The ETF Portfolio Strategist: Saturday, Jan. 23

The Bull Market Revives

Equity markets around the world closed higher this week. Last week’s stumble inspired a new round of worries, but a lot can change in a week. For now, the bulls show no signs that they’re ready to throw in the towel on the post-coronavirus-crash recovery.

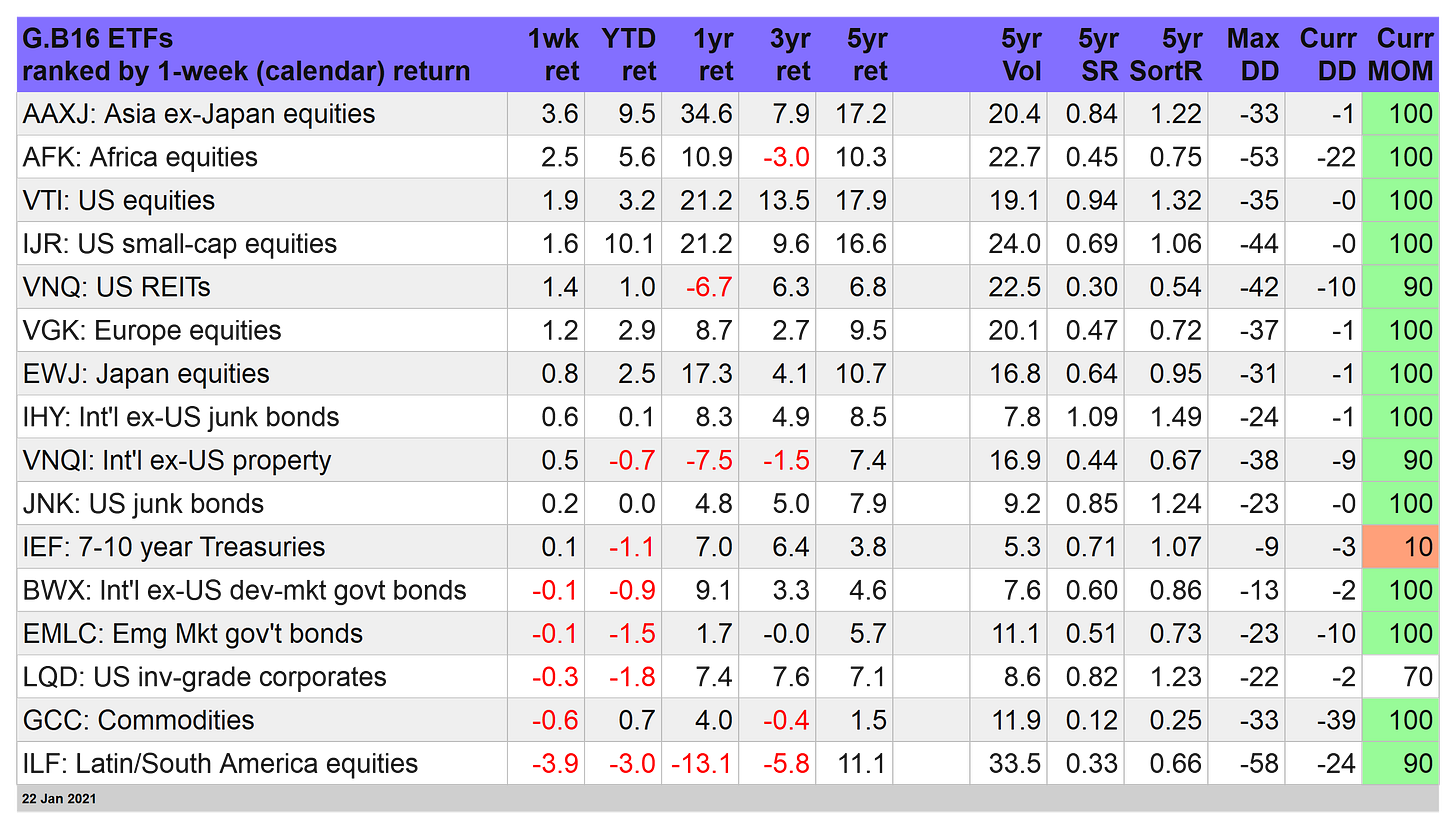

This week’s top performer: stocks in Asia sans Japan shares. The iShares MSCI All Country Asia ex-Japan ETF (AAXJ) surged, rising 3.6% this week through Friday, Jan. 22. The rally left the fund just below a record high, which was set on Thursday. Much of the fund’s upside is due to strong gains in China- and Taiwan-listed names, which represent 44% and 15% of the portfolio, respectively, as of Jan. 21, according to iShares.

