The Global Economy Is Slowing; The Chill From The US Trade War Makes It Worse

“The main way the president can get the Fed to change course on interest rates is by doing things that hurt the economy... Of course, this is a Pyrrhic victory, since the reason the president wants the Fed to cut rates is that he hopes it will boost short-run economic performance by doing so. Instead, all he gets is a Fed that does its best to offset what he does to dampen economic performance.” (Josh Barro, Trump Can Trade-War His Way to Interest-Rate Cuts, Even Though That’s Stupid, August 2, 2019)

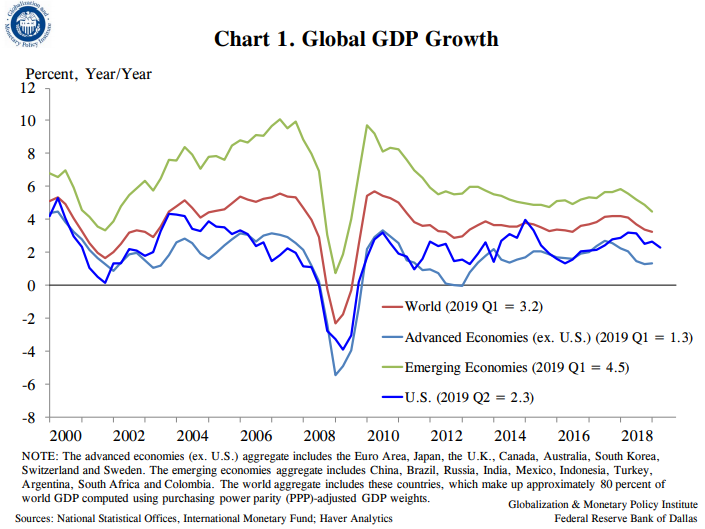

The American led trade war is having a chilling effect on the advanced economies which were already decelerating.

In addition, because the US-China trade dispute has had such a profound effect on global growth prospects, the longer-term yields on government debt around the world have dropped quite dramatically.

Economic concerns were also recently amplified when three central banks in the Asia-Pacific region (New Zealand, India and Thailand) also unexpectedly cut their policy rates due to signs of slowing growth.

Negative interest rates have become more common and are spreading throughout Europe and Japan. The yield curve also recently inverted in Canada and the US.

An inverted yield curve occurs when long-term interest rates are lower than short rates. An inverted curve often foreshadows either an economic slowdown or a recession. Considering that the global expansion is roughly ten years old, neither an economic slowdown or recession should not be too surprising.

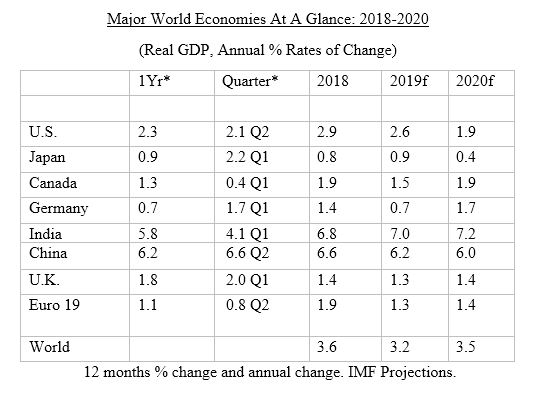

Nonetheless, the latest IMF report (World Economic Outlook, July 2019) assumes a version of a global soft landing, with no recession in sight. The IMF report has the global economy growing 3.2% this year and picking up to 3.5% in 2020. The global economy expanded by 3.5% in 2018. However, the IMF acknowledges that the projected pick up in growth next year is chancy since it is predicated on growth stabilizing in the emerging market countries and an assumed soft landing on the trade disputes.

Although there is only scattered evidence available with respect to growth in the second quarter of this year, thus far the US seems to have the most rapidly growing G7 economy, with a 2.3% y/y pace. Indeed, the IMF projections indicate that the US economy will outpace the G7 countries in 2019 and 2020, even though growth is projected to slow to below 2% next year.

The other industrial economies are growing slower than the US, with the 19 country Euro Area expanding at a 1.1% annual rate as of Q2.

Based on first-quarter data only, growth in Japan was at a 0.9% annual rate, the UK’s growth rate was 1.8%, and Germany’s was 0.7%. Canada’s economy grew by 1.3% y/y as of the first quarter.