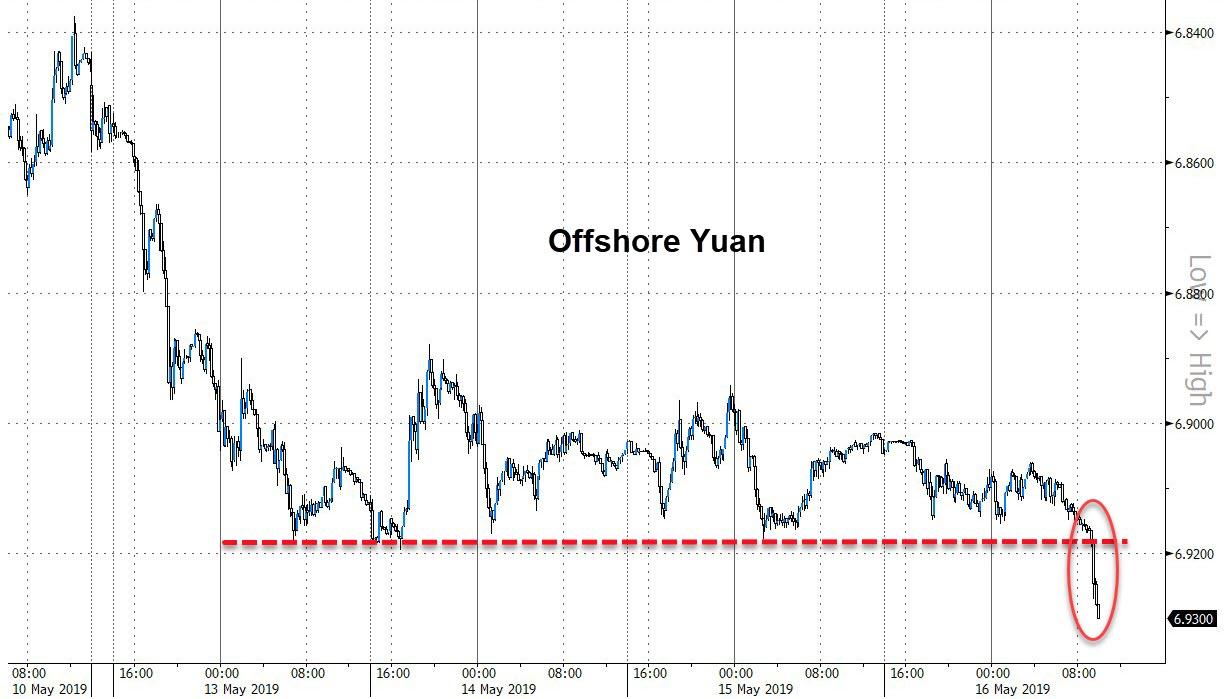

Something Just Broke In The Chinese Yuan

Having been well-managed all week, amid various headlines (and extreme hopium in US equities), something just snapped in the Chinese yuan...

(Click on image to enlarge)

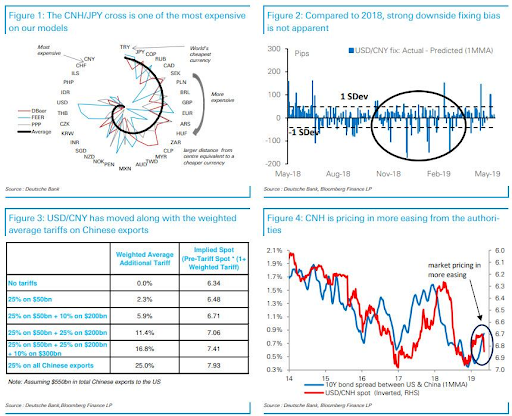

As we just detailed, from Deutsche Bank, who worry that USD/CNY will break through 7...

Asia is the region we expect to suffer most from the renewed global headwinds. We argue that policymakers in China are now going to be more accepting of USD/CNY appreciation through 7: years of regulatory measures should make outflows more manageable, easier monetary policy will add upside pressure and a weakening FX is the natural means of offsetting tariffs.

(Click on image to enlarge)

Moves so far in USD/CNY have been proportional to the weighted average tariff being borne by Chinese exporters with the measures currently imposed already consistent with USD/CNY at 7.10. Our preferred trade expression is shortCNH/JPY with the yen primed to benefit from global risk aversion and resumed signs of Japanese equity repatriation in recent weeks.

(Click on image to enlarge)

Big picture CNH/JPY remains one of the most expensive currency crosses in the world.

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more