Taiwan Central Bank Stays Put As Expected

The central bank left policy unchanged in June. This was expected because interest rates are already low and pushing them down further would not have created a big enough marginal impact on credit growth. The economy has to rely on fiscal stimulus instead

Source: istock

The central bank stands pat

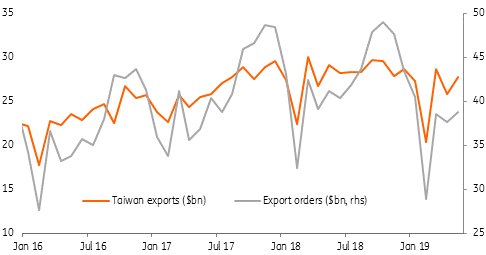

Taiwan's central bank has not moved its policy interest rate since the middle of 2016. Even though export orders have contracted for seven straight months, falling 5.82% year-on-year in May, the bank has continued to keep policy on hold. This is largely because rates are already low, at 1.375%, so a cut would have little marginal impact on creating money, i.e. credit growth. In addition, each cut by Taiwan's central bank has been just 12.5 basis points (half of each normal move by the Federal Reserve), which makes the marginal impact even smaller.

Taiwan's export orders have shrunk for seven straight months

Source: ING, Bloomberg

Fiscal stimulus in the spotlight

As monetary policy can do very little to stimulate growth at this point, Taiwan's economy- which has been affected by the ripple effect from the US-China trade war- has to depend more on fiscal stimulus.

However, we know from the experience of 2016 that government support only lasts for about a year, at most. If the government implements a big fiscal stimulus package, it would certainly hurt its debt level, as there has been almost no fiscal surplus for the past four years.

As such, the government has been trying to encourage manufacturers to move their production on the Mainland back to Taiwan. This has led to several firms proposing a total investment of $1.29 billion in 2019. Still, we doubt that all the investments will be realized this year. Even if the whole amount were to be invested in Taiwan, it would only contribute around 0.2% of GDP.

Presidential election in 2020 will help the economy

Unless the economy falls into recession-which we don't expect- we doubt the central bank will cut interest rates in 2019.

Taiwan will hold a presidential election in January 2020, and the economy could benefit as a result. This is because the current government is likely to be more supportive to the economy to try to earn votes and keep Tsai Ing-Wen (the leader of the Democratic Progressive Party, DPP) in power.

If Tsai wins the election, Mainland China is likely to tighten its control on cross-strait business and individual activities. If the KMT party (Kuomintang) wins, the Mainland administration is likely to deliver preferential policies to Taiwan, for example by relaxing restrictions on Mainland tourists going to Taiwan.

We believe that Mainland China will continue to leverage its economic ties with Taiwan. And the government will probably work harder to convince Taiwan of the benefits of working alongside it.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more