Macro factors played a roll in the bubbly prices. China this week reported that its economy rose 2.3% last year. That’s a weak performance by China’s standards, but in the context of a global pandemic the gain is impressive. Indeed, the increase in output marks one of the few economies to end 2020 with a full-year expansion.

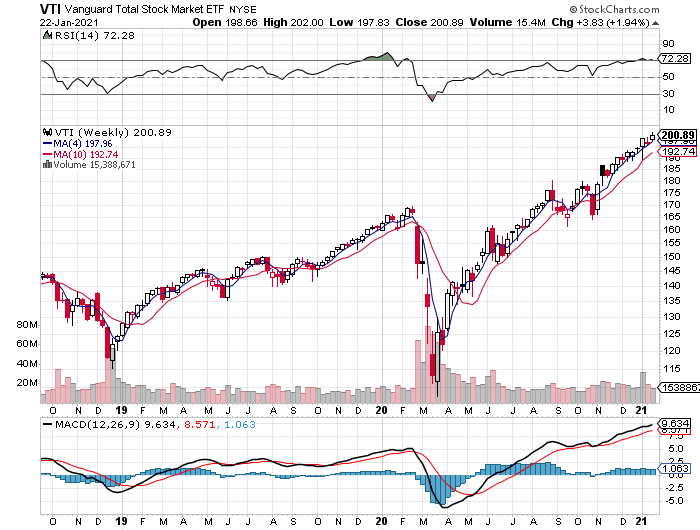

Stocks generally had a good week, including US shares, which rallied 1.9% via Vanguard Total US Stock Market (VTI). The power shift in Washington this week hasn’t rattled Wall Street, at least not yet.

By some accounts, the Biden administration’s push for more stimulus/relief is bullish for the near-term since it raises the odds that the economy will stabilize/rebound in the months ahead. There’s the question of whether we’re in a buy-the-rumor-sell-the-news scenario, but for the moment the arrival of Team Biden hasn’t frightened the bulls.

The losers this week on our list of ETF proxies for the major asset classes is limited to foreign bonds, US investment-grade corporates, commodities, and shares in Latin America, which posted the biggest decline for the fund set in the table below.

The iShares Latin America 40 ETF (ILF) tumbled 3.9% this week, adding to the previous week’s modest decline. The depth of the recent slide raises questions anew about the fund’s recovery of late. Despite ILF’s recent rally, it never regained its pre-coronavirus heights, in contrast with most of corners of the equity world. The next couple of weeks will be a test of whether ILF has the right stuff to keep the rebound alive.

US bonds were mixed this week. While investment-grade corporates slipped, Treasuries continued to stabilize. For a second week, iShares 7-10 Treasury Bond (IEF) was up fractionally.

Is this a sign that the recent rise in yields (and the commensurate fall in bond prices) has run its course? It's too soon to say, although the bearish momentum profile for IEF remains intact, as indicated by the fund’s low MOM score in the table above. Perhaps next week, the first full week for the Biden administration and its policy agenda, will drop critical clues that will shape the bond market’s next act.

