Thai Stock: Poor Profitable Growth At Thai Union Group

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Background

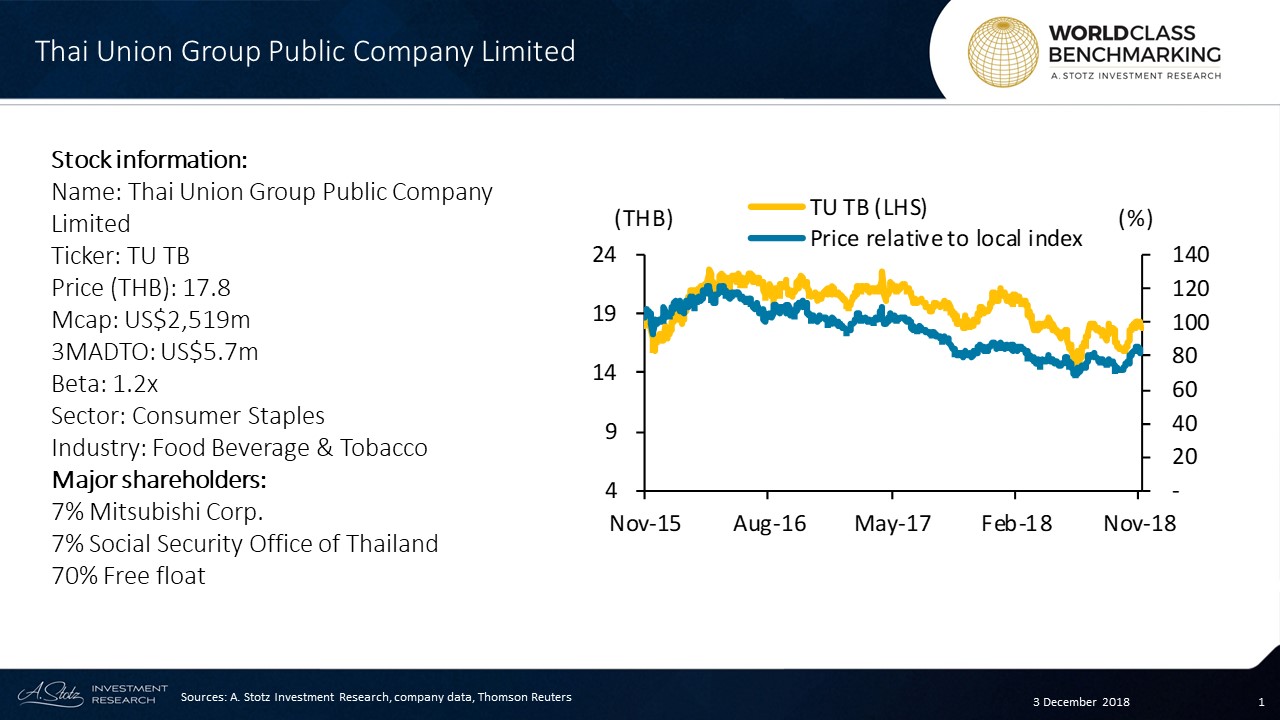

Thai Union Group Public Company Limited has top global market share in frozen and canned seafood.

(Click on image to enlarge)

Its main processing facilities are in Thailand, but it also has 17 manufacturing plants in the US, its largest overseas market.

About 80% of sales are to markets in the US, Europe, and Japan.

