Slump In Eurozone Bars And Restaurants In Stark Contrast To Soaring Food Sales

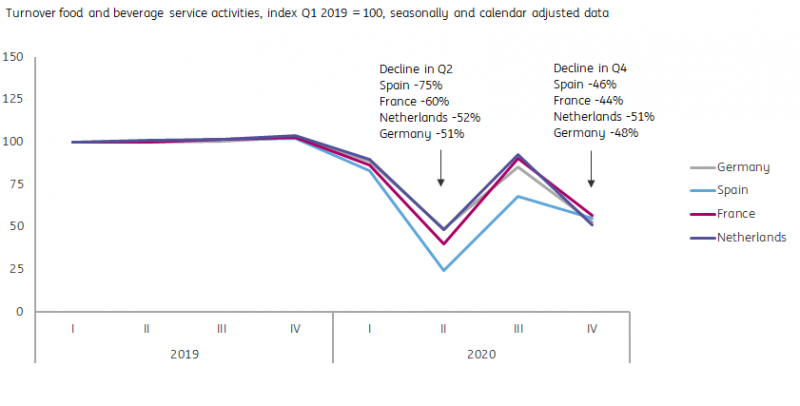

2020 was a dire year for restaurants and bars across the eurozone. After an initial downturn in the spring, their turnover fell by 45% in the last four months of 2020. The first quarter of this year doesn't give much relief to the foodservice industry and its suppliers. But food retailers are benefiting from Covid-19 restrictions in a big way.

Stark contrast between foodservice providers and food retailers

Covid-19 has created a clear divide between the different sales channels in the food sector. Foodservice companies, such as restaurants and bars, are obviously heavily impacted by Covid-related restrictions and social distancing. During the last quarter of 2020 turnover fell back to 55% of normal levels, with many businesses only open for delivery and take-away.

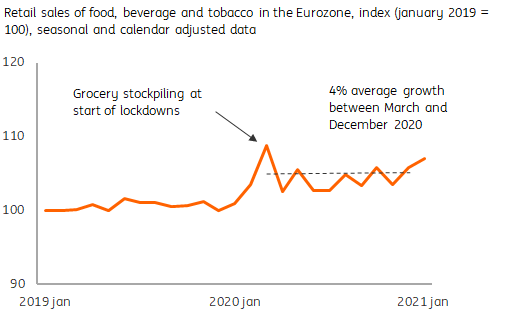

Compared with spring last year, this time the decline is being felt equally in some of the larger eurozone economies. At the same time revenues at food retailers like supermarkets and speciality stores has fared well. Within the eurozone, retail sales of food, drink, and tobacco have increased by 4% on average since the beginning of the pandemic.

Turnover in restaurants, bars and catering took a double hit in 2020

Source: Eurostat, ING Research

The connection between food service and food retail

Compared to the double-digit declines in foodservice, the single-digit growth in food retail seems modest. But keep in mind that absolute turnover in food retail is around 2.5 times larger. Besides that, a consumer who would normally spend 25 euro on a restaurant dinner is likely to spend a lot less on the ingredients for a meal when shopping in a supermarket.

Turnover in food retail increased during 2020

Source: Eurostat, ING Research

Foodservice: not much change expected in Q1

For most restaurants and bars in Europe, winter is not yet over. Due to the extension of lockdowns in the first quarter of this year, turnover remains at low levels. In the Netherlands, for example, nowcasting data shows that debit card transactions in restaurants and bars continue to be heavily impacted by the local lockdown. Within the industry, there's huge anticipation for the (gradual) reopening of both outdoor and indoor premises which will signal the return of domestic customers. But things are not so great for businesses that rely on foreign customers who can only return when travel restrictions are lifted.

Food retail: sales remain at a higher level for now

For food retailers clearly, it works the other way around. The longer it takes for restrictions to be eased, the longer they will experience these elevated sales levels. The 6% growth of turnover in January 2021 across the eurozone is a good illustration of that. However, from March onwards, growth rates in food retail will become less pronounced, because year-on-year it will be hard to beat the March 2020 stockpiling boost.

Impact on the food industry: striking a different balance

The shift in consumption patterns is also felt in the supply chains. Production in the food and beverage industry in the eurozone fell by almost 3% in 2020, mainly due to lower demand from foodservice operators. However, the impact differs from company to company and is very much dependent on the level of exposure to both food retail and foodservice.

The beverage industry (including brewers and soft drink producers) is on average more exposed to the foodservice channel. For them, and many other food producers, shifting some of the lost volumes towards the less profitable retail channel provides some compensation. As such, a reopening of restaurants and bars across Europe will clearly boost food and beverage industry output, but a return to pre-Covid levels in 2021 is not likely.