Thoughts On The Coronavirus, And Its Impact For Investors

The year has started full of twists and turns. We started the year on the ride of the reflation narrative from the end of 2019, but, suddenly, we hit the wall of the coronavirus.

What will be the impact of the virus?

Here I should pause and make a quick note. I am by no means an expert on pandemics. What I am about to say is based on public information and the perceived underlying trends of the current virus outbreak. However, even if I am not an expert, there is plenty of data available, and history is full of epidemic events, all of which can help us form an opinion.

The way the events are unfolding is very similar to the SARS outbreak, back in 2002. Back then, the virus infected thousands around the globe, revealing a terrifying rate of fatalities. The Chinese authorities responded, and measures like screening passengers in airports helped to control the propagation of the epidemic. In the end, the estimated impact on humans was the following:

Probable cases of SARS by country and region, 1 November 2002 – 31 July 2003.

(From: Wikipedia)

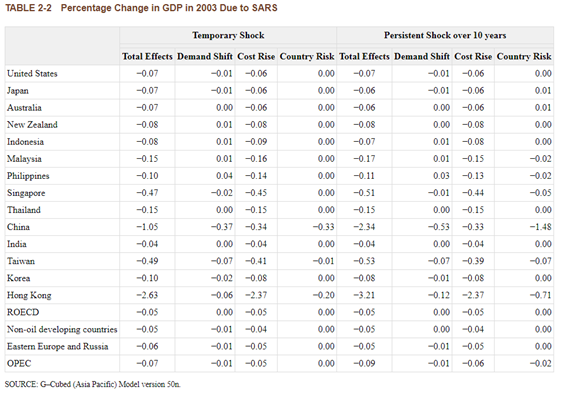

The economic impacts were big, notably, the 2.34% negative impact on the Chinese GDP.

(Click on image to enlarge)

(From: NCBI)

So, that’s the broad picture from what happened in 2020/3. What might we expect now? On a positive note, the fatality rate seems significantly lower than the SARS. Additionally, the Chinese authorities seem to have been faster and more transparent in dealing with the situation.

On the flip side, it seems that people infected, but not showing any symptoms, might spread it to others. That’s a big problem because it would mean that the screenings that authorities are applying at airports (and other traveling hubs) might not be enough to contain the contagion.

Making matters worse is the fact that China has become much more integrated in terms of transportation, which, if we add to the fact that the virus seems more contagious, means that it might surpass the number of SARS cases.

(From: poundsterlinglive.com)

It might be a simplistic conclusion, but I think that the probabilities for the present outbreak to surpass the SARS episode are high. That means that the impact on economic and business activity might be higher as well.

(Source: worldometers.info)

What should worry investors?

One point that increases my anxiety over this problem is the fact that the stock market is near all-time highs, and the end of the year rally was fast and loose. Usually, that’s a sensitive moment, because confidence tends to be critical for the boom to keep going. This virus might infect the market, making investors lose confidence.

(Source: CNBC)

Additionally, as we saw with the SARS episode, there were real effects on the economy and business. Therefore, it is plausible that during the next three months, we start seeing indicators from the Chinese economy flashing weakening signs. Business-wise, I see three main sectors that might feel the pain. I think that retail (especially brick-and-mortar exposed to China), traveling, and tourism will suffer the most. Beware of companies relying heavily on China for its supply chain.

I have tweaked my portfolio accordingly. My holdings of luxury retailers exposed to China, like Tapestry (TPR), have been cut. I’ve also reduced my positions in Chinese stocks (FXI) (MCHI), semiconductors (SOX), and auto producers.

In my opinion, brick-and-mortar retailers will suffer significantly. The presence of western luxury retailers has increased many times since the SARS outbreak in 2003. If people must stay at home, they can’t buy things. This might accelerate online retail adoption, but the question remains on whether the supply-chains can handle the dislocation. In part, because sourcing and delivery might also be affected by the lockdown. In the long term, that’s the sector where I see this episode leaving most scars and lasting dislocations.

All-in-all, I don’t expect an end-of-the-world scenario. Likely, the shocks will prove mostly temporary, and one year from now, things will be back to normal. However, with the stock market near all-time highs, it’s hard to envision a steadily rising market.

Disclosure: I have no positions in the mentioned securities. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business ...

more