Sensex Trades Over 1600 Points Lower; Dow Futures Down By 103 Points

Share markets in India are presently trading on a negative note.

The BSE Sensex is trading down by 1692 points, down 3.3% at 49,330 levels.

Meanwhile, the NSE Nifty is trading down by 473 points.

Sun Pharmaceuticals is among the top gainers today. Mahindra & Mahindra and ICICI Bank are among the top losers today.

The BSE Mid Cap is trading down by 2.2%.

The BSE Small Cap index is trading down by 1.2%.

On the sectoral front, all sectors are trading in red with stocks from the banking sector witnessing most of the selling pressure.

US stock futures are trading lower today, indicating a negative opening for Wall Street.

Nasdaq Futures are trading down 113 points (down 0.8%) while Dow Futures are trading down by 150 points (down 0.5%)

The rupee is trading at 73.04 against the US$.

Gold prices are trading down 0.4% at Rs 46,060 per 10 grams.

Gold struggled in Indian markets for the fourth day in a row and remained near 8-month lows. On MCX, gold futures were up 0.1% to Rs 46,297 per 10 grams.

Note that the precious metal has been under pressure since the start of this year amid hopes of faster global economic recovery and rising US bond yields. As compared to August highs of Rs 56,200, gold is down about 18% or about Rs 10,000.

In global markets, gold prices were flat today but were on track for their second straight weekly decline as rising US Treasury yields dented the appeal of bullion which does not pay any interest. Spot gold was flat and is on track for a 0.6% decline for the week so far.

Moving on to stock-specific news...

Among the buzzing stocks, today is DHFL.

DHFL said that it has received no objection from the Reserve Bank of India (RBI) and has filed an application with the National Company Law Tribunal (NCLT) for submission of the resolution plan of Piramal Capital & Housing Finance.

The resolution plan has been approved by the Committee of Creditors (CoC).

In November 2019, the RBI had referred DHFL, the third-largest pure-play mortgage lender, to the NCLT for insolvency proceedings. It was the first finance company to be referred to NCLT by the RBI using special powers under Section 227 of the Insolvency and Bankruptcy Code (IBC).

Prior to that, the company's board was superseded and R Subramaniakumar was appointed as the administrator. He is also the resolution professional under the IBC.

The company is being investigated by the ministry of corporate affairs from December 2019 through the Serious Fraud Investigation Office (SFIO). The Enforcement Directorate is also probing the company in connection with loans given by it to certain borrowers.

The financial creditors have claimed an outstanding worth of Rs 870 billion from DHFL.

How this pans out remains to be seen. Meanwhile, stay tuned for more updates from this space.

At the time of writing, DHFL share price was trading up by 4.8% on the BSE.

Moving on to news from the automobile sector...

Ashok Leyland to Acquire Nissan International's 38% Stake in Hinduja Tech

Ashok Leyland has entered into a share purchase agreement with Nissan International Holding BV to acquire the latter's stake in Hinduja Tech (HTL).

The commercial vehicle major informed the BSE that it has entered into a share purchase agreement with Nissan International Holding BV to acquire 58.5 million shares for a total consideration of Rs.702 million constituting 38% in the paid-up share capital of HTL.

Consequent to the aforesaid acquisition, HTL will become a wholly-owned subsidiary of the company.

HTL works in the information technology (IT) & ITeS space. In FY20, the company reported a profit of Rs 159 million as against Rs 143 million in the year-ago period. The company's revenue stood at Rs 2.3 billion in 2019-210 as compared to Rs 2.1 billion in the corresponding period of the last year.

In 2014, Nissan International Holdings, a Dutch investment arm of Japanese automaker Nissan, came as the strategic investor on Hinduja Tech.

Founded in 2009, Hinduja Tech, formerly known as Defiance Technologies, provides engineering, manufacturing, and enterprise (EME) services and solutions for automotive, aerospace, defense, industrial, and general manufacturing industries.

We will keep you posted on more updates from this space. Stay tuned.

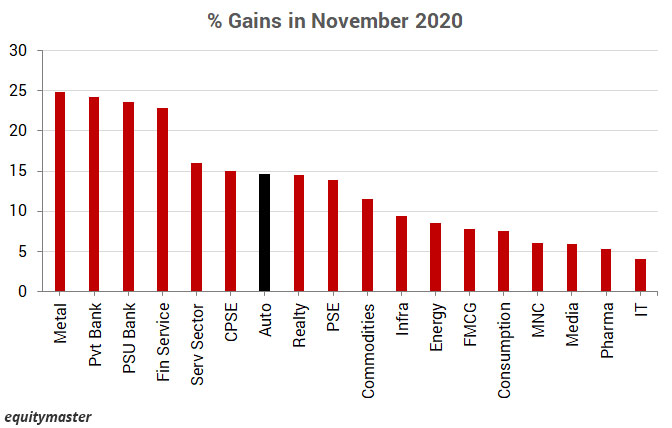

Speaking of the automobile sector, note that the sector has rebounded sharply from its March lows.

The auto index entered the greed phase in September 2019 and will stay there until December 2021. This means there is still a lot of fuel left for auto stocks.

How automobile stocks perform in the coming months remains to be seen.

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more