Sensex Trades Marginally Higher, Dow Futures Up By 25 Points

Share markets in India are presently trading marginally higher.

The BSE Sensex is trading up by 200 points, up 0.3%, at 58,378 levels.

Meanwhile, the NSE Nifty is trading up by 60 points.

IndusInd Bank and Hero MotoCorp are among the top gainers today. UltraTech Cement and Hindalco are among the top losers today.

The BSE Mid Cap index is trading up by 1.2%.

The BSE Small Cap index is trading up by 0.6%.

On the sectoral front, barring the metal sector, all sectors are trading in green with stocks from the utility sector witnessing most of the buying interest.

US stock futures are trading higher today, indicating a positive opening for Wall Street.

Nasdaq Futures are trading up by 3 points (flat) while Dow Futures are trading up by 25 points (up 0.1%)

The rupee is trading at 73.61 against the US$.

Gold prices are trading down by 0.04% at Rs 46,890 per 10 grams.

Gold prices continued to trade in a narrow range in India today amid subdued global cues. On MCX, gold futures were down 0.1% to Rs 46,860 per 10 grams in their third decline in four days.

In international markets, gold edged lower today as the dollar index was steady near a two-week high while investors also remained cautious ahead of crucial US inflation data due later today. Spot gold slipped 0.1% to US$ 1,791.2 an ounce.

Moving on to stock-specific news...

Among the buzzing stocks, today is Zee Entertainment.

Shares of Zee Entertainment soared over 30% on the bourses today amidst buzz over a rejig of the company's board.

On 13 September 2021, the company's largest shareholders Invesco Developing Markets Fund and OFI Global China Fund LLC, called an extraordinary general meeting (EGM) seeking the removal of Punit Goenka, Manish Chokhani, and Ashok Kurien as directors of the firm.

Punit Goenka, who is the son of Essel group founder and chairman Subhash Chandra, is the managing director and chief executive officer of the media company.

The two funds have sought to appoint six new independent directors, the filing added.

The proposed directors are Surendra Singh Sirohi, Naina Krishna Murthy, Rohan Dhamija, Aruna Sharma, Srinivasa Rao Addepalli, and Gaurav Mehta.

However, the shareholders said,

- We understand that the company is required to seek approval from the Ministry of Information and Broadcasting ("MIB") in connection with the appointment of the proposed independent directors.

Accordingly, we request that the company submit an application with the MIS seeking approval for the appointment of the proposed independent directors at the earliest.

In a separate filing, the company said that Manish Chokhani and Ashok Kurien have resigned from the positions of non-executive non-independent directors of the firm with immediate effect.

We will keep you posted on more updates from this space. Stay tuned.

At the time of writing, Zee Entertainment shares were trading up by 33.8% on the BSE.

Moving on to news from the retail sector...

Goldiam International Soars 17% as Board Approves Buyback

Shares of Goldiam International soared 17% to a new high on the BSE in intra-day trade today after the company's board approved a proposal to buyback shares at a price of Rs 1,200 per share.

The company is an integrated manufacturer and supplier of diamond jewelry to leading retailers and wholesalers in the USA and Europe.

In an exchange filing, the company said,

- The board of directors of Goldiam International at its meeting held on 13 September 2021 has approved a proposal to buyback up to 380,000 equity shares of the company for an aggregate amount not exceeding Rs 456 m, at a price of Rs 1,200 per equity share.

The company further said that the buyback is proposed to be made from the existing shareholders of the company as on the record date on a proportionate basis under the tender offer route.

On the rationale behind share buyback, Goldiam International said that the company believes that the strong future and outlook of its business activities is not accurately reflected in the prevailing market price, thereby giving an opportunity for buyback to create long-term value for its shareholders.

The buyback would help in improving financial ratios like earnings per share and return on equity, by reducing the equity base of the company; and thereby, enhancing the overall return to shareholders, it added.

Over the last five years, Goldiam has carried out two buybacks of shares to the tune of Rs 300 m. It has also utilized Rs 841.7 m on dividends and buybacks.

How this buyback pans out remains to be seen. Meanwhile, stay tuned for more updates from this space.

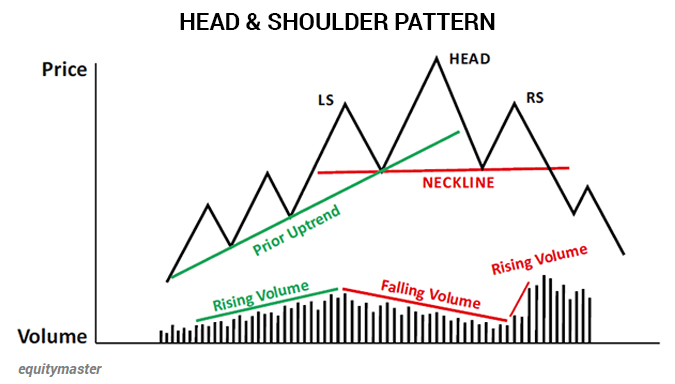

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more