Thailand: July Trade Signals Good Start For Economy In 2H 2019

One month of trade outperformance doesn’t make it a trend though, especially when persistent external risks and anemic domestic demand continue to hinder the upside growth potential of the economy.

Source: Shutterstock

Low base effect lifts annual growth

In a big upside miss, Thailand’s external trade swung back to growth in July after several months of contraction this year. Exports rose by 4.3% year-on-year and imports by 1.7%, against consensus estimates of a 2% and 6% contraction respectively.

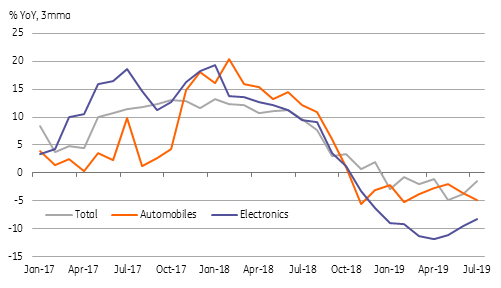

However, a positive swing in exports from 2.9% YoY fall in June rather tells us more about what happened a year ago – a low base effect from a big month-on-month (MoM) fall in July 2018, while key drivers of automobiles and electronics with a combined weight of about 30% continued to hold down the headline export growth. Electronics were down by 5% MoM and autos and parts by 2.5%.

Autos and electronics have been key export drivers

Source: Bloomberg, CEIC, ING

Good start for the economy in 2H19

But even bigger positive swing in import growth, to +1.7% YoY from -9.7% in June, lift hopes of some recovery in domestic demand. Growth of all key import segments – fuel, raw materials, capital goods, and consumer goods – improved, though this was also associated with a sharp narrowing of the trade surplus to $110 million in July from $3.2 billion in the previous month.

Data puts year-to-July export growth at -1.9% and import growth not far apart from that at -1.8%, down sharply from +11.1% and +9.5% in the same period of 2018. But the $4.1 billion of cumulative trade surplus through July was little changed from a year ago to sustain positive sentiment toward the Thai baht (THB).

Still, the economy is in need of more stimulus

One month of trade outperformance doesn’t make it a trend though, especially when persistent external risks and anemic domestic demand continue to hinder upside growth potential in the periods ahead. However, just as with trade growth, we see a favorable base year effect preventing further slippage in GDP growth in the rest of the year from a 5-year low of 2.3% YoY in 2Q19.

Indeed, the Bank of Thailand (BoT) minutes of the recent policy meeting on 7 August released today reinforced the need for continued policy support for the economy going forward. Supporting the decision of a 25 basis point rate cut at that meeting, the minutes noted, “Most Committee members viewed that more accommodative monetary policy would foster the continuation of economic growth and the return of headline inflation to target in the context of heightened uncertainties mainly from external factors”.

While we expect the BoT to cut rates again this year, at least by 25bp, if not more, hopes also remain pinned on fiscal stimulus. The Thai cabinet has just cleared a $10 billion stimulus package, likely lifting growth by 0.5-0.6%. Still, it seems a tough ask for the economy to outperform the 3% "new-normal" growth rate of recent years.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more