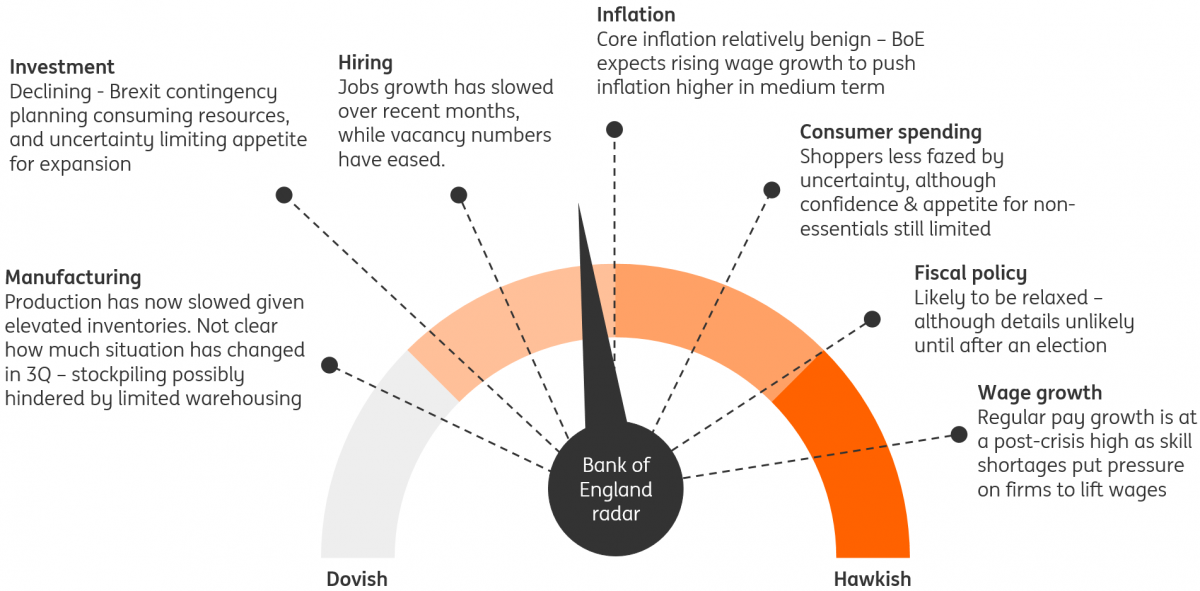

The Bank Of England’s September Dashboard

Despite recent moves by the Fed and the ECB, we think it's too early to be penciling in UK rate cuts and we suspect the Bank of England will retain its notional tightening bias tomorrow. But with Brexit uncertainty still very much alive, we'd expect policymakers to strike a cautious tone. We expect rates to remain on hold for the foreseeable future.

Source: Bank of England

Bank of England to keep rates on hold and retain cautious tone

Thursday's Bank of England meeting will be another awkward one for policymakers. While the Bank's forecasts from August point to a need to tighten policy further, they are premised on the idea of a smooth Brexit - something which despite the past couple of week's events, still seems like a long way off.

That said, with wage growth close to post-crisis highs, we think the Bank will retain its notional tightening bias again at this week's meeting - a loose signal that if Brexit were to calm down, markets may be underestimating the potential for hikes. To us, this emphasizes that it's too early to be penciling in UK rate cuts.

But with investment under pressure, and a 'no deal' Brexit still posing a risk (even if the chances of it occurring in October have fallen), we think policymakers will still opt to strike a cautious tone this week. The prospect of further tightening still seems very distant.

Brexit still a considerable headwind for the Bank of England

On the face of it, the Brexit story looks a little less negative than it did back in August. The risk of an imminent 'no deal' Brexit has undoubtedly fallen since policymakers' last gathering. Parliament has since passed a bill designed to force an Article 50 extension should the government fail to get a Brexit deal approved by lawmakers.

This has been a key factor in lifting investors' interest rate expectations over recent days. Markets no longer expect a rate cut within the next year, and in fact, are not fully pricing in any move at all within the next three years.

However, Brexit still poses a clear risk to the outlook. The path to getting a revised Brexit agreement from the EU, and then gaining majority support for it in parliament, still looks incredibly fraught despite more positive noises from the UK government over recent days. We continue to think an election before the end of the year is highly likely. This would have to be coupled with another Article 50 extension, which we suspect would most likely last into the early stages of 2020. The EU has recently signaled it would most likely be open to a further delay.

Importantly, this means that a 'no deal' exit is still a possibility further down the line, particularly if the Conservative party were to regain an outright majority at a general election (although as we explored in more detail recently, the result of an election would be almost impossible to predict given the current volatility in UK political polls).

Bank of England September dashboard

(Click on image to enlarge)

Source: ING

Rising wage growth suggests rate cuts remain unlikely for now

Having said all of that, we agree with the current market view that rate cuts are unlikely to materialize in the foreseeable future. We expect the Bank to retain its notional tightening bias again this week, and a key reason for that is wage growth.

Regular pay is growing close to its post-crisis high, and while this has been partially boosted by some public sector gains, much of it has to do with skill shortages in various parts of the private-sector jobs market. For the time being, this trend looks set to persist given that we suspect it is as much structural as it is cyclical in nature. We, therefore, think the Bank will be inclined to look through the latest dip in core inflation.

The economy also looks set to avoid a technical recession during the third quarter - although getting a clean-read on growth is not straightforward given the swings in inventory over recent quarters. Some of the stockpiles that built up over the first quarter appear to have unwound in the second.

Since then, July growth rebounded and it's likely that August GDP may also have performed solidly too. Don't forget that many firms brought forward their annual factory shutdowns (for re-tooling/maintenance etc) from August to April as a cushion against the original 'no deal' risk. The result is that production will likely be higher than it would normally have been over the summer period.

Investment downfall suggests the Bank of England to stay cautious

However, if we dig deeper, the underlying trend in growth still looks fairly lackluster. While consumers appear less fazed by the Brexit uncertainty, consumption posted fairly solid gains during both the first and second quarters and investment has resumed its downward trend.

We suspect this is partly because many firms are directing resources at Brexit contingency planning activities, drawing money/people-power away from possible investment projects. Equally the combination of Brexit, but also global growth, uncertainty is limiting appetite to expand.

With this in mind, we expect policy rates to remain on hold for the foreseeable future. While the Bank is likely to maintain its forward guidance on interest rates (tightening bias), we'd expect the overall tone to remain cautious on Thursday.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more