Speculators Shed US Dollar Index Bets For 2nd Week; Japanese Yen Bets Fall Into Bearish Level

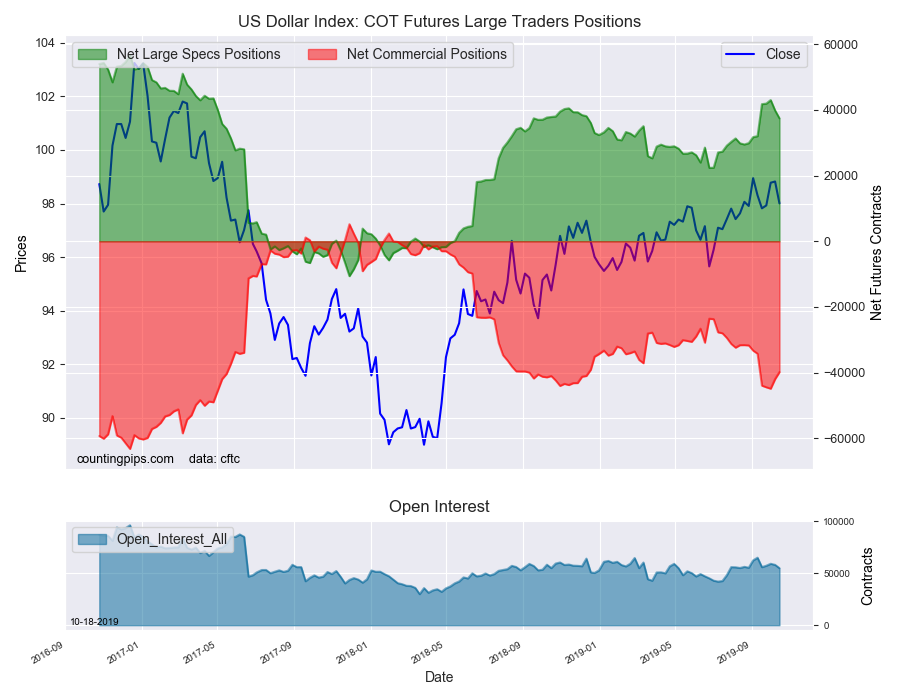

US Dollar Index Speculator Positions

Large currency speculators decreased their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 37,436 contracts in the data reported through Tuesday October 15th. This was a weekly reduction of -2,423 contracts from the previous week which had a total of 39,859 net contracts.

This week’s net position was the result of the gross bullish position (longs) dropping by -4,689 contracts (to a weekly total of 44,288 contracts) compared to the gross bearish position (shorts) which saw a lesser decrease by -2,266 contracts on the week (to a total of 6,852 contracts).

US Dollar Index speculators dropped their bullish bets for a second straight this week following a streak of six consecutive weekly gains. The dollar positioning s now under the +40,000 net position for a second straight week after bets had ascended to a 127-week high at +43,028 net contracts on October 1st.

Individual Currencies Data this week:

In the other major currency contracts data, we saw only one substantial change (+ or – 10,000 contracts) in the speculators category this week.

Japanese yen speculators strongly bailed out (-17,653 change in contracts) of their positions this week and pushed the overall level back into bearish territory for the first time in eleven weeks. Yen positioning had reached a 2019 high on August 27th at a total of 33,607 contracts before sentiment turned lower and fell for five out of the next seven weeks.

Overall, the major currencies that saw improving speculator positions this week were the euro (259 weekly change in contracts), British pound sterling (267 contracts) and the Canadian dollar (7,648 contracts).

