TalkMarkets Tuesday Talk: The Green Grass Of August

Image Source: Pixabay

The COVID-19 news is mixed, as is much of the rest of the news, but the markets are showing continued optimism with the Dow gaining 358 points yesterday to close at 27,791, the S&P 500 up 9 points closing at 3,360 and the Nasdaq hovering at 11,000 but closing down 43 points at 10,968.

Yesterday’s top gainers were largely pharma related, showing continuing sentiment for risk in anything coronavirus-related and real investor zeal for an answer to the pandemic.

Source: The New York Times

The morning futures for New York are currently showing green. Key indexes in Asia were up today and the European markets are also looking green.

Every gardener knows that it’s not good to let the grass get too high. As such, we should be on the lookout for a trim.

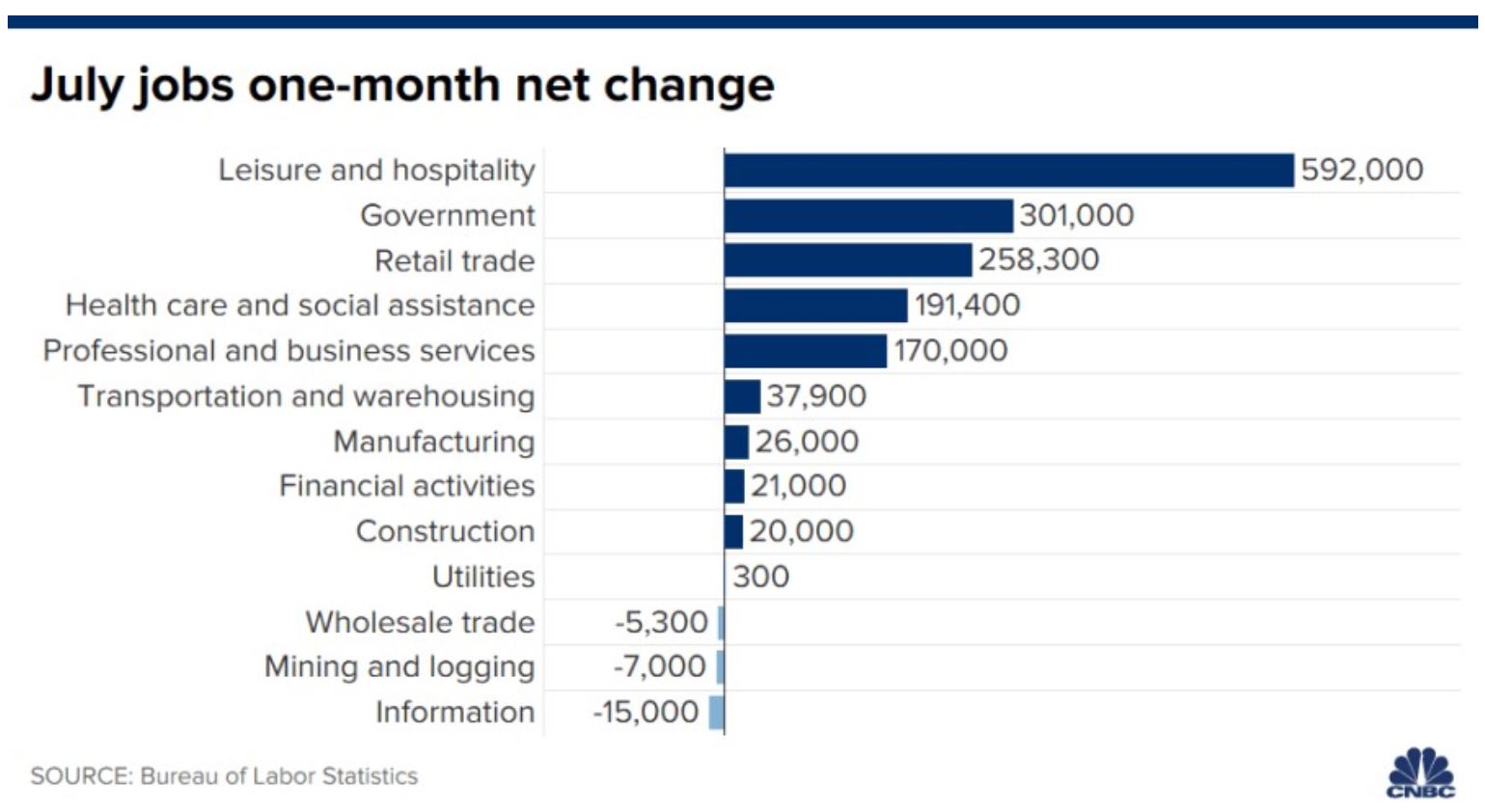

TalkMarkets contributor TheoTrade in their article Much Stronger Jobs Report Than Expected reports that stronger than expected employment data for July is a strong signal that the economy is recovering.

