The ECB Admits That The Euro Area Economy Faces Stiff Headwinds

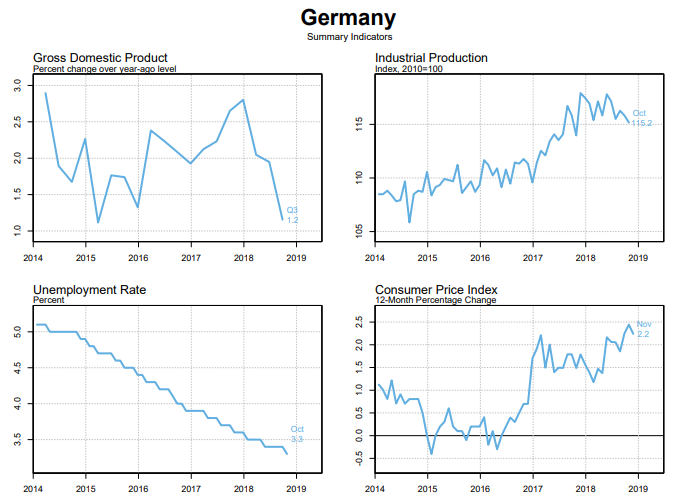

“The Euro Area’s manufacturing PMI is at its lowest level in over four years, and the services measure is at a 5-year low. The sluggishness in Germany doesn’t seem temporary after all: the manufacturing PMI contracted for the first time in four years, although services held up. Business confidence is at a 2-year low. The VDMA is seeing weaker foreign and domestic demand for machine orders. There is also uncertainty about whether or not the U.S. will introduce higher import taxes on European cars. And, although it appears that Germany just managed to skirt a recession, the fact that the “R” word is even entering the conversation is astonishing”. - (Jennifer Lee, BMMO Capital Markets Focus, Jan. 25, 2019)

Mario Draghi, President of the European Central Bank, has been forced to acknowledge that the risks to the Euro Area’s economy have dramatically worsened.

In particular, the economic slowdown in China and the threat of protectionism out of the US are curtailing Eura Area growth, which relies heavily on exports.

While low oil prices and a strengthening job market are positives, nonetheless most forecasting groups are lowering their expectations for Euro Area growth this year.

The International Monetary Fund has reduced its prediction for Euro Zone growth in 2019 to 1.6%. This year’s economic growth in Germany and Italy are also projected to slow to 1.6% and 1.3%, respectively.

While Draghi has argued that the Euro Zone escaped the risk of prolonged Japan-style deflation, nonetheless core inflation was barely above 1% when he announced that the ECB was going to stop adding new bonds.

The Euro Area annual core inflation, which excludes volatile prices of energy, food, alcohol & tobacco, stood at 1% in December 2018, the same as in November.

In other words, the ECB’s target of keeping core inflation at slightly below 2% over the medium term.is at risk this year.

As a result of these worries, the European Central Bank recently pledged to keep interest rates at record lows at least through this summer because of the rising concerns over the region’s economic growth outlook.

The ECB has also said that it is ready to use its hefty policy tools to support Europe’s softening economy, including possibly even restarting the recently shelved bond-buying program. In other words, the ECB could reintroduce quantitative easing again in a worst-case scenario.

The European Central Bank formally ended its post-crisis phase bond buying last year, and its purchases fell from 15 billion euros a month to zero as of December of 2018.