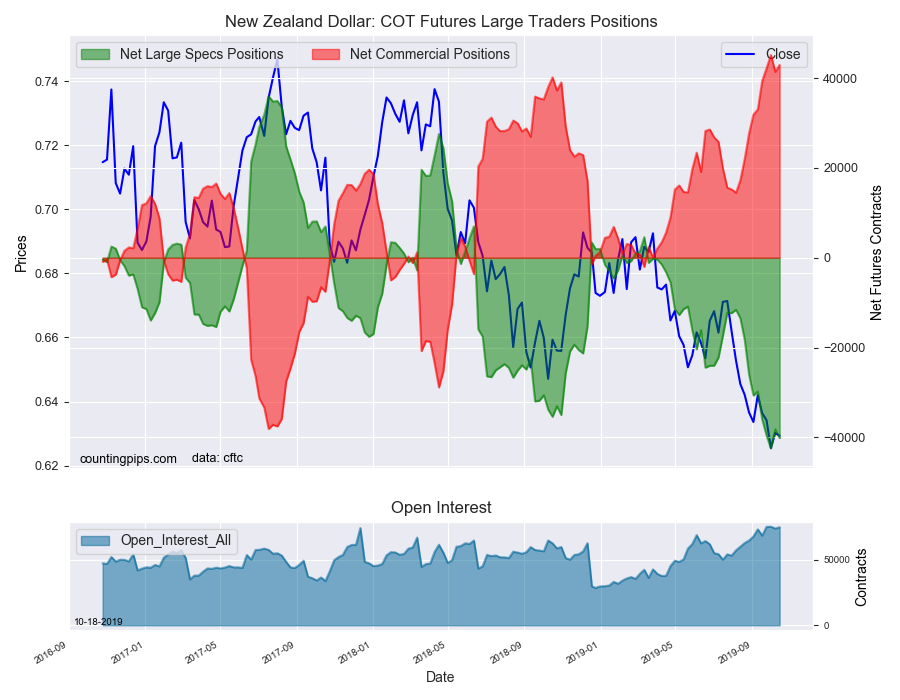

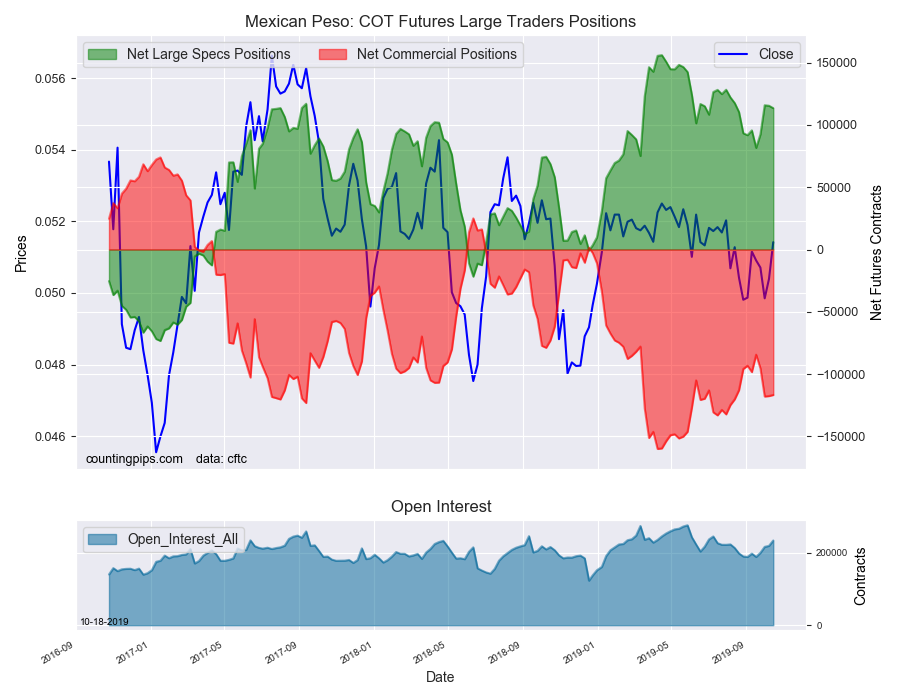

The currencies whose speculative bets declined this week were the US dollar index (-2,423 weekly change in contracts), Japanese yen (-17,653 contracts), Swiss franc (-1,719 contracts), Australian dollar (-661 contracts), New Zealand dollar (-1,946 contracts) and the Mexican peso (-1,920 contracts).

