Sensex Trades Over 200 Points Higher; Dow Futures Down By 7 Points

Share markets in India are presently trading on a strong note.

The BSE Sensex is trading up by 271 points, up 0.6% at 46,231 levels.

Meanwhile, the NSE Nifty is trading up by 68 points.

ONGC and GAIL are among the top gainers today. Divi's Laboratories and Eicher Motors are among the top losers today.

The BSE Mid Cap index is trading up by 0.3%

The BSE Small Cap index is trading up by 0.8%.

On the sectoral front, barring the healthcare sector, all sectors are trading in green with stocks from the oil & gas and metal sector witnessing most of the buying interest.

US stock futures are trading lower today, indicating a negative opening for Wall Street indices.

Nasdaq Futures are trading down by 30 points (down 0.2%) while Dow Futures are trading down by 7 points (flat).

The rupee is trading at 73.59 against the US$.

Gold prices are trading flat at Rs 49,088 per 10 grams.

In global markets, gold prices edged higher today as muted US jobs data spurred concerns about swift economic recovery.

However, gold prices struggled to edge higher in Indian markets amid muted global trends. On MCX, February gold futures were up 0.15% to Rs 49,149 per 10 grams after a two-day fall. In the previous session, gold had dipped 0.3%.

Moving on to stock-specific news...

Among the buzzing stocks, today is HCL Technologies.

IT services major HCL Technologies on December 10 said it has set up its first delivery center in Vietnam at Hanoi and plans to hire more than 3,000 people over the next three years.

From its first delivery center in Vietnam's capital city Hanoi, HCL will deliver advanced technology solutions to its global client base across several industries and verticals, including banking and financial services, healthcare, infrastructure, engineering and cybersecurity.

HCL's local entity, HCL Vietnam Company will also train the nation's talent pool in collaboration with local ICT and engineering institutions

HCL Technologies began its business operations in Vietnam in July this year and aims to hire more than 3,000 local university graduates and experienced professionals over the next three years.

A key part of HCL's business and development strategy in Vietnam will be to provide the right skilling and platforms to train graduates for career opportunities in hi-tech domains and provide them with the requisite exposure of working on global assignments.

The company will host a virtual job fair for college graduates and experienced professionals on December 19, 2020.

The company believes that Vietnam and its skilled youth have the true potential to develop a robust IT industry that is spearheading economic growth in the country.

We will keep you posted on all the updates from this space. Stay tuned.

At the time of writing, HCL Technologies' share price was trading up by 0.1% on the BSE.

Moving on to news from the automobile sector...

US$ 6.5 Billion TVS Group to Rearrange Family Shareholding In Group Companies

The members of the family, holding shares in various TVS Group companies will rearrange their stakes so as to "align and synchronize" with the management of the respective companies, the patriarch of the group Venu Srinivasan said in a letter.

The communication which was sent to the BSE also mentions that the letter was the fallout of the memorandum of family arrangement executed on December 10 between the members of the TVS family.

The present shareholders of the TVS Holding Companies primarily consist of the third and fourth generations of the original founder, TV Sundaram Iyengar. The various businesses/entities of the TVS Group have been traditionally managed by members of the different branches of the TVS family.

Senior nominated members of the TVS family shall now deliberate on how best to further implement this arrangement.

The TVS family has been engaged, for more than a century, in a diverse range of businesses through various entities in which the branches of the TVS family have invested in or through T V Sundaram Iyengar & Sons, Sundaram Industries, and Southern Roadways. These entities are the group's holding companies.

"This arrangement shall not affect the management and functioning of TVS Motor Company in any way, and we expect to continue business in the ordinary course without impacting any of the stakeholders", Srinivasan added.

Furthermore, the terms of the family arrangement do not envisage any royalty or brand usage payments from the operating businesses/ companies to the TVS Family members/ their holding companies.

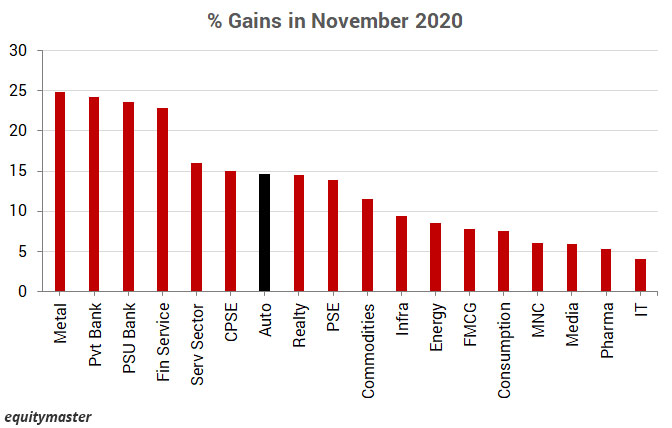

Speaking of the automobile sector, note that the sector has rebounded sharply from its March lows.

The Nifty Auto index gained as much as 15% last month.

The auto index entered the greed phase in September 2019 and will stay there until December 2021. This means there is still a lot of fuel left for auto stocks.

How automobile stocks perform in the coming months remains to be seen.

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more