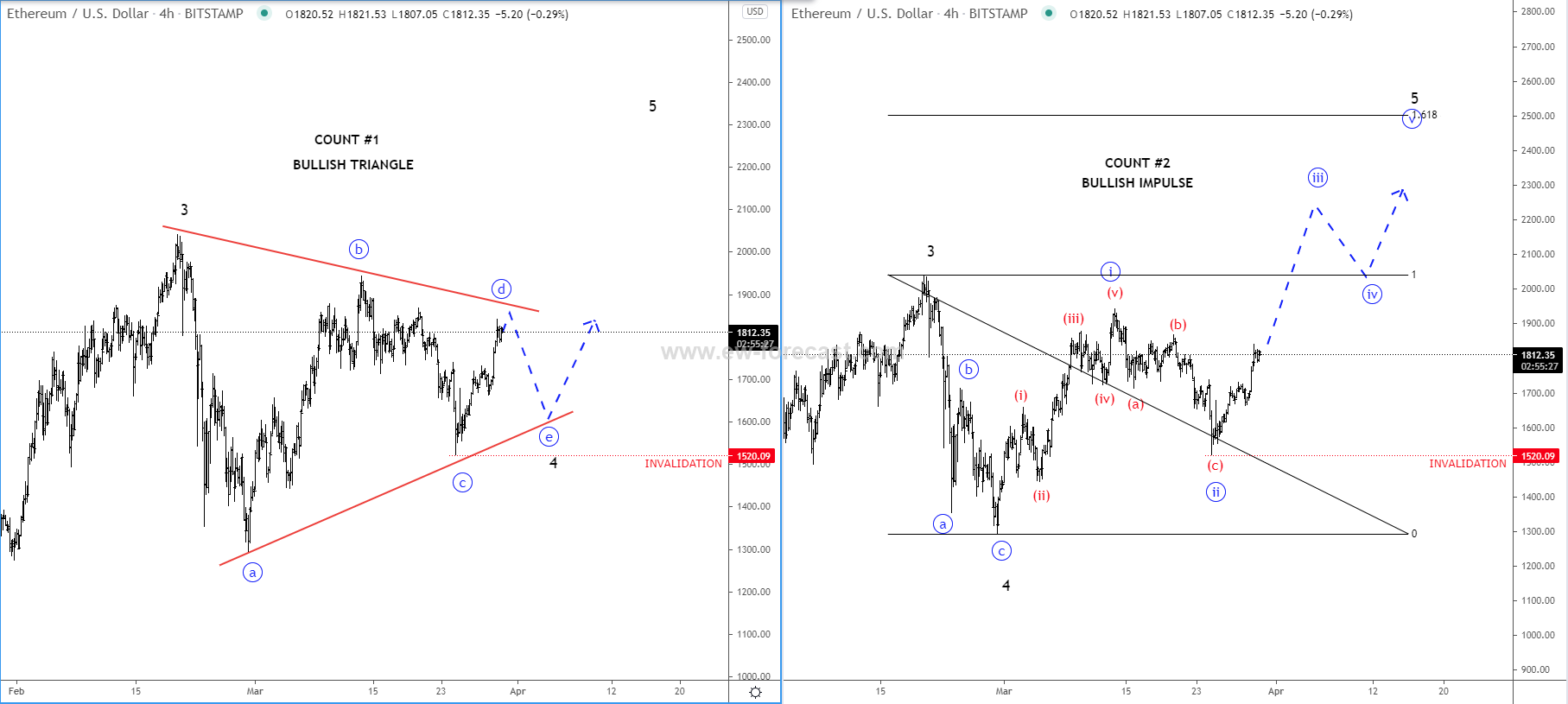

In Ethereum Remains Bullish, Gregor Horvat gives a bullish review of Ethereum (ETH-X) using Elliot Wave analysis.

"the Crypto market is in a massive rally and after recent sideways price action and corrective wave structure, seems like there's room for more gains, especially for ETHUSD in which we see a bullish development based on two different interpretations.

In the first count, we are tracking a bullish triangle formation within wave 4, where the final wave »e« is still missing before we will see a break into new all-time highs for wave 5.

In the second count, we are observing a completed wave 4 correction, which can be followed by a new five-wave impulse within wave 5 that can push the price straight into all-time highs with room even up towards 2500 area...be aware of a bullish continuation on Ethereum at the beginning of April, but only if the price manages to stay above the 1520 invalidation level."

As analysts and pundits both continue to search for the end to the current perceived downturn in Tech stocks Sweta Vijayan suggests a few good opportunities in 3 Small-Cap Tech Stocks Rated 'Strong Buy'.