Other Notables:

New Zealand dollar speculators pushed their bearish positions higher again this week for the fourth time out of the past five weeks. The overall position is back over the -40,000 net contract level for only the second time in history with the first being two weeks ago (the all-time record bearish position of -42,474 contracts).

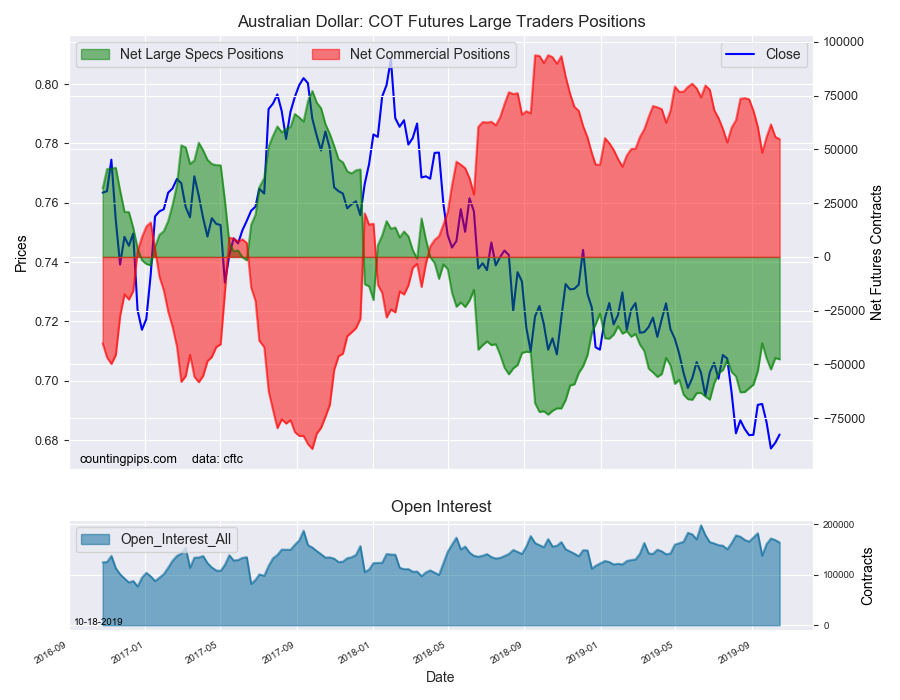

Australian dollar speculators slightly added to the bearish bets this week for the third time in the past four weeks. Overall, the AUD position remains in the lower part of its three year range and the AUD has now been in bearish territory for eighty-one straight weeks, dating back to March of 2018.

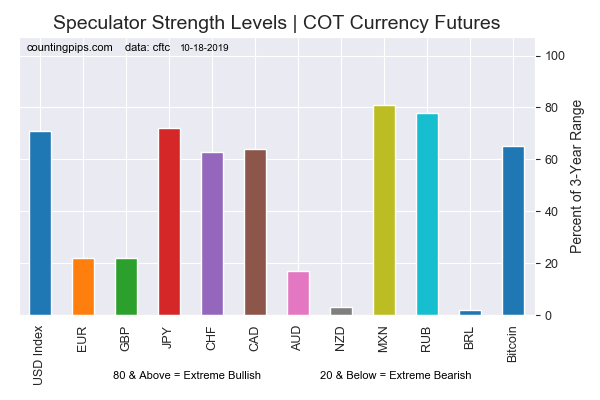

Chart: Current Strength of Each Currency compared to their 3-Year Range

See the table and individual currency charts below.