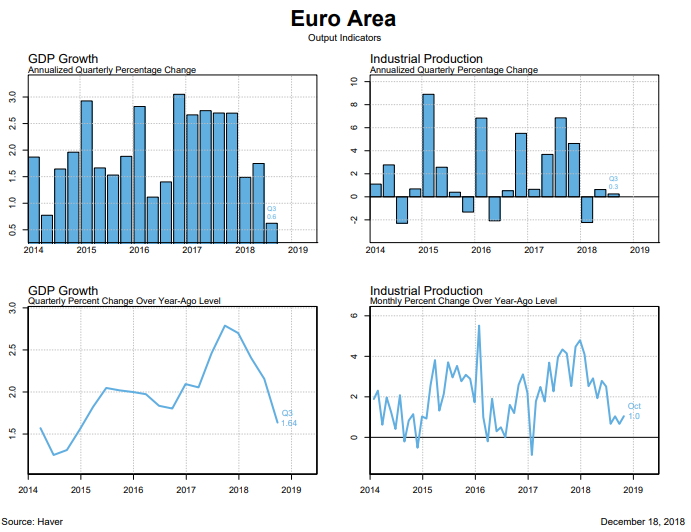

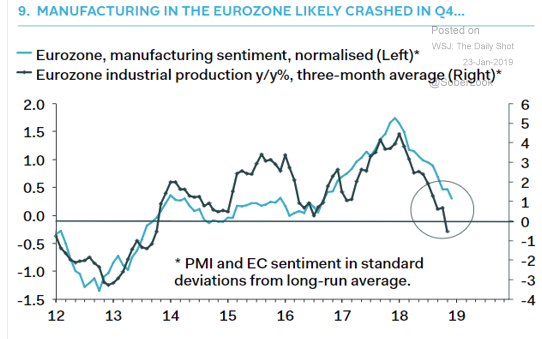

As the following chart illustrates, the Euro Area’s industrial production has slowed sharply on a year-over-year basis in the final quarter of 2018.

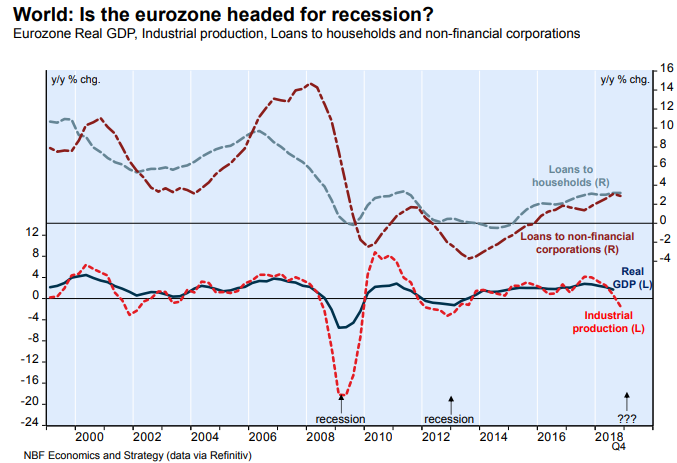

And as a National Bank report points out (Jan. 15, Hot Charts) “the last two times this happened (2008 and 2012), the common currency area eventually fell into recession.” See the second chart which follows.

Nonetheless, unlike 2008 and 2012, loans to households and non-financial corporations in the Euro Area continued to expand strongly last year.

Such positive loan growth is usually a precursor for healthy consumer spending and business investment.

(Click on image to enlarge)

(Click on image to enlarge)

Germany’s Economy Is Also Facing Stiff Headwinds Because Of Declining Exports To China

(Click on image to enlarge)

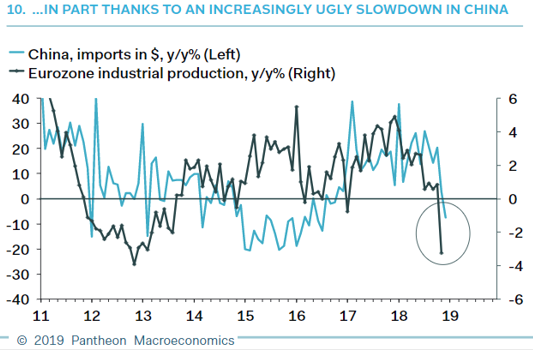

China’s Economic Slowing Has Spilled Over Into The Euro Zone

“Any significant growth recession in China would hit the rest of Asia hard, along with commodity-exporting developing and emerging economies. Nor would Europe – and especially Germany – be spared”. - (Kenneth Rogoff, Risks to the Global Economy in 2019, Project Syndicate, Jan 11, 2019)

The Euro Area economy was slowing down towards the end of last year, and China’s recent growth slowing has been one of the key drivers.

(Click on image to enlarge)

(Click on image to enlarge)

Disclosure: None.