"QAD Inc. (QADA)

With a market cap of $1.27 billion, QADA provides cloud-based enterprise software solutions for global manufacturing companies across the automotive, life sciences, consumer products, food and beverage, high technology, and industrial products industries...Analysts expect QADA’s EPS to improve 25% year-over-year for the current quarter, ending April 30, 2021, to $0.15. It has surpassed the Street’s EPS estimates in each of the trailing four quarters. Also, its consensus revenue estimate of $78.55 million for the current quarter represents a 6.3% rise on a year-over-year basis. The stock has gained nearly 69% over the past year and closed yesterday’s trading session at $64.36.

CTS Corporation (CTS)

Founded in 1896, CTS designs, manufactures, and sells a line of sensors, electronic components, and actuators mainly to original equipment manufacturers (OEMs) in the transportation, industrial, medical, information technology, defense and aerospace, and communications sector... A consensus EPS estimate of $0.36 for the next quarter, ending June 30, 2021, represents a 125% rise year-over-year...The company’s consensus revenue estimate of $120.92 million for the current quarter, ending March 31, 2021, represents a 17.3% rise from the prior year period. The stock has rallied 46.7% over the past year to close yesterday’s trading session at $30.36.

Avid Technology, Inc. (AVID)

With an $868.89 million market-cap value, AVID provides an open and integrated technology platform and applications and services that enable the creation, distribution, and monetization of audio and video content...Analysts expect AVID’s EPS for fiscal 2021 to be $1.14, representing an increase of 75.4% year-over-year. For the next quarter, ending June 30, 2021, analysts expect AVID’s revenue to be $88.01 million, representing an 11% rise from the prior-year period. The stock has gained 213.5% over the past year and more than 23% so far this year. It closed yesterday’s trading session at $19.53."

Read the full article for more details. Caveat Emptor.

In a TalkMarkets Editor's Choice piece from Sunday, Michael Kramer in 7 Fearless Stock Market Predictions For The Week Of March 29 takes a stab as to how the month might end and what is really causing the Volatility Index (VIX) to fall.

On the S&P:

"S&P 500 (SPY)

Despite the index closing at a new high, it didn’t pass resistance at 3,985 in the cash market after nearly falling off the cliff on Thursday morning. Meanwhile, the S&P 500 futures closed around 3,960, which I have deemed to be the very top end of the range for the S&P 500, leaving it to be tested one more time.

One more time, I will defend that as the top of the range, and one more time, the market will challenge my belief. If it fails, it fails. This 3,950 to 3,960 region has been in the upper range since the beginning of the year, and it has been a better call than most have had over this period of time. Certainly, a much harder call than saying the S&P 500 will climb to 4,400, just because.

If we finish lower on Monday than Friday’s move, higher movement would invalidated and could be seen as a rejection of the previous all-time highs, and the region at 3,960 would stick as the upper bound."

On the VIX:

"I have had so much confidence in the 3,960 level on the S&P 500 over the past few months because I believed the VIX was at the bottom of the range, around 20. But now the VIX has had its most serious test, and that is because the VIX closed on Friday at 18.9 for the second time last week.

The VIX is finally falling because we can now see implied volatility levels dropping across the market. This is because volumes are falling across stocks, resulting in market-makers reducing their options pricing. This is because the call volume in technology stocks has more than been cut in half since the beginning of February due to rising interest rates. So while some may point to the idea that the VIX is falling because the fear in the market is receding, this is incorrect. The VIX is falling because investors are fearful of buying calls. Because the call volume is falling, market-makers push implied volatility levels lower as their risk levels aren’t as high. The VIX is merely normalized as a result of fewer people trading."

Kramer continues with a look at the Nasdaq 100 (QQQ)

"This issue is now front and center in the Nasdaq 100, which has been unable to reclaim its highs and will likely not be able to do so unless those call buyers return. Remember, call buying results in the market-maker being short calls, and forces them to hedge by buying stock. That has been one of the driving forces behinds the Nasdaq’s rally. The next major level of resistance for the NASDAQ 100 is around 13,100, and then around 13,600."

The S&P closed slightly above Kramer's resistance level of 3,960 on Monday and the Nasdaq slightly lower at 13,060.

We have two more trading days to see whether March will go out like a lion or a lamb. Right now it looks a little "mmehh".

Have a good week. I'll see you next month!

I read that for every hour that ship was stuck in the canal, $400 million was lost by the shipping industry. An industry that was already reeling from the pandemic and that ship was stuck for a WEEK! I bet someone is getting fired for that!

There really does need to be a few more rules about how large ships are handled when passing through this waterway. The disaster certainly could have been prevented.