Strong Gains for Strategy Benchmarks

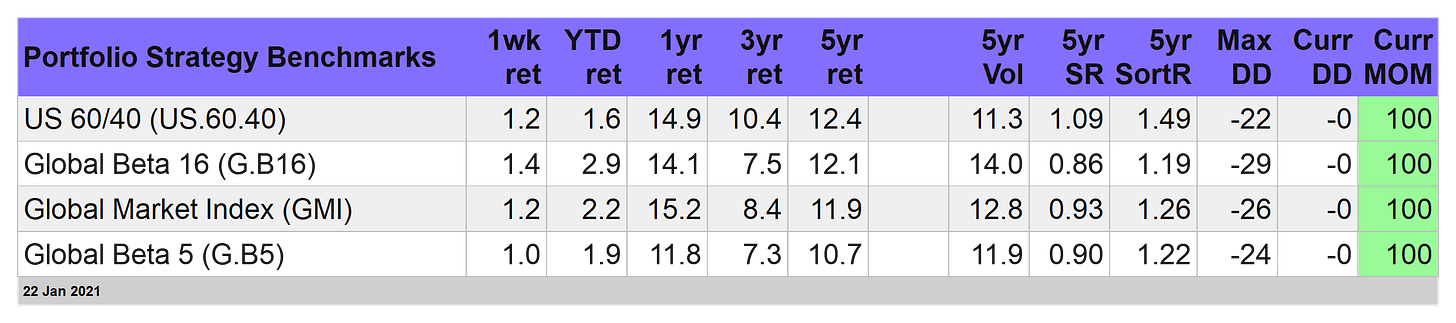

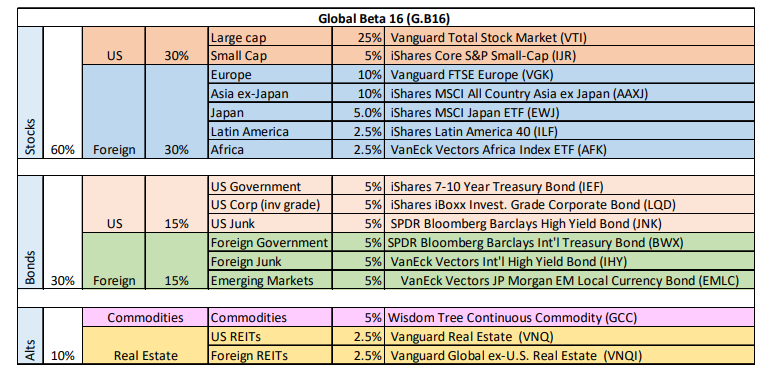

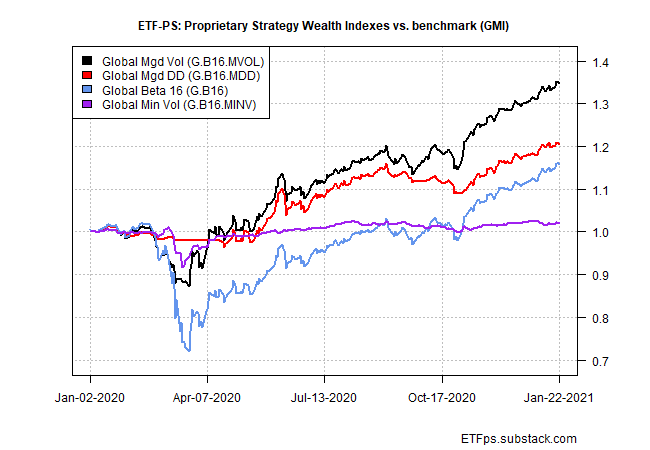

After a modest setback in the previous week, our four strategy benchmarks posted strong gains. The Global Beta 16 Index (G.B16) led the field with a robust 1.4% rally. G.B16, a global 60/30/10 mix of stocks, bonds, and alternative asset classes (commodities and real estate), regained all of its previous week’s loss and then some.

Notably, all the strategy benchmarks are again posting impressive year-to-date results. It’s still January, of course, and so there’s still plenty of room for doubt and debate about what lies ahead this year. But G.B16’s opening 2021 bid of 2.9% gain reminds that optimism is still alive and kicking.

