Thailand: Has GDP Growth Really Bottomed?

Headline GDP growth improved slightly in the third quarter but the main GDP drivers are still missing in action. We think the Bank of Thailand will use firmer growth as an argument for leaving policy on hold in the rest of 2019 and throughout 2020.

Source: Shutterstock

Barely an acceleration

Thailand’s economy expanded 2.4% year-on-year in 3Q19, a slightly better rate than 2.3% in 2Q. It was still short of the 2.7% median expectation in the Bloomberg survey. 0.1% quarter-on-quarter (seasonally adjusted) growth moderated from 0.4% in the previous quarter, which was the slowest pace in the last four quarters.

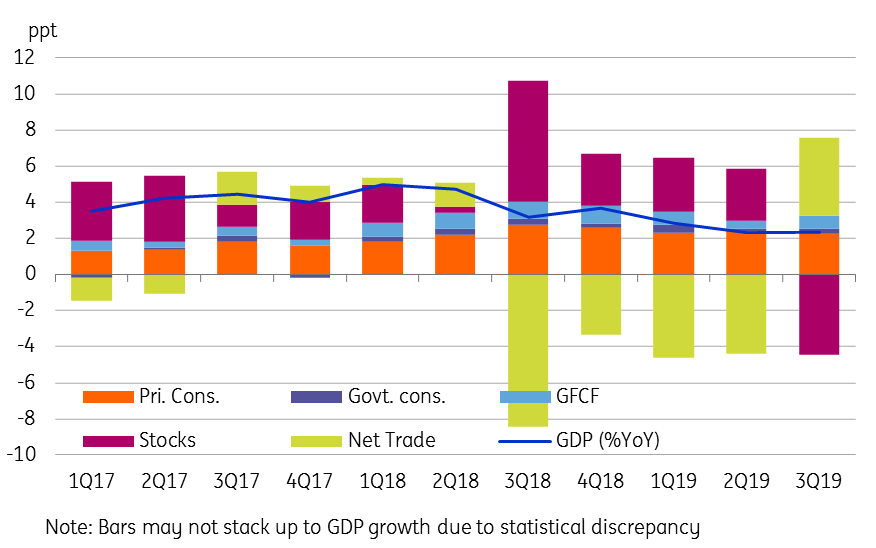

Net exports displaced domestic demand as a driver of GDP growth. A 4.3 percentage point contribution of net exports to yearly GDP growth was a significant shift after large drags in the previous four quarters. However, that’s not a particularly healthy sign because it just mirrors the weakness of domestic spending denting imports of goods and services. This is further reflected by the shrinking private consumption contribution to GDP growth.

In a hopeful sign of stimulus kicking in, growth of government spending improved to 1.7% YoY from 1.0%, though in terms of the actual contribution to GDP growth, it's still a weak link. One small silver lining in what was otherwise a fairly dismal set of numbers was signs of some recovery in fixed capital formation growth.

From the industry side, manufacturing remained one of the main drags on GDP growth, but it was offset by firmer growth by agriculture, mining, and services.

Sources of year-on-year GDP growth

Source: Bloomberg, CEIC, ING

Growth forecast downgrades

We don’t read the slightly better third-quarter growth numbers as signifying that the worst is over. Nor do we see it preventing a further downgrade of the official growth outlook. Just recently, a top Bank of Thailand (BoT) policymaker, Deputy Governor Mathee Supapongse, flagged a further cut to their GDP forecasts for this and next years' 2.8% and 3.3% respective forecasts - coming at the next policy meeting in December.

Year-to-date GDP growth of 2.5% is still falling far short of the central bank’s forecast for this year, while hopes of any big bounce in the fourth quarter remain unlikely amidst the significant political headwind to fiscal stimulus (stiff opposition to the ruling administration), strong currency (THB) hurting exports and tourism, and lack of improvement in external trade environment. We recently cut our 2019 growth forecast to 2.3% from 2.5% and that for 2020 to 3.0% from 3.3%. We stand by our revised forecasts.

A policy dilemma

Deputy Governor Mathee Supapongse also suggested that there was room for further monetary policy easing after a 25 basis point cut in the policy rate at the meeting earlier this month.

We remain skeptical about further BoT easing from Asia’s arguably most hawkish central bank. The latest cut has pushed the policy rate to its lowest level ever, 1.25%. We anticipate that there will be stiff resistance from policymakers to nudge it further, and these latest GDP data may be put forward as one reason for them to leave rates unchanged.

If any strong argument for lower rates is left, then it’s the need to curb THB appreciation, though small rate cuts are unlikely to go far in reaching this objective, while macroprudential measures to curb inflows also are failing.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more