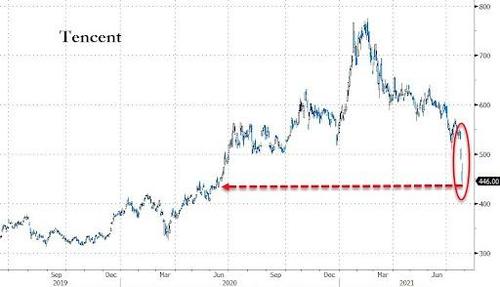

Tencent Shares Tumble As WeChat Removed From Chinese App Stores

Beijing's crackdown on its education and tutoring industry continued Tuesday, further rattling Chinese stocks traded in Hong Kong and the US.

Hang Seng tech shares added to their weekly loss following reports that regulators had ordered the suspension of new users for WeChat, one of the most popular apps in China. According to Bloomberg, WeChat, which already has more than 1 billion users, won't be allowed to register new users while it undergoes a "security technical upgrade" in accordance with relevant laws and regulations according to a statement released by Tencent.

Before yesterday, most Americans probably didn't grasp the significance of China's burgeoning techedu sector. More than $1 trillion has been wiped off Chinese education stocks since February.

But Tuesday's news is only the latest in a seemingly unceasing series of setbacks for Tencent: in a punishment that has also befallen Didi and other popular Chinese apps, Tencent's "WeChat" app has been removed by Tencent from Chinese app stores on orders from Beijing, Bloomberg reports.

This isn't even the first China crackdown news this week. Yesterday, one of Beijing's tech regulators (seems like there are so many) the Ministry of Industry and Information Technology, announced that Chinese companies would soon be forced to end what Beijing described as "the malicious blocking o website links". Analysts warned afterward that "everyone is in the crosshairs".

Over the last nine months, President Xi Jinping has presided over a crackdown of China's tech industry that started when Beijing scrapped the Ant Group IPO - what would have been the biggest IPO ever - after Alibaba founder (and Ant Group chief) Jack Ma angered the Politburo with complaints about China's regulatory framework, which Ma said stifled innovation.

Since then, Alibaba has hit with a massive $2.8 billion fine, while Ant Group and other companies with fintech operations have been forced to apply for a banking license, subjecting them to cumbersome regulations that will likely limit their growth, and their ability to compete.

Tencent sank 9% on Tuesday, its biggest drop since October 2011, and the latest example of panic selling that has afflicted many Chinese stocks.

While new downloads will be halted while the "security upgrade" continues, billions of people - and more than 1 billion of China's 1.4+ billion citizens - have already downloaded the app. For investors who are trying to remain exposed to China while avoiding this type of blowback, Jian Shi Cortesi, a portfolio manager at GAM Investment Management in Zurich, told Bloomberg that the key is to avoid companies that the government might determine are benefiting a "small group at the expense of broader prosperity." Those businesses are likely to face tighter regulation, Cortesi said, pointing to live streaming as one area that may be vulnerable. At the same time, she’s looking for chances to buy shares that have been unduly punished in the selloff.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more