The IMF Shines A Spotlight On The Risks In The Emerging Markets

“We’ve gotten some bad news and the probability we’d attach to further bad news has gone up”.

Maurice Obstfeld, the IMF’s chief economist

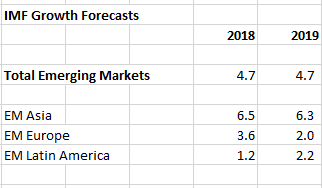

Downgrading world economic growth from 3.9% to 3.7% for 2019 does not seem worthy of headlines. Let’s see what is behind this revision and what risks lie ahead. In particular, the IMF’s forecasts were weighed down by the emerging markets (EM)s recent performance and the risk they continue to face.

We saw in the case of Turkey recently, that the surge in the USD generated higher import prices, domestic inflation, capital outflows, and the stress of managing USD-dominated public and private debts. This combination impelled Turkey’s central bank to raise rates, just when lower borrowing costs are needed to sustain growth.[1]

Now, the IMF is clearly concerned that ‘a reversal of capital flows to emerging market economies with weaker fundamentals, and higher political risk—have become more pronounced or have partially materialized.’ Accordingly, the organization cutback the outlook for some 19 countries in Central and Eastern Europe, Asia and Latin America.[2]

Developing nations, regardless of their size, are tightening financial conditions to counter capital outflows and weakening currencies. The IMF does not mince words when it claims that these financial conditions ‘constitute a potential fault line’.

Today’s announcement that Pakistan started bailout talks with the IMF is the latest indication that the EMs’ problems are not contained. Pakistan faces the problems that are all too familiar to developing nations----- an exploding trade deficit, a weakening currency and the need to finance large public capital projects.

The real crux of the IMF report is the acknowledgment that the EMs do not have adequate policy levers to combat slow growth. The IMF concludes that ‘any sharp reversal for emerging markets would pose a significant threat to advanced economies, as emerging market and developing economies make up about 40 percent of world GDP ‘. The big question is: does the Trump Administration understand the implications for the world of its trade wars?

[1] How The Emerging Markets Troubles Are Transmitted Around The World