The Canadian Bond Market Has Fully Adjusted To Future Inflation Expectations

Photo by Tech Daily on Unsplash

During the Clinton Administration, James Carville famously remarked that ‘if there were such a thing as reincarnation, I would like to come back as the bond market”. In the 1990s bond yields often moved up sharply as a warning to the government to manage to spend better, lest inflation gets out of hand. Today, the bond market is playing a different role in warning policymakers that aggressive rate increases will, in short order, produce a recession. The yield curve is either flattening or outrightly inverting. In either case, the bond market is signaling that a recession lies on the horizon.

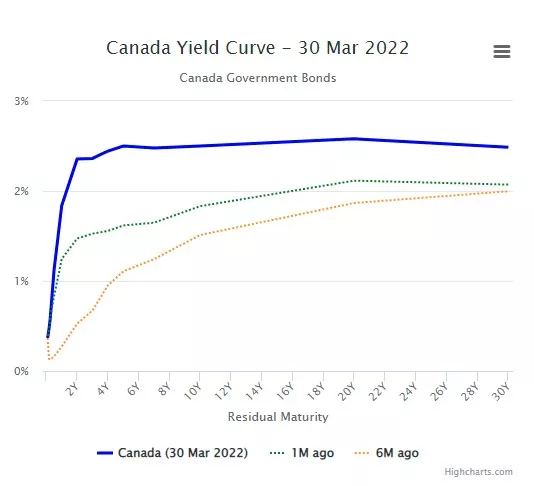

The entire landscape of the yield curve has changed dramatically. About 6 months ago, the Canadian 2-year yield stood at 0.5% and the 10-year rate at 1.5%----the normative positively sloped curve. Today, the 2-year rate stands at 2.3% and the 10-year rate at 2.5%, hence the entire burden of adjusting to inflation falls on the shoulders of the two-year yield (Figure 1).

This debate regarding inversion will continue and, frankly, is somewhat sterile since various rates could be subject to random movements that do not lead to a meaningful conclusion. However, what is important to note is that the yield curve has flattened and is expected to remain so indefinitely. Put differently, bondholders believe they are adequately protected over the next decade against inflation.

Figure 1 Canadian Yield Curve, March 29, 2022

Source: http://www.worldgovernmentbonds.com/country/canada/

Canadian bank economists continue to anticipate that the Bank of Canada will hike rates well into 2023 as part of its strategy toward normalizing rates. The CIBC anticipates the BoC will raise its overnight policy rate 7 times in increments of 25bps by September 2023 (Figure 2). However, the bond market has taken all these rate hikes fully into account. The 2-year rate, currently at 2.36% will reach its zenith during this rate cycle of 2.5% by September 2022. According to the CIBC economists, the 10-year rate will continue to move up slightly, but ultimately be slightly lower by September 2023 than today. Putting aside the specifics of these forecasts, the main point is that those purchasing Canadian bonds today will not be subject to any capital losses over the next 18 months.

Figure 2 Canadian Interest Rates, 2022-2023

Source: CIBC, Economics

If capital losses are not expected, what about the prospect of capital gains? At almost every turn, we see that future growth is threatened. Rising food and energy prices are two of the greatest threats consumers have seen in a generation. It is highly questionable if central banks should raise rates aggressively at a time when supply constraints restrict world trade. Moreover, COVID-19 is not finished-----witness China’s severe lockdown affecting its major manufacturing and commercial centers. Quite plausibly, hiking interest rates in the face of these threats to economic growth will, indeed, result in recession. Hence, the purchases of long-dated bonds may well turn out to generate outsize returns over the next few years.

Disclosure: None.