The Bank Of Canada Introduces Ambiguity Into Rate Policy

The Bank of Canada moved off a measure of certainty regarding rate hikes to a measure of considerable doubt, according to the most recent speech by Governor Poloz[1]. The Governor said the path toward higher interest rates is “highly uncertain”, citing worries about housing and business investment. Yet, virtually in the same breath, he stressed that borrowing costs eventually will need to go higher.[2] How are we to interpret this mixed message?

The speech did not get into specifics about the economy, other than to point to the obvious weakness in the oil industry and the fact that business investment has not panned out as the Bank anticipated. Somewhat on the defensive, the Governor argued that the five rate increases since mid-2017 were necessary. But he was quick to point out that the Bank has been on hold since October last year, mainly out of concern that consumer indebtedness was too high. More importantly, the Governor made it quite clear to Canadians that they should be prepared for a neutral bank rate, somewhere in the range of 2.5% to 3.5%. The Bank has been buoyed by surveys on capital investment intentions and a strong belief that exports would be one of the driving forces behind further economic expansion.[3]

Again, there is a mixed message when Poloz avers that “we expect investment spending to regain momentum in 2019, especially in light of the government’s new accelerated capital depreciation rules. However, we must acknowledge that the future of the global trade environment is highly uncertain right now.“If the trade environment is so uncertain, why would the Bank expect entrepreneurs to step up business capital formation? Given the recent disappointment in business investment in the United States after the passage of a huge corporate tax cut, Canada’s accelerated depreciation allowances will not generate the stimulus needed to boost growth.

Ironically, the Governor highlighted that housing activity is “a little weaker than we expected”. A major contributing factor to the slowdown in housing is the introduction of new mortgage rules, at the instigation of the Bank, that makes it much tougher for new owners to purchase homes.

(Click on image to enlarge)

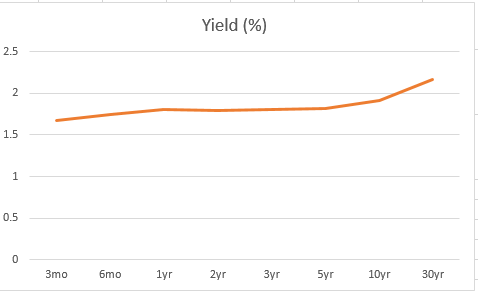

Canadian Govt Bond Yield Curve

In contrast, the Canadian bond market does not share any of the Bank’s angst regarding the future of interest rates. With the 6- month and 5-year rates trading at an identical yield of 1.8%, bond investors have adopted the view that the Bank rate will not even reach the lower bound of “neutral”. The bond market is not ambiguous regarding the path of rates. Inflation is not a threat and real rates of interest will continue to be around the zero mark.

We have what is often referred to as the “one-handed “economist. On the one hand, the Bank does not see a clear path pointing to higher interest rates. On the other hand, the Bank has not dropped its narrative that rate hikes are necessary and we should anticipate returning to neutral. Ambiguity is the last thing investors want to hear from a central banker.

[2] BoC Stubbornly Clings To The View That Rates Have To Rise

[3] Canadian Lagging Exports And The Future Of The Canadian Dollar

A thoughtful and clear explanation of why the BoC is on hold

I thinh the bank should drop this idea of neutral rate. After 10 years where the actual rates are do far below that rate

It is a pipe dream....

Neutral is just another word for recession. Especially going past the neutral rate. Workers benefit from being below or at the neutral rate. But it fluctuates, right Prof? So, how does one know where they are? It sounds like the Bank of Canada is going to eventually take down the housing bubble unless it loses its will to do so. And what happens if the low long bond yields have nothing to do with the growth of the economy but are an effect of massive usage of bonds as collateral? I wish economists would start measuring this. Liberty Street has done some of this work in revealing this conundrum.

Gary, I do not follow your point that " neutral is just another word for recession." i know the BoC uses the term to describe the rate of interest that would give rise to full employment and 2% inflation. The figure Poloz uses is a range 2.5%-3.5% which means it is just a notional number. Where the number comes from is a total mystery --- someone just made it up. Poloz is very focused on the real rate of interest which in Canada is still negative.And that is why he goes for the neutral rate which results in a positive real rate. The entire industrialized world has negative real rates, so why is he so reluctant to accept.

Poloz lives in Ottawa where there was no huge increase in housing costs. He has no clue how tight housing is the major centres, like Toronto. The market is totally driven by land constraints and not be interest or cap rates. So, housing in Toronto is still very tight and prices are firm and supply is low which accounts for unit sales been off from the highs. It is very expensive to buy or sell in this kind of market ( land transfer taxes and agent fees are about 6% of total costs). With an election coming in Oct, the BoC and Fed govt will likely relent on some of the mortgage rules.

Long bond yields in Canada have no term premia since the demand is strong domestically.Long bonds are in tight supply because the Fed govt uses the short end of the market for most of its financing ( under 3 years )The Fed deficit is low ( 3% of GDP compared to the US's 6% ). Canada has a higher bond rating than the US so issuance is no problem.

Can you point me to the Liberty Street studies?

Hi Prof,

Yes, I wrote about the Liberty Street issue with a link to their work. I called them the Liberty Fed boys and referred to an article from the Liberty Street blog. Again, whether they get it right, with the numbers, they know something is acting upon long bonds that has nothing to do with the bigger economic picture. Let me know what you think. I hope it stirs some interest in the community of economists: talkmarkets.com/.../bond-vigilantes-liberty-street-fed-collateral-study-and-art-cashin

I find it hard to imagine that long bonds are used in repo markets because long duration means more volatility. It is safer to use short duration for collateralized loans

My belief is traditional...no inflation and the need for bonds by institutions leads to low term premia. I think Cashin is an example of a player who has hard time with flat yield curves but if he were to look at history there are many periods with flat curves