Sometimes Bad News Is Just Right

There is some hope among those viewing bad news as good news. In China, where alarms are currently sounding the loudest, next week begins the plenary session for the State Council and its working groups. For several days, Communist authorities will weigh all the relevant factors, as they see them, and will then come up with the broad strokes for economic policy in the coming year (2019).

We won’t know the full details of the State Council’s decisions until March next year, but there are whispers that things might be so bad right now it will kick officials into action. Bad news is good news. And if it’s really bad news, so much the better?

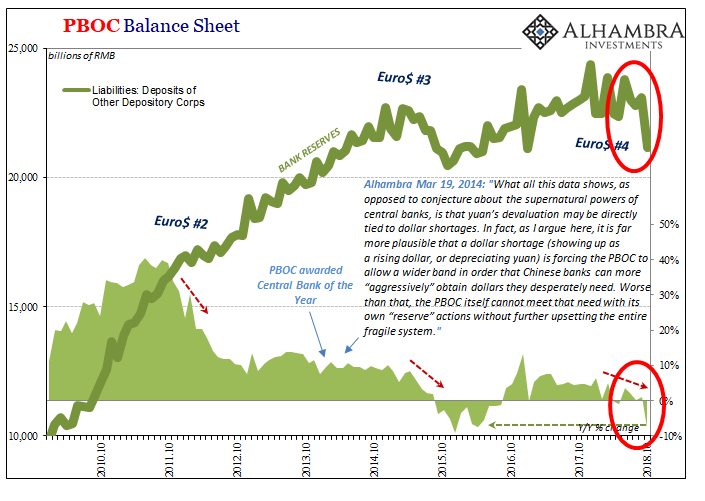

Except it wouldn’t be, not really. If China is in such bad shape now, what good was its last burst of stimulus started less than three years ago and wound down about eighteen months later? That’s what everyone seems to be waiting for, a new Chinese rescue to rescue the last rescue. Yes, it’s absurd as it sounds.

The global economy will only go round and round in this pathetic shape so long as that’s the appeal – until it can’t go round the next time. A no-growth world doesn’t do anyone any good, so why keep at it?

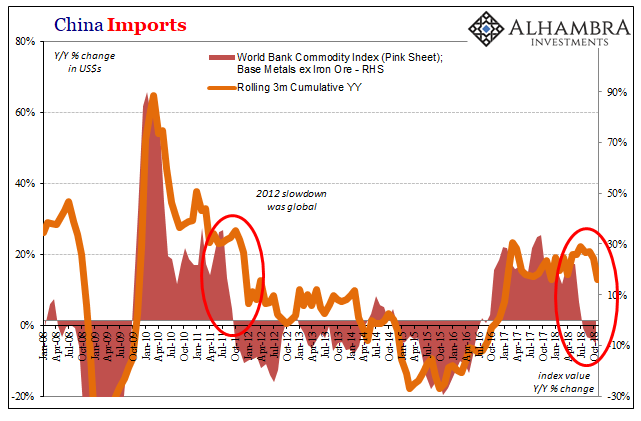

China’s top monetary authority, Yi Gang, Governor of the People’s Bank of China, started the process by warning about further “downside pressure on the economy.” No kidding. It’s been forecast all year, and over the last several months it has begun to appear more forcefully. Not trade wars, external illiquidity.

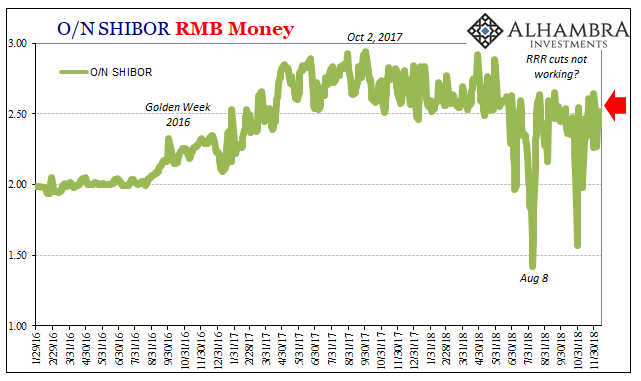

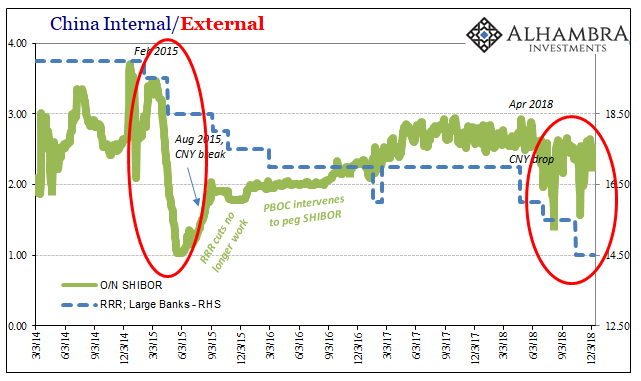

Yi, therefore, advised how the PBOC will try and keep things loose but also neutral (as in, not too loose). He’s done that already, though one is forced to question why. As we’ve chronicled throughout 2018, they’ve adjusted bank policy to allow more bank reserves to be put into use by banks – only because there are now fewer bank reserves.