Table of Large Speculator Levels & Weekly Changes:

| Currency | Net Speculator Position | Specs Weekly Change |

| USD Index | 37,436 | -2,423 |

| EuroFx | -75,154 | 259 |

| GBP | -72,952 | 267 |

| JPY | -6,641 | -17,653 |

| CHF | -12,766 | -1,719 |

| CAD | 12,961 | 7,648 |

| AUD | -47,605 | -661 |

| NZD | -40,163 | -1,946 |

| MXN | 113,476 | -1,920 |

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

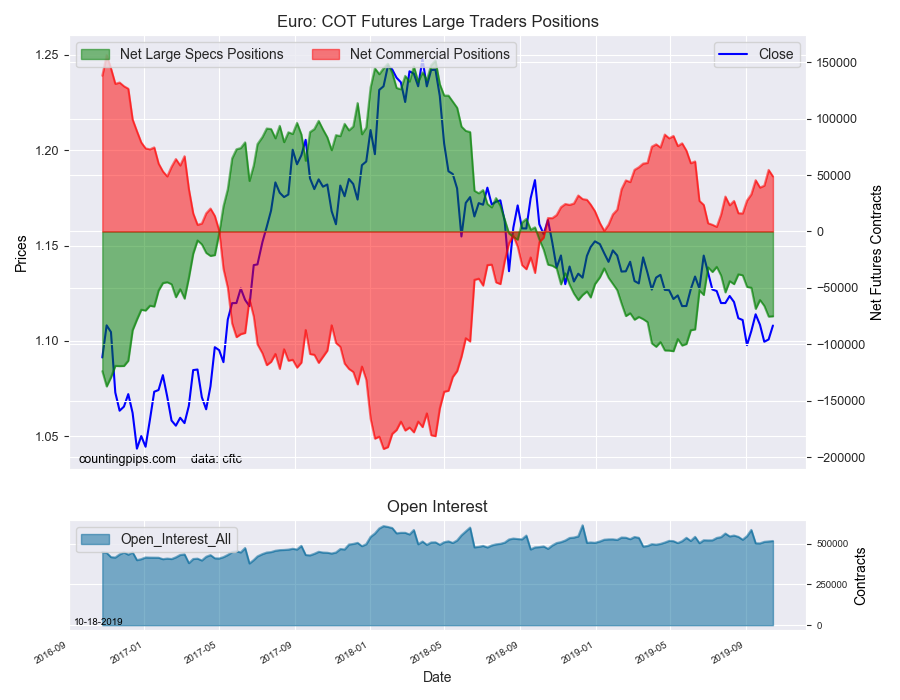

EuroFX:

The Euro large speculator standing this week resulted in a net position of -75,154 contracts in the data reported through Tuesday. This was a weekly gain of 259 contracts from the previous week which had a total of -75,413 net contracts.

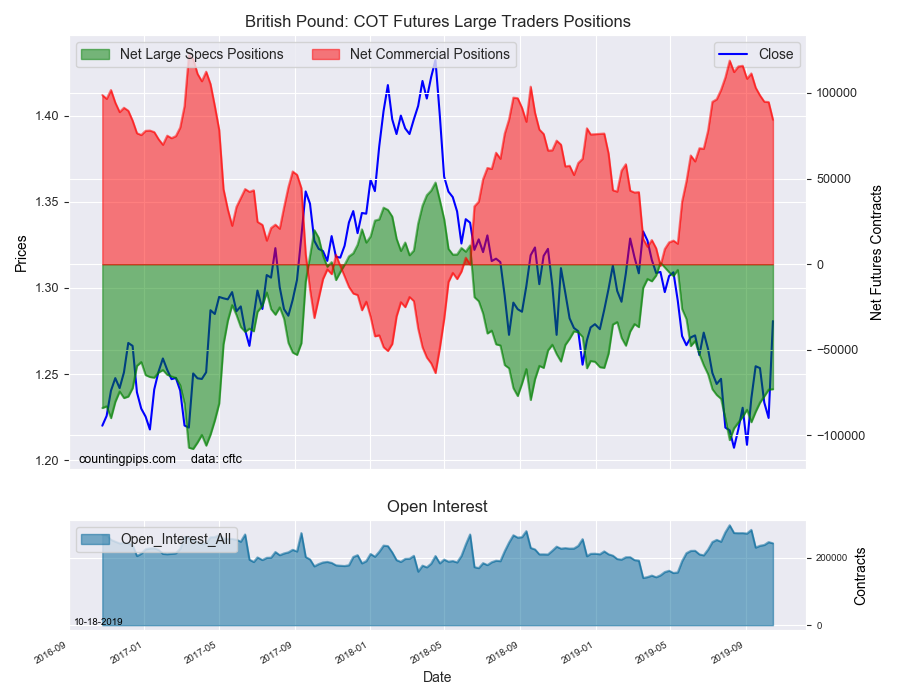

British Pound Sterling:

The large British pound sterling speculator level totaled a net position of -72,952 contracts in the data reported this week. This was a weekly advance of 267 contracts from the previous week which had a total of -73,219 net contracts.

