Thailand’s External Trade Ends 2020 On A Positive Note

Thailand's worst year seems to be over. But with persistently weak domestic demand and lack of tourism, the Thai government’s view of the economy bouncing back by 3-4% in 2021 hinges on vigorous export recovery. We're quite skeptical.

Source: Shutterstock

First positive growth in months

Year-on-year export growth in most Asian economies surprised on the upside in December, which is why we expected Thailand’s exports to join the crew too. And we were right.

Exports turned a corner to positive territory in December, rising by 4.7% from a year ago after contracting by -3.7% in November surpassing our forecast of 2.0% YoY growth and the consensus view which was centred on continued contraction. The December data ends the negative export growth streak that was in place since May 2020.

Exports ended the negative growth streak that was in place since May 2020.

Among the key export drivers, electronics staged a strong rebound by 15.9% YoY (prior -1.4%), agricultural products posted a modest pick-up by 2.1% (prior -2.4%), but automobile and parts exports softened by -0.2% (prior 1.6%).

Imports followed exports on the growth path too, posting a 3.6% YoY growth in December after having a slightly longer negative stretch than exports. Capital goods and raw material imports stood out with 8.9% YoY and 11.2% growth respectively.

The trade surplus jumped to $964 million from $53 million in November, which was the lowest monthly surplus in 2020.

The worst year is over

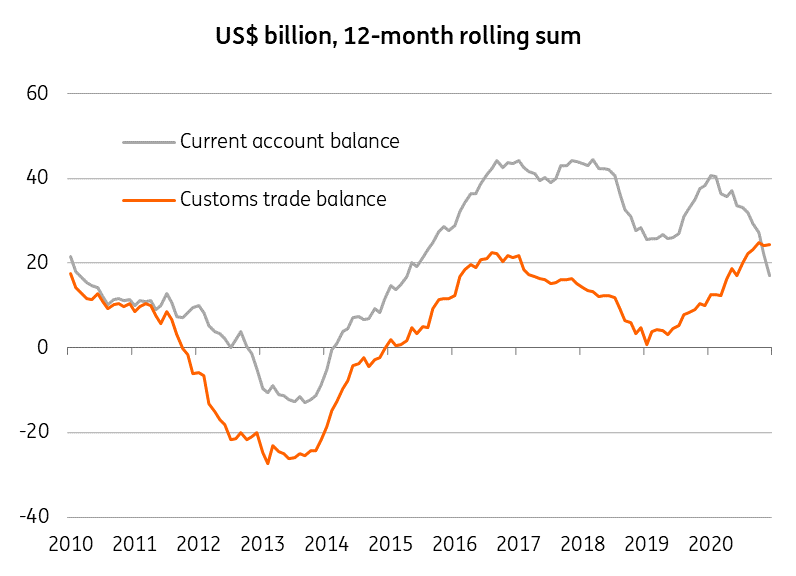

December data brings FY20 export contraction to -6.0%, and import contraction to -12.4%, which caused a sharp widening of the annual trade surplus to $24.5 billion from $10 billion in 2019.

However, a large trade surplus wasn’t enough to offset Covid-induced dent to services inflow, resulting in a significant narrowing of the current account surplus in 2020. The cumulative surplus of $17 billion in the first 11 months of last year was almost half its level a year ago (December data is due next week, 29 January).

Looking ahead, with persistently weak domestic demand and lack of tourism the Thai government’s view of the economy bouncing back by 3-4% this year hinges on vigorous export recovery but we're sceptical.

Trade and current account balances

Source: CEIC, ING Bank

A resilient currency

Falling current surplus has been the main drag on investor sentiments towards the Thai baht (THB) recently, alongside authorities talking down the appreciation pressure to aid potential export and tourism recovery. Even so, the currency has been pretty resilient to these developments, partly to a broader emerging market rally since June last year.

The markets continue to defy the authorities' efforts to curb the THB strength.

Staying on course to curb currency appreciation pressure, the Bank of Thailand launched fresh measures earlier this month allowing non-financial companies with trade and investment in Thailand to manage currency risks and THB liquidity more freely. Like many of these measures, we're doubtful of this working too.

The USD/THB exchange rate has been steady around 30.0 since December - and we see it continuing to hover around here in the months ahead until the Covid-19 situation stabilizes. Our end-2021 forecast for this pair remains at 29.3 (spot 30.0).

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more