Should I Buy ASX Shares Now?

Best undervalued stocks ASX for 2020

Well you might have to scroll until the end to see my two cents worth in regard to the above questions.

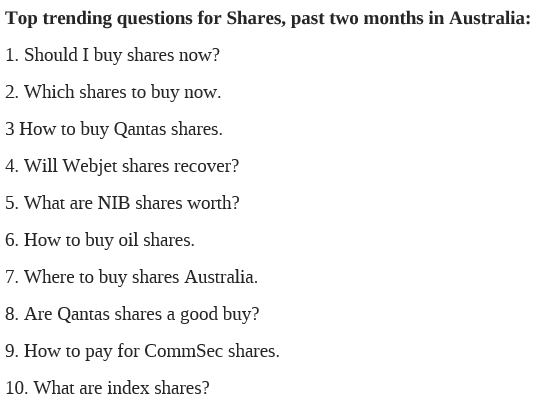

Actually no, I don’t want to give out stock tips but perhaps I can give an answer on what areas to look at. The main reason I went for these headings is I am reading reports that beginner investors throughout the world are rushing into shares. The various search terms in google that are surging are ones such as the title above. Here are some others.

This was from some research conducted by ASIC from the end of February until early May.

They were trying to protect the “mum and dad” investors. The implication was that turnover was higher, they were speculating and likely to rack up big losses due to inexperience.

I also suspect that will be the case eventually, if it isn’t already. Although I am not sure they have all done badly yet, perhaps they are even making a killing in the market?

“Dumb” money versus “smart” money?

This report made news in the first week of May. As I write markets continue to move higher. I wonder if perhaps ironically many of these “mum and dad” investors are dramatically outperforming most professional fund managers. It seems like the trend is for them to find a stock they are familiar with (Qantas, or simply the index, or Afterpay perhaps?) that has crashed in price in March, then buy. (QUBSF)

Meanwhile many of the articles that are written by the professionals on Livewire markets in late March were boasting about the elevated cash levels they were carrying.

Maybe ASIC will soon issue a warning to fund managers to invest their own money in low cost index ETFs, and not to gamble trying to time the market as much.

My own dumb money investing

By the way this is the first blog post I have made for almost 6 months. I was going to keep quiet for the whole year. Lockdown in Melbourne right now has changed my plans a lot to how I thought this year would be, so I have some more free time now. It also seemed strange if I regularly blogged for four years and stopped the minute the markets got interesting! So here I am again.

One reason I gave the blog a rest in January was I got a bit grumpy how most of these mum and dad speculators seemed to be doing better than me! I was feeling FOMO and something didn’t feel right that the stock market could be so easy for some. I wanted to disengage a bit from twitter and stock market forums for that reason, otherwise I might go performance chasing.

Fortunately that meant my cash levels were a little higher than normal. It was largely luck that this was the case leading into COVID-19. There was a period though from mid Feb that lasted until the first week of March where markets were still quite complacent. This was after the virus was at a minimum having a major impact on China. I did some more selling then.

That was the relatively good news. On the negative side small cap stocks got hit harder than I ever imagined, and faster than I thought was possible. Was pretty amazing seeing some of my stocks in this area crash so quickly! My portfolio initially didn’t beat the overall market to the extent that I would have hoped given I luckily held more cash.

I was able to run down my elevated cash levels to closer to normal levels in late March, but in hindsight nowhere near what I should have done. When markets fall 30% I have a bit of a rule of thumb to buy some more exposure no matter what. For no other reason than historically buying such falls eventually tends to turn out ok. Just buy something, shut your eyes and hope!

I wasn’t however smart enough to focus my buying on the small cap stocks that got hit. Returns since in that area have been spectacular. It has also shocked me the speed and magnitude to which they rebounded and all this happened.

L1 Long Short Fund Ltd (ASX:LSF)

Since it all happened so fast my buying was more focused on LICs which also saw their discounts widening substantially. For me mainly (ASX:LSF), which spent plenty of time at a 33% or more discount to pre-tax NTA, and much larger to the post tax measure. This may be a surprise to some as I have been quite critical of them in the past about the fee structure. However in March the fee drag was less of an issue as I shall explain.