And what good are bank reserves, public or private, if monetary tightness extends to more basic, straightforward tools like actual currency. The effects of a shortage are profound and equally simple. Monetary tightness leads to the economic situation where things start to go wrong first where money is most at use.

China’s automobile sales fell about 14 percent in November from a year earlier, the country’s top auto industry association said, marking the steepest such drop in nearly seven years in the world’s largest auto market…

The November drop comes on the heels of almost 12 percent declines in each of the past two months, putting China on track for an annual sales contraction not seen since at least 1990.

I noted just a few weeks ago:

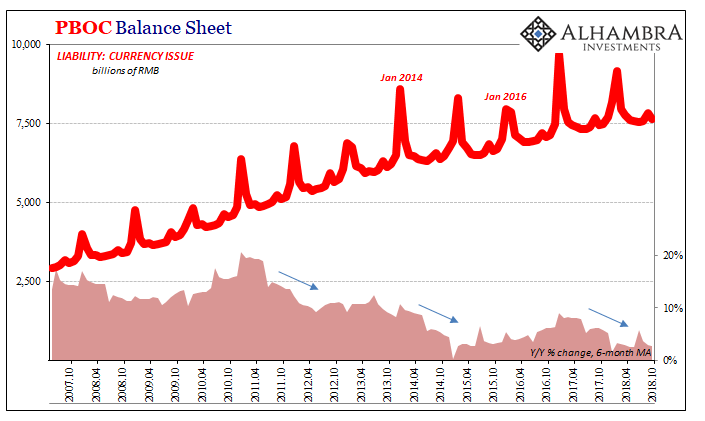

In October, currency issue expanded by just 2.6% year-over-year. That brings the 6-month average down to 2.7%, which is the lowest average (not counting New Year January/February distortions) in all of the published PBOC data. They’ve just about turned off the literal printing press in China.

According to Yi Gang, this has to be Goldilocks. According to the whispers, the PBOC is going to reverse course and stimulate, stimulate, stimulate? Don’t think so. Sometimes bad news is just bad news, especially when the central bank is so obviously preoccupied with CNY. Some are just surprised by all this, but that doesn’t mean everyone else is.

This, by the way, is something that the last PBOC Governor, Zhou Xiaochuan, had warned about only a year ago. It was quickly forgotten because, hey, inflation hysteria!

[rough translation] Overall, the financial situation in our country is good. However, at present and for a period in the future, China’s financial sector is still in a period of high risk-prone period [sic]. Under the pressure of multiple factors at home and abroad, the risks are wide and varied, presenting invisibility, complexity and suddenness, contagious, harmful characteristics, prominent structural imbalances, illegal and disorderly chaos, potential risks and hidden dangers are accumulating, and the vulnerability obviously increases.

It isn’t outside the realm of possibility that the Chinese have resigned themselves to all this, and have been looking for it all along. Not that they want this direction and the unpredictable dangers it could dig up, but more so an acceptance that this just may be how it is.

Thus, everything could be just that easy; in the sense China wants the world to fix its reserve currency problem, the hidden eurodollar not dollar, at the same time it also knows Western officials won’t (can’t) admit there even is such a thing. You can’t work together to solve money nobody on the other side of the table will acknowledge exists. Besides, US and European central bankers are now too busy substituting a circus for the boom they were just talking about a minute ago.

There will always be a subset of people who treat monetary policy and central banks like a deus ex machina and try to sell the narrative that way. There’s no turnaround a good bit of monetary policy can’t accomplish. Except 2008. Or 2011; 2014; an actual recovery; etc. For the PBOC, they aren’t much better but they haven’t had the luxury of being so blind.

In China, there’s as much a risk authorities next week concede the further downside of this longstanding “L” reality as there is they retry for a fourth time what already hasn’t worked. The idea of a hard landing has it all wrong since it proposes a floor. The news can and has been at times only flavors of bad.

Disclaimer: All data and information provided on this site is strictly the author’s opinion and does not constitute any financial, legal or other type of advice. GradMoney, nor Jennifer N. ...

more