1.763 million jobs were created in the U.S. economy in July, beating estimates for 1.675 million. TheoTrade includes a chart from the U.S. Bureau of Labor Statistics showing in which sectors the jobs were created.

TheoTrade notes that wages also rose higher than expected and concludes, "This labor report was very strong. It beat estimates by a lot. Some investors were already bullish on the economy because COVID-19 cases are falling and a stimulus should be coming. With this great report, they are even more bullish because it means we are closer to single-digit unemployment.”

Chatter continues about wither the US dollar, but this morning TalkMarkets contributor Yohay Elam in King Dollar’s Comeback Seems Unstoppable, And For Good Reasons writes that last week’s strong jobs report, declining COVID-19 case over the weekend in the U.S., and continued U.S.-Sino tensions are all reasons that support the dollar’s renewed strength.

Elam cites a worrisome rise in COVID-19 infection rates in Germany and an anticipated minor decline in business sentiment to be reported in the ZEW Economic Sentiment index today. He cites these concerns as reason to believe that “Overall, the wind is blowing strongly in favor of the dollar and moderately against the euro.”

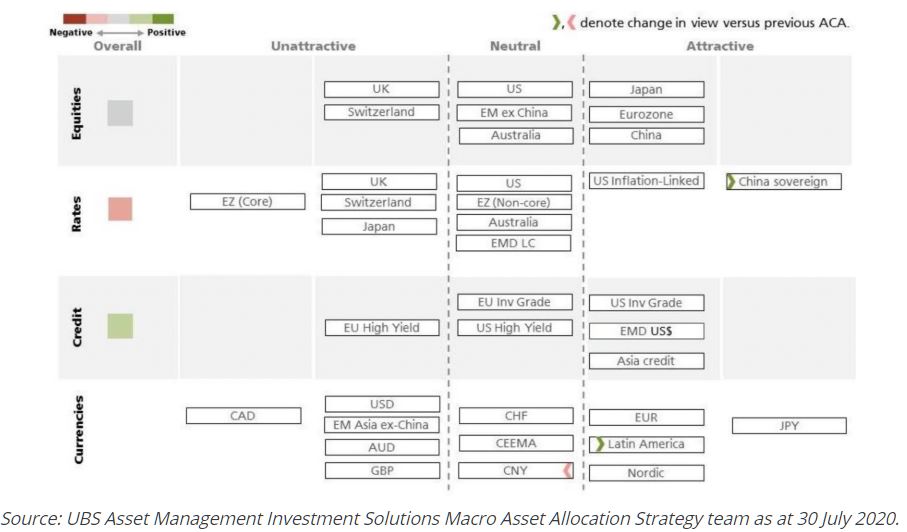

The staff at UBS Asset Management take a deeper look at what looms ahead for US-China tech as tensions between the two nations remain high and many companies in the U.S. look to loosen parts of their relationship with Chinese tech companies and manufacturers. In The Dueling Threats To US, China Tech, UBS looks at the relationship between Chinese tech stocks and the Chinese government, US tech stocks and their interaction with the Chinese economy, and increased U.S. government scrutiny of U.S. tech firms. According to UBS:

- “We believe that any disruption over coming months could provide pockets of opportunity in Chinese technology stocks, which enjoy supportive underlying trends that include a deep, captive domestic base and a government committed to the development of technology champions as well as macroeconomic stability.”

- “In a world in which COVID-19 has exacerbated and laid bare the hardships of victims of economic inequality, politicians in the US and abroad may be incentivized to rein in the financial benefits accruing to the more profitable and monopolistic entities, the US tech giants."

In what is an extensive and insightful article UBS looks at international and domestic issues facing tech companies in both China and the U.S. and what this means for investors. You might be surprised to learn that in some areas UBS favors China. The asset allocation chart below reflects this thinking:

The article concludes:

“A preference for Chinese equities is reflective of our asset allocation, which sees more value in early-cycle trades and favors exposures outside the US. The upcoming November election is just one example of the broader risks facing US risk assets. In addition, the US’s poor ability to control the COVID-19 virus relative to other advanced economies, ensuing implications for the timing as well as durability of the economic recovery, and step-down in fiscal support leave us broadly negative on the US dollar and more positive on global risk assets.”

Interesting reading indeed.

TalkMarkets contributor Ironman, writing in Foreign Holdings Of U.S. Equities, notes that preliminary estimates for 2020 show that in percentage terms foreign holdings in U.S. equities has declined nominally as compared to 2019.

“According to the U.S. Treasury Department, foreigners owned $8.63 trillion worth of U.S. equities through the end of the second quarter of 2019, which is the equivalent of 35.3% of the total market capitalization of the S&P 500 (SPX) at that time. Our rough preliminary estimate of foreign holdings of U.S. equities at the end of the second quarter of 2020 is $9.19 trillion, which is the equivalent of 34.2% of the S&P 500's reported $26.79 trillion market cap.”