I still own, it is looking like the buyback will be quite accretive to NTA. They are going a bit slower than what I like but may end up acquiring more than 5% of all units back at a 25% discount to NTA over a 12 month period. That effect reduces a lot of the drag from their management fee. Even now after the huge bounce it will still take a while for them to get back to their high watermark and for any performance fees to kick in.

From boom to gloom to boom in 2 months?

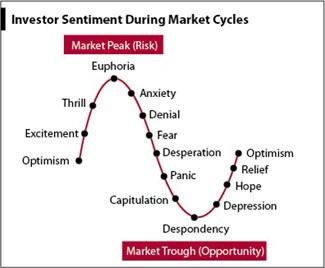

If had a $1 for every time I have seen the below market cycle sentiment picture the last 2 months I would have a lot of dollars.

What strikes me as weird is the confidence to which investors stated in various times in March where we were at in this cycle.

The most amusing of course was in February when the ASX200 falls from 7,150 to 6,850 and they quote Buffett about time to be buying in gloom. You usually know when to disregard it as those early calls often quote “Buffet” instead.

Just 2 or 3 weeks later things got more interesting when the ASX200 was 5,500. You could find many confidently expressing that this was clearly the denial phase, therefore clearly you should be selling a lot of your portfolio. At the same time though many were saying clearly capitulation has occurred so it makes sense to be buying a lot. Confused yet?

As I write now I seem to be coming across more comments that markets will keep going up because too many investors are bearish. Yet if I am seeing more and more investors saying this doesn’t that mean more and more investors have already turned bullish?

I am sure I have confused my readers now on this market sentiment analysis stuff, I have certainly confused myself anyway by writing this.

A good example of how fickle sentiment is might be how I have felt using twitter this year for following stock market news and opinions. As I said at the beginning of the year it gave me the sh*ts because everyone was bragging about how their portfolio rose 88% in 2019! That swung around so quickly though, FOMO was replaced by FEAR. Mid to late March I had to switch it off a lot of the time because it would have psyched me out of doing any buying whatsoever. A few more days of reading the news and various opinions might have seen me convert to a doomsday preppers lifestyle.

Certainly the markets have changed a lot again since March 23rd.

Now once again I think if I get too plugged into stock market forums etc I will be convinced to take on more risk. Seems like the Aussie thing to do is get your line of credit on your house (or your stimulus payments / $20k of early retirement fund releases), leverage that into a margin lending structure, then open up a CFD account using Afterpay, to punt on Afterpay (AFTPF) going to $100 a share.

YouTube is going gangbusters with “market experts” opining on stocks, their follower counts are surging. You can search there for “ASX shares to buy”. You can find your favourite video with 80k views and join 500 odd people commenting to get comfort of what to do next. Get your “non-advice” answers from a youtuber that has seen it all in markets. Veteran 22 year old’s that were old enough to have survived the great market panic of late 2018 so therefore know what to do now.

New stock market gamblers in the US also, and Davey Day Trader

This theme of inexperienced investors taking risks in the share market since March is not only a theme confined to Australia.

What if all the bulls and all the bears both get it dramatically wrong?

Earlier I confused probably the readers and definitely myself about where the consensus thinks markets are going. If you are a contrarian now you probably don’t even know what the consensus is to go against it!

Perhaps the contrarian view on the market’s direction from here is to have no view. Or that we stay in a range on the ASX of 5000 to 5,800 for a long time. Then spend a year or more of listening to bulls and bears criticizing each other. That might be painful to listen to.

Rather then offer another two cents on that issue I thought I just might throw in some charts to show some of the dispersion in market performance.

Maybe some areas are dominated by FOMO, but some still show signs of fear?

I shall refer to the following link to reference many charts. Bear in mind the article was a little over a month old on April 9th. I think it still tells some interesting stories.

https://www.topdowncharts.com/single-post/2020/04/09/10-Charts-on-the-PE10-Valuation

Because the charts more reflect when markets were bottoming out in March they are less meaningful now from an absolute standpoint. They might provide some context over why markets were able to rebound sharply from the March lows though.