Business Description

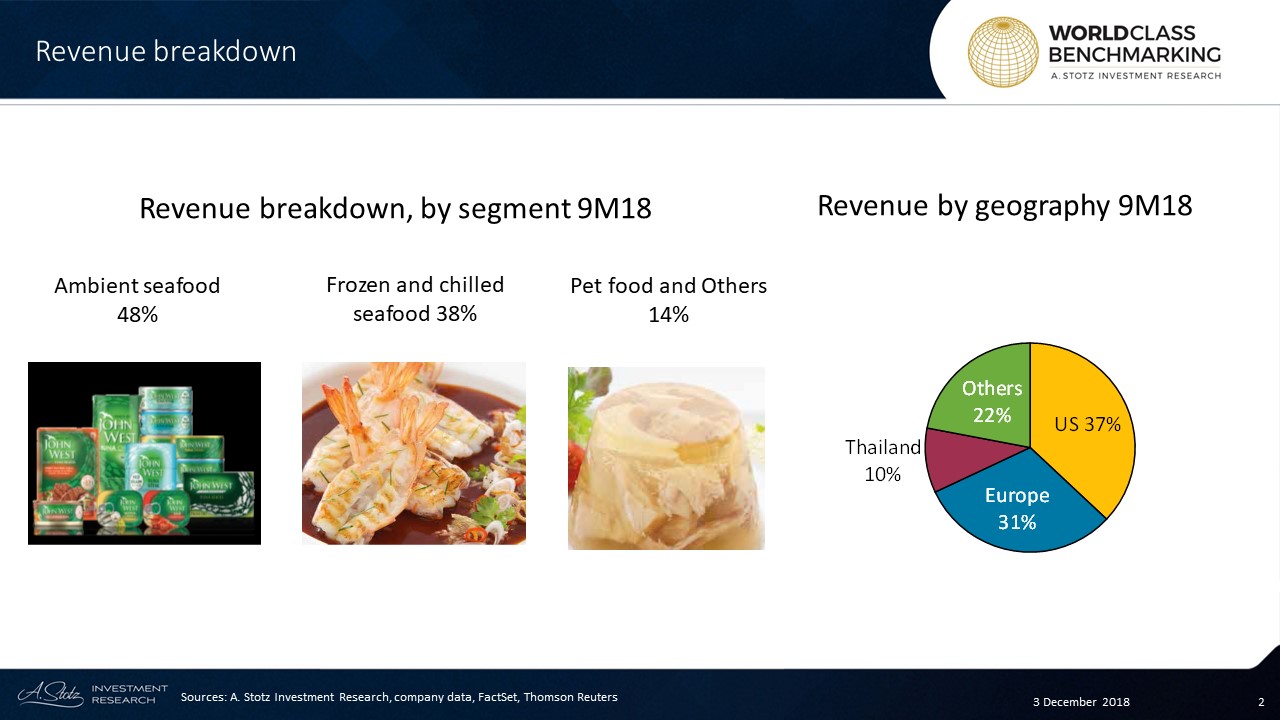

TU has three business divisions, of which the biggest, accounting for nearly half of revenue, is ambient seafood. This is largely canned tuna, sardines, and other canned fish. Tuna is the company’s biggest contributor to gross profit.

The second-largest division, at 38% of sales, is frozen and chilled seafood, mainly shrimp and other shellfish. The rest of the TU’s revenue is pet food and other value-added businesses, accounting for 14% of sales.

(Click on image to enlarge)

TU sells tuna fish under its own brands, but also sells its tuna to other companies for sale under other brands. Its own brands include Chicken of the Sea in the US and John West in the UK. With the shrimp division, TU acts mainly as a processor and trader.

Historically the group was very successful in growing via acquisition. However, it has recently begun to focus on streamlining its business divisions and is actively divesting loss-making products, including its Scottish smoked salmon business.