Ironman notes further that, “In 2002, foreigners owned the equivalent of 15% of the S&P 500's market cap and that (ownership) rose steadily to peak at 36.5% in 2015.”

Despite (or in spite of) the growth of emerging markets and the heavy shadow cast by the pandemic in the U.S., U.S. equities remain a strong bet for foreign investors.

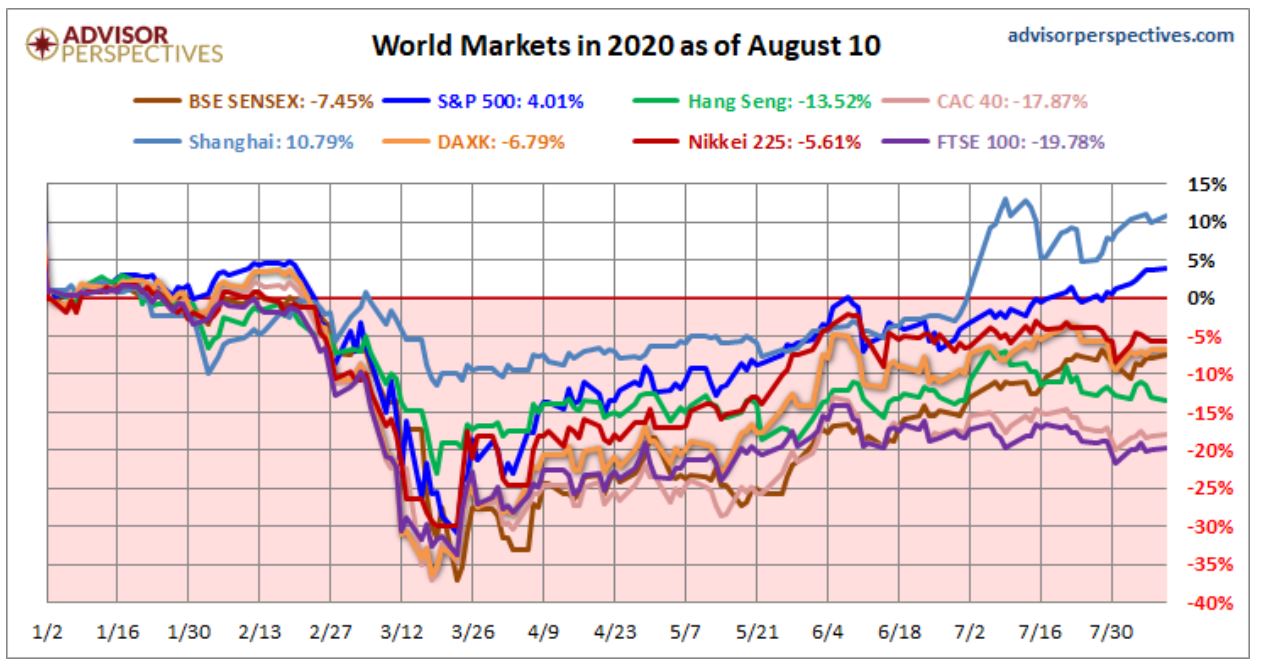

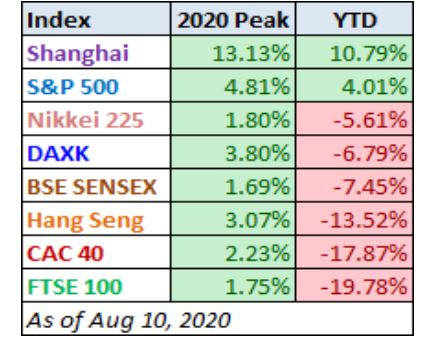

Jill Mislinski, in World Markets Update - Monday, Aug. 10, looks at the returns of the major world stock market indexes for 2020 year to date, as well as from 2009, 2007 and 2000. Mislinski does this in the form of charts which makes for some vivid reading. The 2020 y-t-d chart, as well as her comments are below:

- “Six of eight indexes on our world watch list posted losses through August 10, 2020. The top performer is China's Shanghai with a gain of 10.79%. Our own S&P 500 is in second with a gain of 4.01% and in third is Tokyo's Nikkei 225 with a loss of 5.61%. Coming in last is London's FTSE 100 with a loss of 19.78%.”

Jill’s long term perspective chart (January 2000 to 2020 Y-t-D) shows that if you had started investing in the Bombay Stock Exchange’s SENSEX Index in 2000, your investment would have been up 610.3% as compared to a similar investment in the S&P 500 which would have been up 130.9%.

Think about that! See you next week.

Quite interesting, but I am not sure about investing a whole lot in foreign markets today. Things are just a bit too uncertain at present.