I think it still offers some insights into how much dispersion of performance in markets we have seen.

Investors who have focused a lot on investing outside of the big cap names in the US (or some glamour ASX thematic stories), are probably hardly feeling exuberant about their investment returns from the last couple of years. (well maybe I am just speaking for myself!). Think of themes such as value vs growth (yes I realise they are joined at the hip but refer to how many define these), emerging markets, small cap value in particular. Not a lot of FOMO in those areas.

But perhaps it is all different this time, the new normal?

Now for some usual rants

Should I buy WAM shares?

I want to stress here that I have a healthy respect for the long term performance numbers of WAM. Geoff Wilson had done a good job over a long time and is generous with his time at the investor meetings. I have to call it as I see it though and I don’t like their latest format of the NTA reports.

A few things that have come to light since I last commented on them are as follows. Recent performance versus their benchmarks have been disappointing.

ASX LIC performance reporting

What I find more frustrating on that is not quickly being able to look up the figures for recent years. Investing is about the very long term of course. I would argue though that WAM over the last 3-5 years is a different beast to their first decade. Huge AUMs now, different staff making the calls. Knowing performance of the last 3-5 years might still have some relevance I would have thought. I hope they haven’t fallen in the trap of playing games with performance reporting.

I bring this up because another issue with some lacklustre performance is the depleting profit reserves at a time of an increasing premium to NTA. According to the last NTA report, their premium to NTA was 20%, with 6 cents in profits reserve, and they were holding 25% of the fund in cash. If they ever have to cut their dividend in the future it will be interesting seeing how the share price reacts.

Should I buy AFIC or Argo shares?

Less extreme premiums to NTA have been seen recently in these two, but still baffling to me. I have said that before of course. Despite some discounts occurring after that, we have swung around now to the point that nothing much has changed. So I have been proved wrong again, the premiums have more or less been sustainable so far.

Be careful of buying in this range of 10% though, pretty sure many were buying in March at a premium of more than 12%. Seems excessive for a fund with the inflexibility of built in unrealised capital gains and one with no clear evidence of any active performance edge.

Below is a chart of the movements in the discount / premium of AFIC over the years.

AFIC premium / discount to NTA

Beware future tax policy

If you were buying a lot of WAM, AFIC or Argo during the share market falls I would want to think that the debate around policies on franking don’t resurface again. When this occurred in early 2019 pre the election premiums quickly shrunk or disappeared on these LIC dividend favourites. WAM from around a 25% premium to only 10%. AFIC / Argo from 5% premiums to 5% discounts.

I suggest all investors should ponder how future taxation policies can be unreliable. With the economic headwinds from COVID-19 I think this is the case more than ever. I discussed this topic in a blog post here from 2018, on the very day Labor proposed some changes in regard to franking.

As crazy as it seems right now, the S&P 500 (SPY) would only have to climb around 12% to get to all-time highs again!

Does it feel kind of wrong that us investors could soon potentially seeing new high levels of personal wealth, at the same time of unemployment rates of circa 20%? In that environment will there be much sympathy for those worrying about their franking credits?

Perhaps the saviour will be if the government locates another $60 billion of loose change behind the couch when reflecting on their next budget forecasts.

NAB SPP 2020

Just one final word before I wrap up. I get a bit tired of reading on Hotcopper that the system is all rigged in favour of the big institutions. I was a holder of close enough to zero NAB shares but get an opportunity to try my luck in buying $30k shares in a SPP that is 10% “in the money”.

Now my suspicions is I will be disappointed and get a measly $4k or something per a $30k application. Still you never know. I remember ANZ in 2009 treating me well not scaling back anyone after their SPP then being well oversubscribed.

Wish me luck. It’s a bit embarrassing the number of small shareholdings I have now for this type of thing, yet so far in 2020 this is my only hopeful one of making a buck. Which as I said may be disappointingly scaled back.

Still I don’t think there is much risk at all playing this game. Just thought I would mention it as investors who perform poorly often like to complain about the disadvantages of being a small investor.

Disclaimer: These views on excessive premiums to NTA have been made before on this blog. Not much has changed so I have been wrong on this before and may well be so in the future!