The Japanese Yen Slips Further Down The Slope Of Policy Divergence

On Thursday, the Bank of Japan (BoJ) once again confirmed it is focused on fighting deflation with every tool in its kit. From the announcement on monetary policy, the BoJ will "continue expanding the monetary base until the year-on-year rate of increase in the observed consumer price index (CPI, all items less fresh food) exceeds 2 percent and stays above the target in a stable manner." The BoJ is full steam ahead on guzzling through its cocktail of monetary measures:

- A -0.1% short-term policy rate

- Unlimited purchases of Japanese government bonds (JGBs) to maintain the 10-year yield at 0%

- On-going direct purchases of exchange-traded funds (ETFs), Japan real estate investment trusts (J-REITs), and corporate bonds

Earlier in the month, the Bank of Japan offered some observations to try to explain why Japan is not suffering the same inflation problems as Western economies.

Overall, I am amazed Japan has not yet nationalized its entire financial system at this point! The immediate result of this news was a fresh plunge in the Invesco CurrencyShares Japanese Yen Trust (FXY).

(Click on image to enlarge)

I have remained bearish on the Japanese yen, but I clearly underestimated just how much policy divergence could punish the yen, especially against the U.S. dollar. Now USD/JPY is well above the 130 level where reportedly the BoJ would become "alarmed". Having just recommitted to aggressive quantitative and qualitative easing, the BoJ seems out of position to conduct a defense of the yen anytime soon...even if it wanted to do so. Thus, I expect traders and ongoing global inflation to weaken the yen further. Now we have the 130 level to watch for potential support (or resistance after a breakdown).

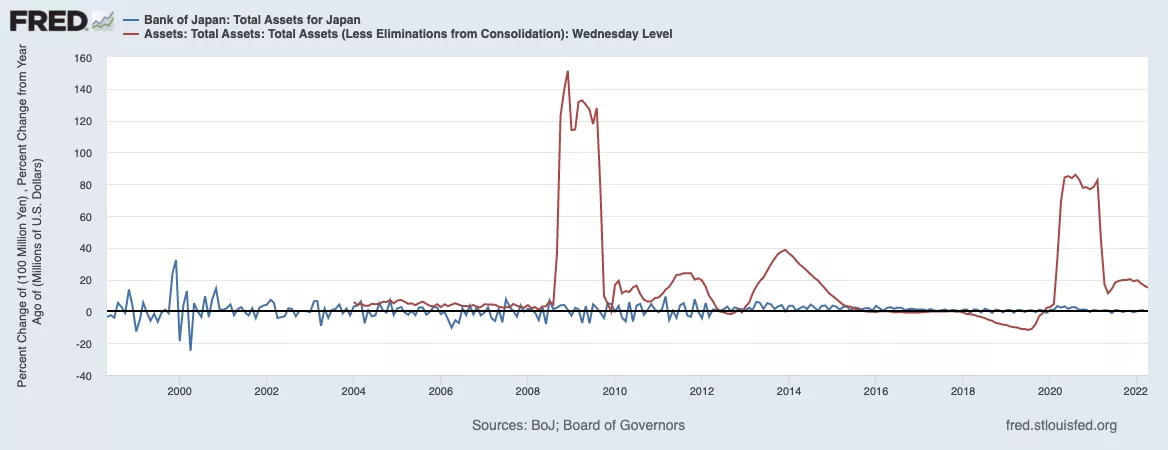

Ironically, the Federal Reserve remains well ahead of the BoJ in the "race" to grow central bank balance sheets even with today's hawkish Fed. While the BoJ has maintained a relatively steady rate, even though the pandemic, the Fed has conducted mass, episodic injections. In recent years, the Fed has only spent about 20 months actively reducing its balance sheet. The chart below compares the monthly year-over-year percentage changes in central bank balance sheets between the Bank of Japan and the U.S. Federal Reserve. In other words, the next period of significant strength in the yen versus the dollar may not come until the next financial calamity.

(Click on image to enlarge)