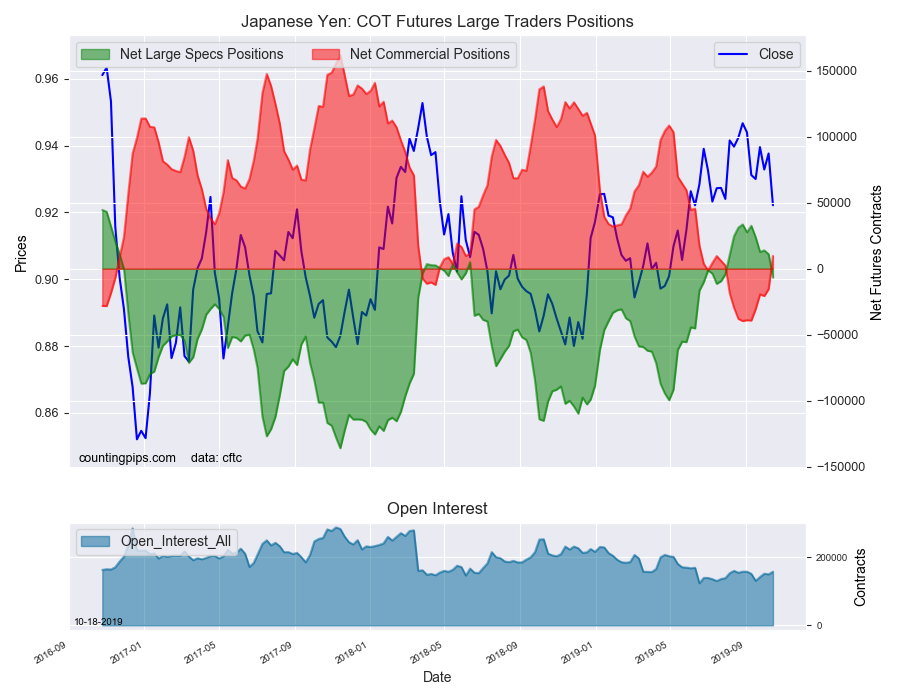

Japanese Yen:

Large Japanese yen speculators recorded a net position of -6,641 contracts in this week’s data. This was a weekly decline of -17,653 contracts from the previous week which had a total of 11,012 net contracts.