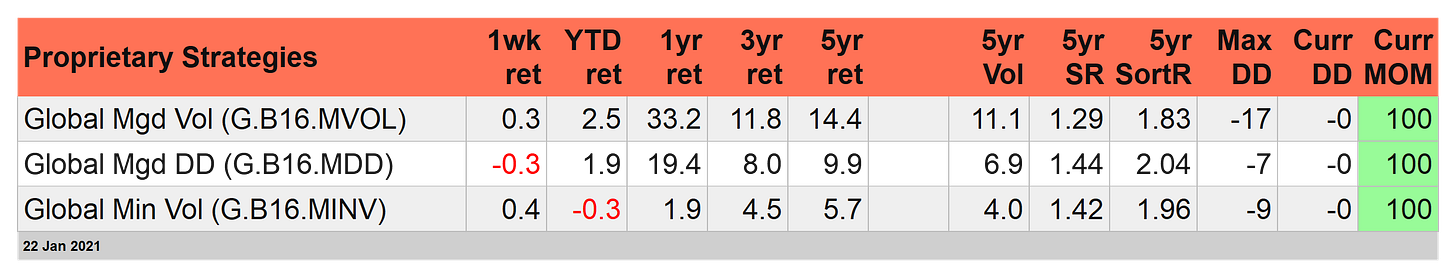

Mixed Results for Managed Risk Portfolios

In contrast with strong gains for the strategy benchmarks, our managed risk portfolios struggled this week. Global Minimum Volatility (G.B16.MINV) led in this corner with a moderate 0.4% gain, although that still leaves the strategy down slightly year-to-date.

Global Managed Volatility (G.B16.MVOL) was a close second this week with a 0.3% advance, which brings the strategy to a 2.5% year-to-date increase. Note that G.B16.MVOL is again all in with a risk-on profile after the lone risk-off bucket (commodities via WisdomTree Continuous Commodity Index Fund (GCC)) flipped.

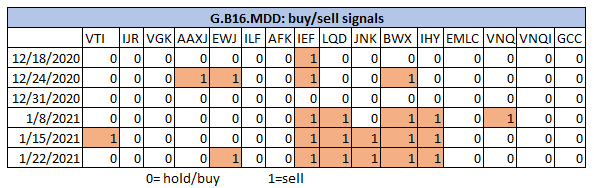

By contrast, Global Managed Drawdown (G.B16.MDD) continues to signal risk-off for nearly half of its funds. (Note: all three risk-managed portfolios use the same G.B16 opportunity set per the table above.)

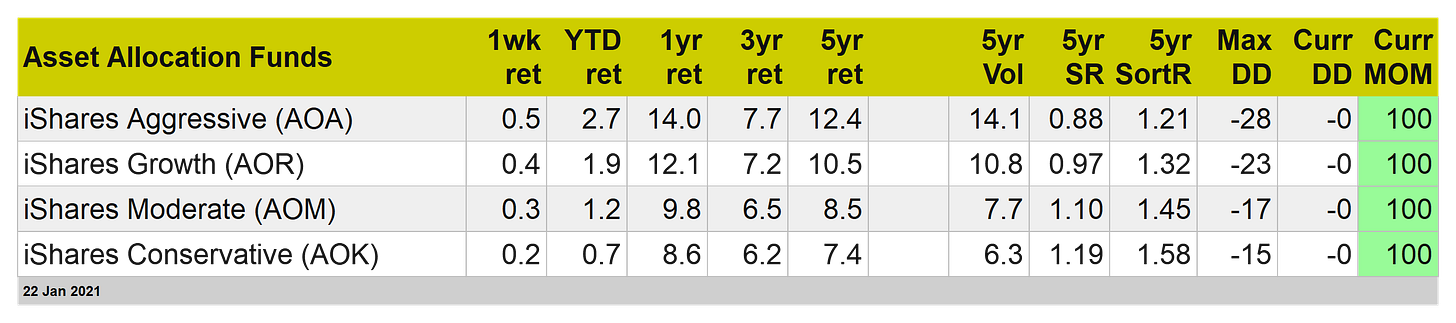

BlackRock’s four asset allocation funds rose moderately this week, albeit well behind the gains for the strategy benchmarks listed above. Nonetheless, this quartet confirmed what we saw elsewhere this week: a revival in animal spirits.

With the US election and the related mess now in the rear-view mirror, all eyes turn the new mess of governing and negotiating the details of Biden’s policy agenda in a Congress that favors Democrats, just barely.

Meanwhile, the pandemic is still raging and economic news remains mixed, which suggests that pressure for results will ramp up quickly for the new administration. As a result, next week will begin to offer a clearer measure of how markets are pricing risk amid political regime change in Washington.

Disclosure: None.