Singapore Central Bank Stays On Hold As Growth Dips Further In 1Q19

Our baseline is a stable MAS policy throughout 2019, though we won’t rule out an easing in the event economic conditions deteriorate further in the rest of the year.

Source: Shutterstock

No change to the SGD-NEER policy band

The Monetary Authority of Singapore (MAS), the central bank, released the outcome of its semi-annual monetary policy review this morning. And, as widely expected, there was no change to the existing policy settings.

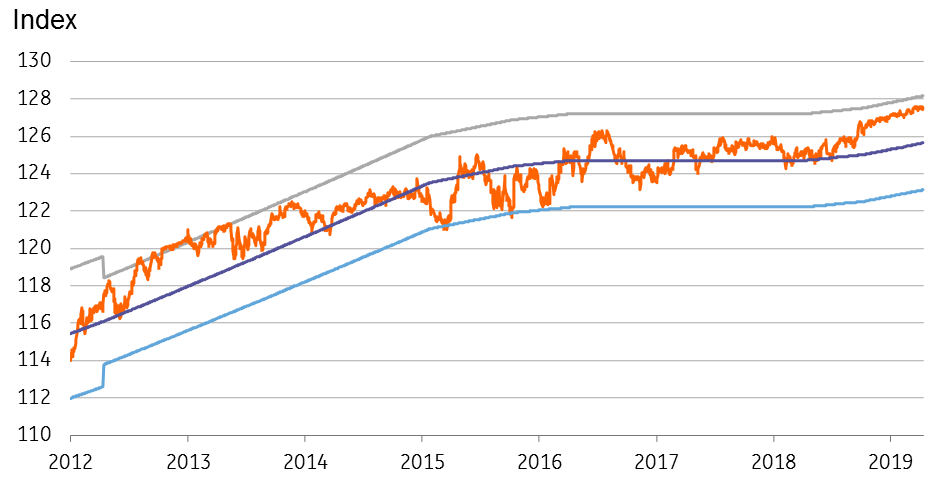

Unlike most central banks in the world, which use interest rates as their policy tool, the MAS uses the trade-weighted exchange rates, or the Singapore dollar nominal effective exchange rate (SGD-NEER) as its policy tool. It guides the SGD-NEER in an unspecified policy band depending on the economy’s growth-inflation dynamics – appreciating it when the economy requires tightening and depreciating when it needs easing.

Today’s decision means no change to the prevailing level, the width, or the slope of the SGD-NEER policy band. This follows two tightening moves in April and October 2018 by which the MAS increased the slope of the policy band, implying a faster currency appreciation. The SGD-NEER has appreciated in the upper half of the policy band since October.

The MAS statement pointed to modest growth and low inflation ahead, cutting projections for both GDP growth and inflation for 2019. Of more significance is the assessment of growth slipping below its potential level this year, after exceeding the trend level for two years, and the shrinking positive output gap without pressuring inflation.

SGD nominal effective exchange rate path

Source: Bloomberg, ING

GDP growth slips to a 3-year low in 1Q19

The MAS’s policy decision comes as the central bank’s acknowledgment of increased downside risks to the economy.

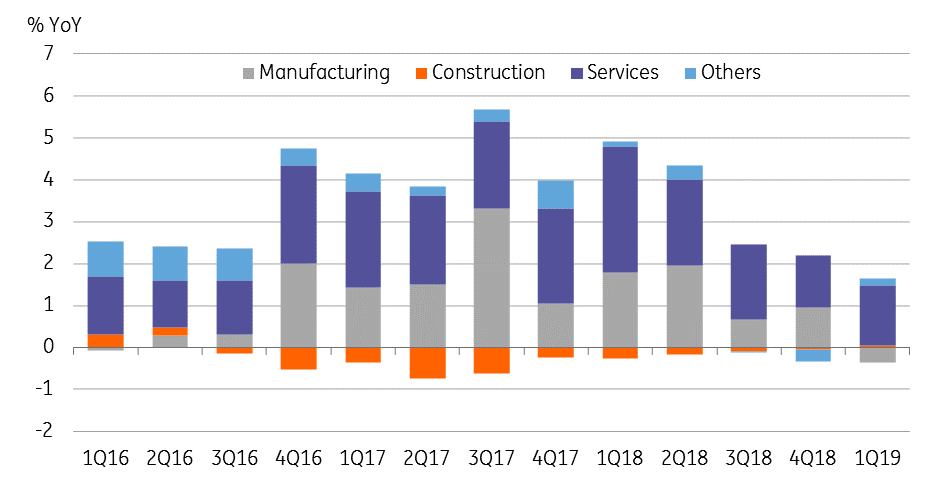

Also released today by Singapore’s Ministry of Trade and Industry, the advance estimate of GDP in the first quarter of 2019 showed a further slowdown in growth to a three-year low of 1.3% year-on-year from 1.9% in the fourth quarter of 2018. Manufacturing was a source of slowdown as output in this sector contracted by 1.9% from a year ago, the worst performance since 2016 that followed over 5% expansion in 4Q18.

Among other main sectors, construction growth returned to positive territory for the first time since 2016, though it barely contributed to the headline GDP growth. That left services as the key driver of GDP growth coming into 2019 (see figure).

The Singapore economy has slowed and is likely to expand at a modest pace in the coming quarters. Core inflation has come in lower than projected due to weaker global oil prices and a stronger impact from the liberalization of the retail electricity market.

Consequently, MAS is downgrading its 2019 forecast range for MAS Core Inflation to 1–2%.

Where GDP growth is coming from?

Source: Bloomberg, ING

Where the MAS policy is heading from here?

The MAS now expects GDP growth this year to be ‘slightly below the mid-point of the 1.5-3.5% forecast range. It has also cut the forecast for the headline consumer price inflation to 0.5-1.5% from 1-2%. That for core inflation, which excludes accommodation and private road transport prices, is cut to 1-2% from 1.5-2.5% previously.

As elsewhere in the world, the central bank policy in Singapore will also be data-dependent. And for the heavily export-dependent economy, all that matters is the direction in global trade and growth. Besides the trade war, the ongoing slump in the technology sector poses a greater threat to Singapore’s exports and manufacturing.

Our baseline is a stable MAS policy throughout 2019. However, we won’t rule out an easing in the event the economic conditions deteriorate further in the rest of the year.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more