Trump's Futile Quest For A Renminbi Plaza Accord

Recent US media reports claim China may depreciate its renminbi to cope with shrinking exports. Yet, economic realities are precisely the reverse. Worse, trade wars are about to hit American consumers.

Recently, the White House lifted tariffs to 25% from 10% on $200 billion of Chinese goods, while targeting another $300 billion worth of Chinese imports for potential punitive tariffs.

As was to be expected, the renminbi depreciated from 6.7 to more than 6.9 against the US dollar, mainly on renewed trade tensions.

China retaliated by imposing duties on $60 billion of US goods, starting June 1. China could have retaliated hard, but opted for a mild response that highlights the importance of talks.

“I love the position we’re in,” President Trump said recently. Yet, the movement of the renminbi may not be to the liking of the White House since it is likely to offset the tariff impact.

Trump tariffs' impact on Chinese and Asian currencies

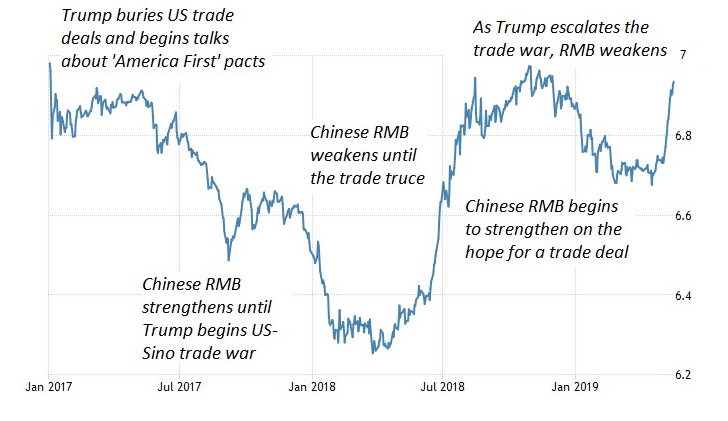

Until Trump's tariff escalation, Chinese renminbi was around 6.80 against the US dollar. That, however, was predicated on the expectation that cooler heads would prevail in the White House and a broad-scale trade war was avoidable. When President Trump opted for tariff escalation, markets reacted quite expectedly. For now, the Chinese currency has only reversed its appreciation year-to-date.

As Trump prepares to raise and broaden US tariffs even more, Chinese renminbi could depreciate more. But that is the White House’s choice, not Beijing’s preference. Indeed, Trump’s tariffs have paced the renminbi fluctuations ever since the start of his trade wars (see Figure).

Figure How Trump tariffs reverberate in renminbi movements

In light of these facts, the claim that China is depreciating the renminbi is simply flawed. Depreciation is precisely what China seeks to avoid. When exports shrink, a light depreciation of the currency is of no help. And if the renminbi would depreciate significantly in a short period of time, it would foster worries about capital flight.

That's why the Chinese government has done precisely the reverse: To avoid steeper depreciation and capital outflows, the People’s Bank of China (PBOC) recently set a stronger-than-expected daily fixing of the exchange rate. The central bank is likely to try to keep the renminbi below 7 per dollar.

The depreciation of the renminbi is in line with that of other emerging-Asia currencies that have taken hits, including Indonesian rupiah, Singapore dollar, Malaysian ringgit, the Indian rupee and the exhausted South Korean won. By the same token, Trump’s tariff escalation is likely to cause a negative spillover effect among the same currencies.

Ironically, those countries that may suffer most of the pain - Taiwan, South Korea, and Vietnam - are closest US allies in Asia, but also targets for next tariff wars. In the future, Trump seems intent to target Europe, Japan, South Korea, and emerging Southeast Asia.

Tariff wars’ collateral damage in the US

A year ago, Larry Kudlow, Trump’s director of National Economic Council, was still gung-ho about US supremacy in the tariff war. Recently, he admitted that American consumers will pay for the Trump trade wars. In the US, his reversal is seen as a betrayal of the American public, and rightly so. As Washington Post put it, “Trump’s own top economic adviser gives lie to his trade war rhetoric.”

Here are the inconvenient truths: A broad-scale trade war could penalize 0.5% to 0.8% off real US GDP growth, while earnings growth could be shaved off by 3% or more effectively halving the figure. Auto sales are a barometer of what’s to come. In 2019, Chinese auto sales could decline by 3%, but in the US by almost 4%. In 2020, US sales could remain in the red, but Chinese sales could increase – according to US data.

Unsurprisingly, several US lawmakers are finally slamming Trump’s tariff increase on China. In just a year or two, the Trump administration has committed some of the worst trade-policy mistakes in the postwar US history. The resulting economic pain will spread in America as products shipped from China arrive in about three weeks.

The fantasy about a renminbi Plaza Hotel Accord

For a decade or two, Washington has periodically used Chinese renminbi as a scapegoat to distract public spotlight away from rising economic challenges in the US. Yet, the renminbi has been largely in line with fundamentals since the mid-2010s, as the International Monetary Fund (IMF) has affirmed.

However, Trump has a more intimate interest in currency manipulation. Before his firm bought the Plaza Hotel in New York City, he monitored closely the talks that led to the 1985 Plaza Accord. The controversial pact led the US, France, West Germany, the UK, and Japan to depreciate US dollar relative to the Japanese yen and Deutsche mark by intervening in the currency markets.

It was that exchange-rate manipulation that played a key role in Japan’s subsequent containment, asset bubbles, deflation, and secular stagnation. And it is the same dream that seems to fuel the Trump trade hawks’ fantasies about China’s containment and stagnation.

Yet, China is not Japan, dreams are just dreams, and the White House is in for an awakening.

Disclaimer: Dr. Dan Steinbock is an internationally recognized strategist of the multipolar world and the founder of Difference Group. He has served at the India, China and America Institute ...

more