The Global Economy Has Momentum, Even Though Uncertainty Has Increased

Despite the considerable uncertainty surrounding the longevity of the recovery, the global economy appears to be maintaining its momentum. For the most part, the global economy is providing coordinated growth in a way that hasn’t been experienced in a long time.

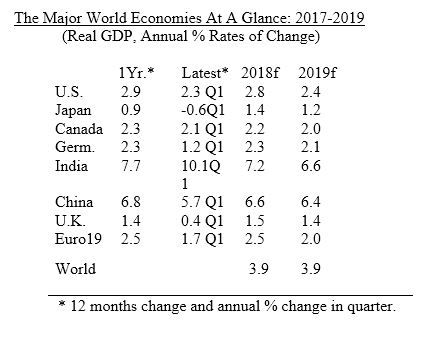

Total global growth is still expected to be around 3.9% in both 2018 and 2019. This year the advanced economies are expecting to post around 4.7%-real growth, while the emerging market countries will record a much faster 7.3% pace. A relatively similar growth pattern is expected in 2019.

Unfortunately, there are major risks on the economic horizon, with trade tensions presenting the gravest threat to the global outlook. The other major concerns are the fragile indebtedness situations of several large countries (particularly Italy, Turkey, Argentina, and Brazil) and of course, the risk of policy errors as the central banks raise interest rates.

Investors should understand that the growth momentum among the advanced economies reflects a convergence of factors that is unlikely to last much beyond next year.

Global growth became re-energized after mid-2016 and owes much to accommodative monetary policy and low-interest rates. In addition, while fiscal policies in the advanced economies was generally restrictive prior to 2016, since then it has shifted to a roughly neutral position.

While the U.S. fiscal stimulus package will certainly support economic growth in its fully employed economy in 2018 and 2019, its growth impact is expected to fade rather quickly after next year. The U.S. economy is doing rather well and did not need any additional fiscal help. Moreover, according to the Congressional Budget Office, the tax cuts along with the $1.3 trillion spending bill that Trump’s Congress passed will add some $2.6 trillion to the national debt over the coming decade.

And, as a recent IMF report emphasizes, China provided considerable fiscal support to its economy since mid-decade, but that country is also expected to reduce its fiscal stimulus in coming years.

On the monetary policy front, the Federal Reserve continues to raise interest rates cautiously and gradually, and the European Central Bank has started to taper its large-scale asset purchases, which played a critical role in supporting euro area growth.

The monetary tightening cycle has begun to spread to the emerging market countries, particularly those which are grappling with indebtedness problems and the strength of the U.S. dollar. Emerging market stocks have been pummeled lately, and the strength of the U.S. dollar gets much of the blame.

For example, India’s central bank unexpectedly raised interest rates 25 basis points to 6.25% on June 6th, its first interest rate increase since 2014. India’s move was a reaction not only to a strengthening economy (10% annual growth in the first quarter), but also is an attempt to pre-empt any spillover effect from the recent currency crises in Argentina, Turkey and other emerging market economies.

This month Turkey increased its central bank rate to 17.75%, while Argentina, which is in terrible economic shape, just secured a $50 billion standby arrangement from the IMF.

Argentina recently recorded a 26% inflation rate and a 7.2% unemployment rate. Turkey’s inflation and unemployment rates are both close to 11%.

Disclosure: None.