The Re-balancing Act In The Aluminum Market

Aluminium demand is expected to return to growth next year for the market excluding China, while a weaker USD should also prove supportive. However, the unreported inventory overhang (ex-China market) and strong supply growth from China are a cause for concern.

As price rebounds, so does supply

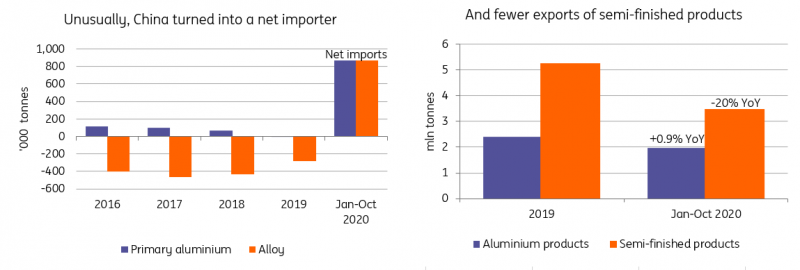

The aluminium (JJU) market has made a strong recovery in the second half of the year, with London metal exchange prices exceeding pre-pandemic levels, breaking above US$2,000/t and reaching the highest levels since November 2018. Weakness in the USD (UDN), along with a robust recovery in China, which has seen the country turn to an unusual net importer of primary aluminium and alloys has driven this rally.

The uneven recovery path of China and the rest of the world has further polarised the aluminium market, with strong supply growth in China, while we have seen a contraction from the rest of the world. Given the growth in China’s aluminium smelting capacity, this is a trend that is likely to continue next year. According to Antaike, Chinese primary aluminium production will likely rise by 3.8% YoY to total 37.3mt in 2020, before jumping a further 5.4% next year. Meanwhile, ex-China production growth is expected to contract by 1% YoY this year, before rising by 3% next year.

The geographic shift in Chinese smelting capacity from Shandong and Henan province, where we see mostly coal-fired power supply, to Southwest provinces (chiefly Yunnan) where there is more hydropower, means that the industry is gradually shifting to a lower carbon footprint. This year, a total of 1.75mt of capacity has started up in Southwest China, including capacity that has relocated, with roughly another 1.5mt in the pipeline for next year.

One of the major input cost variables, alumina prices, have remained largely depressed due to market surplus. Therefore a strong recovery in aluminium prices has left smelters with strong margins. Not only has this been incentivising new capacity to come online, but also to restart capacity. However, most restarts have occurred in China, and it’s doubtful that idle capacity elsewhere will restart anytime soon.

Looking beyond 2021, new smelting additions in China will be limited, as the ceiling for 45mt of smelting capacity will be completely exhausted. Most investments beyond this point are likely to upgrade or replace existing capacity to cleaner power sources.

A sharp reversal in usual trade patterns

This year, there have been some unusual trade flows within the aluminium market.

After being largely absent from importing aluminium in the last few years, China boosted its unwrought aluminium imports to 1mt (annualised based on the first ten months volume), which was largely driven by a positive import arbitrage. This has helped the ex-China market deal with part of its surplus. Meanwhile, China flipped into a net importer of 1.3mt of aluminium alloys (annualised). Imports of such alloys are partially compensating for lower scrap inflows, as China becomes stricter with scrap import standards. This is another trend that we expect to see strengthening going forward. That said, with more scrap (more likely lower grade) being made into alloys elsewhere (namely Malaysia), before entering China, global scrap supply chains are likely to continue to evolve.

Despite China absorbing a large part of the ex-China surplus via imports, there is still a large surplus outside of the Chinese market this year, with demand falling sharper than supply. We expect consumption to fall by 11% in 2020 before rising by 9% in 2021, while absolute consumption is only likely to return to pre-Covid-19 levels by 2022 at the earliest.

As usual, a large amount of surplus is not revealed in reported inventory figures. Instead, it goes into hidden inventories, and these are not necessarily immediately available to consumers as we suspect a widened LME market contango earlier, compounded with lower interest rates, could have seen some of the surplus being locked in for financing.

Transforming aluminium trade patterns

Trade disputes and carbon taxes

China’s exports of semi-finished products may have peaked already, with total exports falling by 20% YoY in the first ten months of the year.

This is not only because of the unfavourable market conditions from a pricing point of view but also due to the rise in trade disputes with an increasing amount of anti-dumping investigations. Meanwhile, exports of aluminium products (excl. aluminium wheels) have grown modestly. Changing trade patterns and further trade disputes could mean that China looks to move further down the value chain by boosting more value-added aluminium product exports.

We see the aluminium industry reshaping and accelerating over the next few years, so much so that we end up seeing changes to current trading patterns and potential repricing of aluminium products, particularly with the possible introduction of European carbon border adjustment mechanism (CBAM). Marginal importers of aluminium (to the EU market) with a carbon footprint above the threshold set by the European Commission will be likely charged with carbon tax based on the specific emissions level associated to the product.

According to the EU, it is planning to adopt the CBAM in the second quarter of 2021; however, some industry experts are forecasting this mechanism to start in the aluminium industry from 2023 at earliest. Based on the current proposals, there are concerns whether the CBAM alone would adequately protect carbon leakage and the scope of indirect emissions associated with aluminium productions is a particular risk due to the power-intensive nature of the electrolysis process. It remains unclear how the carbon tax surcharge would lift the product prices in the EU market, and this could be linked to another hot topic about whether there will be a premium in the near future on low carbon aluminium (carbon footprint <4.5tCO2e/t Al, Carbon Trust).

With LME proposed to launch a separate spot trading platform, it is likely to accelerate the pace within the market to detect a premium at some time.

Price Outlook

The world aluminium market will continue rebalancing next year, with ex-China demand set to return to growth. A weakening USD over the course of 2021 will also support aluminium prices, averaging a little over US$2000/t in 2021.

ING forecasts

Source: ING Research

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more