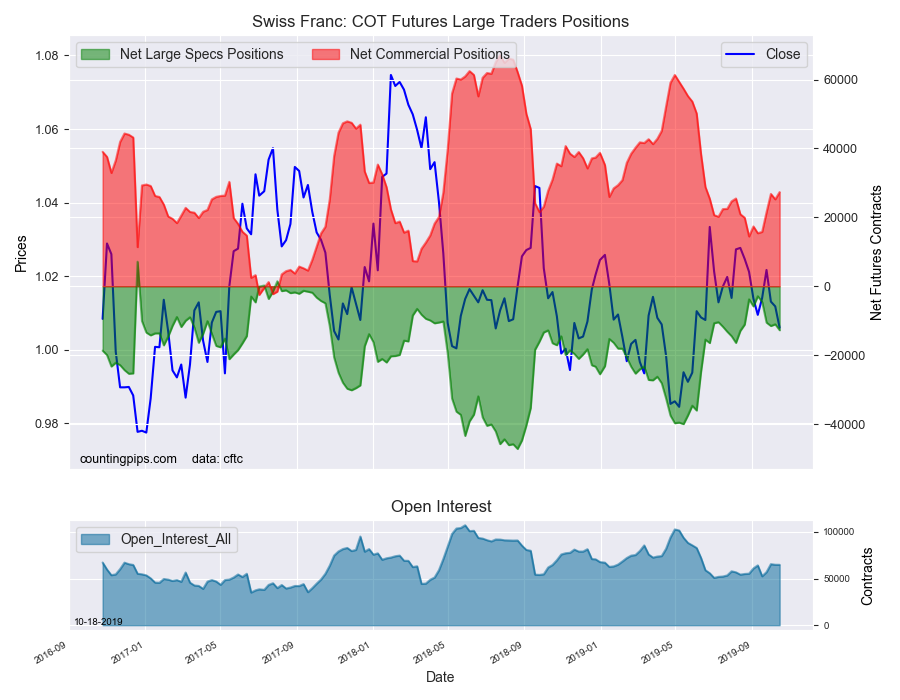

Swiss Franc:

The Swiss franc speculator standing this week reached a net position of -12,766 contracts in the data through Tuesday. This was a weekly decline of -1,719 contracts from the previous week which had a total of -11,047 net contracts.

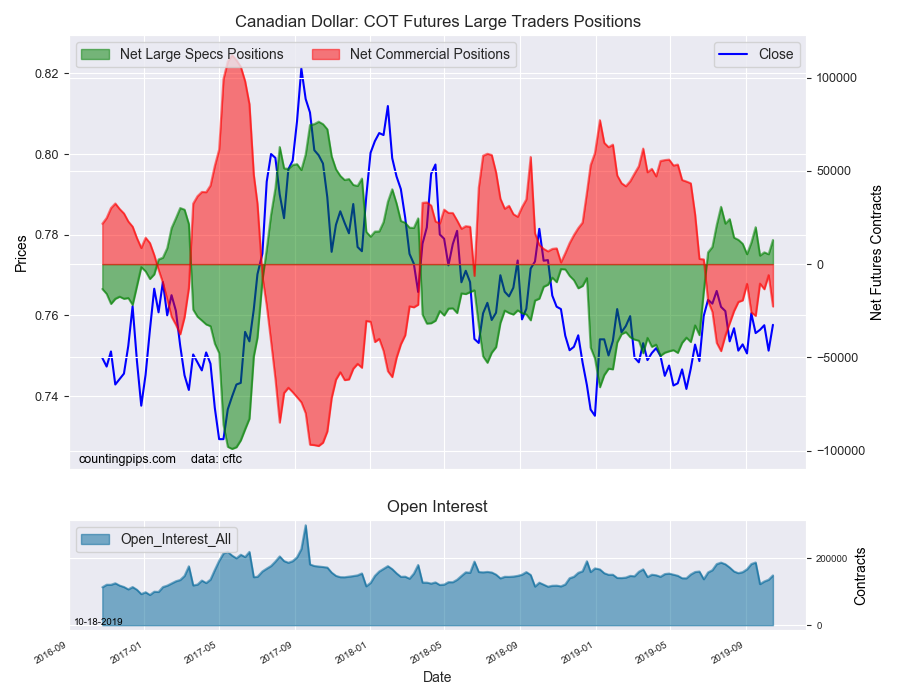

Canadian Dollar:

Canadian dollar speculators totaled a net position of 12,961 contracts this week. This was a rise of 7,648 contracts from the previous week which had a total of 5,313 net contracts.

Australian Dollar:

The large speculator positions in Australian dollar futures reached a net position of -47,605 contracts this week in the data ending Tuesday. This was a weekly fall of -661 contracts from the previous week which had a total of -46,944 net contracts.

New Zealand Dollar:

The New Zealand dollar speculative standing came in at a net position of -40,163 contracts this week in the latest COT data. This was a weekly lowering of -1,946 contracts from the previous week which had a total of -38,217 net contracts.

Mexican Peso:

Mexican peso speculators resulted in a net position of 113,476 contracts this week. This was a weekly lowering of -1,920 contracts from the previous week which had a total of 115,396 net contracts.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here

Receive our weekly COT Reports by Email

Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part ...

more