Sensex Trades Marginally Higher, Dow Futures Up By 71 Points

Share markets in India are presently trading marginally higher.

The BSE Sensex is trading up by 130 points, up 0.2%, at 56,079 levels.

Meanwhile, the NSE Nifty is trading up by 52 points.

L&T and Bharti Airtel are among the top gainers today. IndusInd Bank and Eicher Motors are among the top losers today.

The BSE Mid Cap index is trading up by 0.7%

The BSE Small Cap index is trading up by 0.6%.

On the sectoral front, stocks from the telecom sector are witnessing most of the buying interest.

On the other hand, stocks from the energy sector are witnessing most of the selling pressure.

US stock futures are trading lower today, indicating a negative opening for Wall Street.

Nasdaq Futures are trading up by 45 points (up 0.3%) while Dow Futures are trading up by 71 points (up 0.2%)

The rupee is trading at 74.12 against the US$.

Gold prices are trading up 0.6% at Rs 47,519 per 10 grams.

Gold prices edged higher in Indian markets today despite muted global cues. On MCX, gold futures rose 0.4% to Rs 47,430 per 10 grams. In the previous session, gold had edged 0.2% higher.

In global markets, gold rates were steady today as investors awaited Fed chief Jerome Powell's speech later in the day at the Jackson Hole symposium. Spot gold rose 0.1% but traded below the key level of US$ 1,800 at US$ 1,793.7 per ounce.

Moving on to stock-specific news...

Among the buzzing stocks today is CAMS.

Computer Age Management Services (CAMS) has announced its plans to set up an office at GIFT city (Gujarat) to provide asset management support services for financial institutions which have set up or plan to set up operations in GIFT City.

The company on Wednesday, 25 August 2021, said it was authorised by the International Financial Services Centres Authority (IFSCA) to undertake "administration, asset management support services and trusteeship services."

It had earlier received a letter of approval from the GIFT City Multi Services-SEZ which extended the facilities and entitlements admissible to units in GIFT City.

CAMS has been serving the AIF (alternative investment funds) segment for over twelve years and has deep domain experience in this arena serving several marquee funds.

The company's operations in GIFT city will enable it to readily offer this canvas of services to AIFs based out of GIFT city.

We will keep you posted on more updates from this space. Stay tuned.

At the time of writing, CAMS shares were trading up by 7.4% on the BSE.

Moving on to news from the steel sector...

SAIL Aims to Bring Down Borrowings to Rs 200 bn

Public sector steel major, Steel Authority of India Ltd (SAIL), is looking at bringing down its borrowings to Rs 200 bn by the end of the financial year 2022.

The steel manufacturer has a net debt of around Rs 300 bn. It had a net debt of around Rs 353 bn at the end of the financial year 2021.

However, this depends on steel prices and the demand situation.

Though steel prices have shown a rising trend in early July, they tamed down during the last week of the month. But the company's chairman has said that though the flat steel prices were stable, long steel prices were improving.

On the proposed joint venture between SAIL and ArcelorMittal, the company said that there has been no progress so far.

In December 2017, the SAIL approved the proposal of entering into a JV with ArcelorMittal to manufacture high-end automotive steel. Although the JV has not yet been scrapped both are yet to sign a definitive agreement.

Steel Authority of India (SAIL) is a government-owned steel manufacturing enterprise based in New Delhi, India. It is under the ownership of the Ministry of Steel, Government of India.

How this pans out remains to be seen. Meanwhile, stay tuned for more updates from this space.

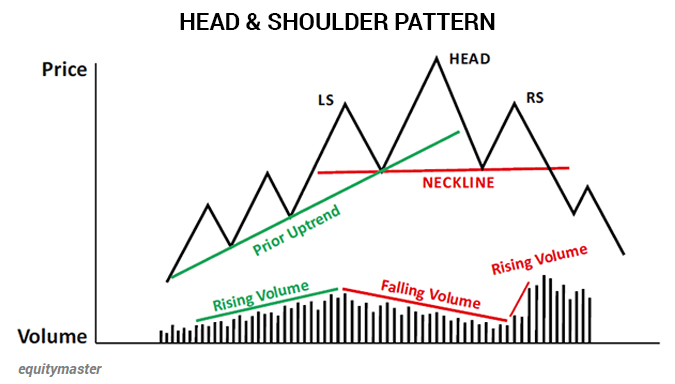

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again, fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more