Thailand: Better GDP Growth, Lack Of Spending Drivers

An ongoing overhang of global trade restrictions on exports and elevated political uncertainty domestically weigh on GDP growth in 2019. We maintain our view of no more policy moves by the BoT this year.

Source: Shutterstock

Above-expected 4Q18 GDP growth

Surpassing expectations, Thailand’s GDP growth accelerated to 3.7% year-on-year in the fourth quarter of 2018 from a three-year low growth of 3.2% (revised from 3.3%) in the previous quarter. A low base effect may have helped an improvement in annual growth but it wasn’t just that. The 0.8% quarterly (seasonally adjusted) expansion followed flat GDP growth in the third quarter. The consensus estimates were centered on 3.6% YoY and 0.7% QoQ growth.

As expected, an improvement in manufacturing growth (3.3% YoY vs. 1.6% in 3Q18) stood out, explaining all of the 0.5 percentage point (ppt) recovery in headline GDP growth. Services remained the biggest source of GDP growth, though its 2.7ppt contribution was little changed from the third quarter.

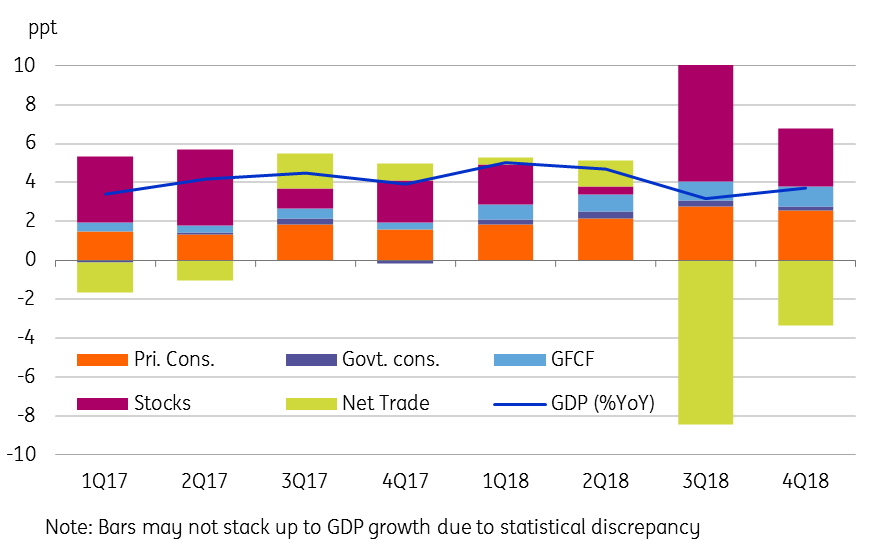

On the expenditure side, there was little evidence of any recovery in the key components. Inventory restocking remained the main driver and net exports the main drag, albeit at a more moderate pace than in the third quarter. The contributions of private and government consumption to GDP growth weakened, while that of fixed capital formation was unchanged.

Lack of spending-side GDP drivers

Source: Bloomberg, CEIC, ING

2019 economic and policy outlook

This puts full-year 2018 GDP growth at 4.1%, in line with our forecast and up slightly from 4.0% in 2017. The government expects annual growth to hold steady at this pace in 2019, while the central bank (BoT) recently cut its forecast for this year to 4.0% from 4.2%. However, the balance of risks is tipped downward in view of an ongoing overhang of increasing global trade restrictions on exports and elevated political uncertainty domestically. We maintain our 3.8% growth forecast for 2019.

The BoT tightened policy with a 25bp rate hike in December, a move we consider premature as the economy is poised to slow in 2019 while inflation will continue to be absent. The central bank has been playing down the likelihood of further tightening and has also expressed concern about THB strength. We maintain our view of no more policy moves by the BoT this year.

Disclaimer: The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial ...

more