Leadership

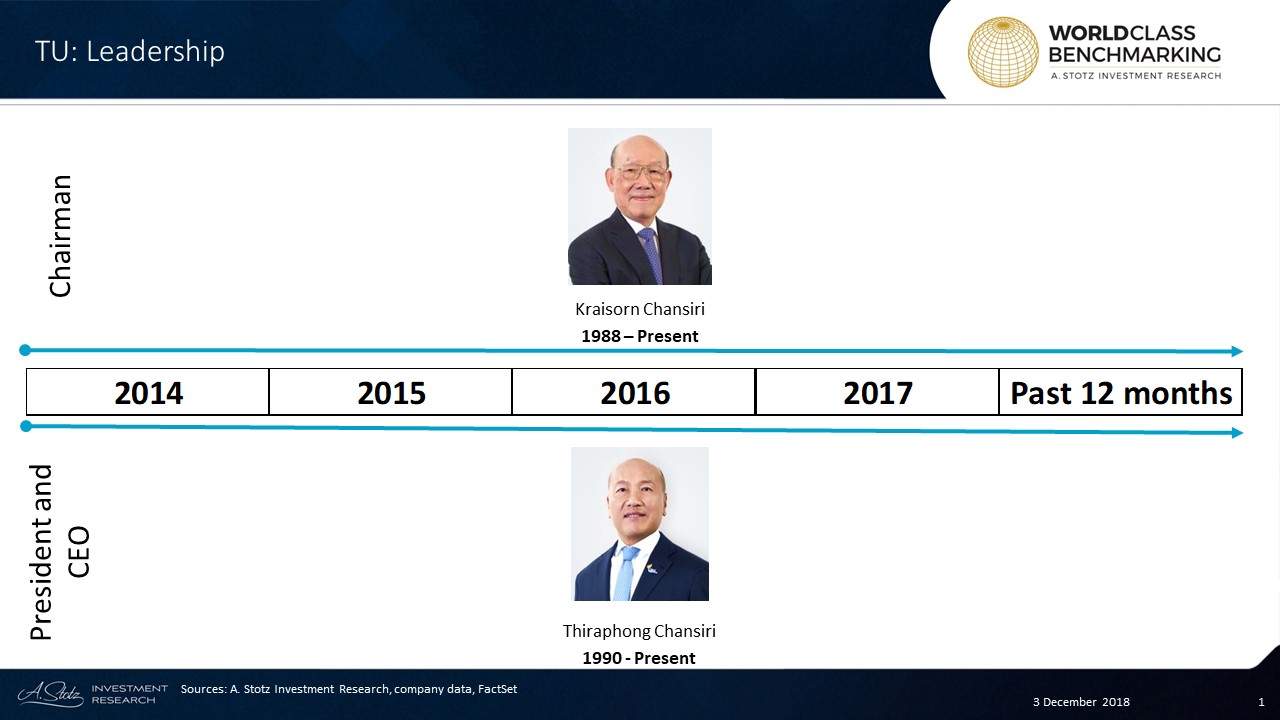

Kraisorn Chansiri has served as the Chairman of TU since 1988. He also holds the positions of Chairman and Director at many non-listed companies. Furthermore, he obtained an Honorary Doctorate Degree of Philosophy in Business Administration, Mae Fah Luang University in Thailand and an Honorary Science Degree of Doctor of Philosophy in Food Science and Technology from Thai Chamber of Commerce University in Thailand.

(Click on image to enlarge)

Thiraphong Chansiri has held the position of President and CEO of TU since 1990. Moreover, he serves as a Director of Minor International PCL (MINT TB). He obtained a Bachelor’s Degree in Marketing at Assumption University in Thailand and a Master of Business Administration in Management at the University of San Francisco in the US.

World Class Benchmarking

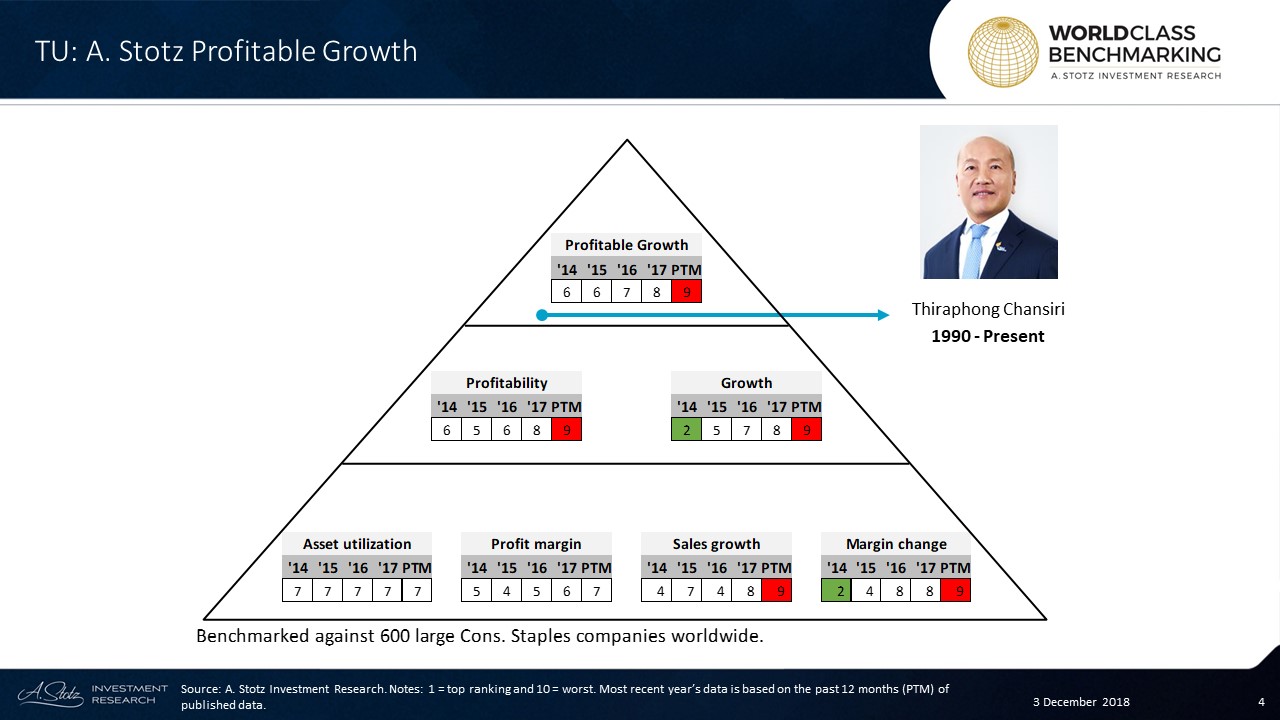

Profitable Growth has stayed below average since 2014, and in the past 12 months, TU ranked among the worst 120 out of 600 large Consumer Staples companies worldwide.

Profitability has a similar performance to Profitable Growth. Growth has a negative trend over the years, and the latest performance is at #9.

(Click on image to enlarge)

Asset utilization has consistently been at #7 since 2014. Profit margin has fluctuated around the average level.

Sales growth has been volatile over the years and stayed poor since 2017. Margin change has shown a negative trend.

Disclaimer: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and ...

more