Sensex, Nifty End At Record High On US Stimulus Cheer; Realty & Banking Stocks Rally

Indian share markets scaled fresh peaks today amid positive global cues after US President Donald Trump signed into law a US$ 2.3 trillion pandemic aid and spending package.

Moreover, the United Kingdom's historic trade deal with the European Union also aided investor sentiment.

At the closing bell, the BSE Sensex stood higher by 380 points (up 0.8%).

The NSE Nifty closed higher by 124 points (up 0.9%).

Titan and SBI were among the top gainers today.

The SGX Nifty was trading at 13,956, up by 195 points, at the time of writing.

The BSE Mid Cap index and the BSE Small-Cap index ended up by 0.8% and 1.5%, respectively.

All sectoral indices ended in green. Gains were largely seen in the realty sector and banking sector.

Asian share markets ended higher with Japanese shares rising to the highest in nearly three decades as investors continued to bet that US fiscal stimulus and coronavirus vaccinations will quicken the global economic recovery.

As of the most recent closing prices, the Hang Seng ended down by 0.3% and the Shanghai Composite stood higher by 0.1%. The Nikkei ended up by 0.7%.

US stock futures are trading higher today indicating a positive opening for Wall Street indices. Nasdaq Futures are trading up by 72 points (up 0.6%), while Dow Futures are trading up by 141 points (up 0.5%).

The rupee is trading at 73.45 against the US$.

Gold prices are trading up by 0.3% at Rs 50,230 per 10 grams.

Global gold rates jumped 1% today as the metal's appeal as an inflation hedge was boosted by news that US President Donald Trump had signed a long-awaited coronavirus relief aid bill.

Tracking firm international prices, domestic gold prices surged today. On MCX, February gold futures rose by 1% to Rs 50,580 per 10 grams.

Speaking of gold, Ajit Dayal, founder of the Quantum Group, shares his views on gold in the latest episode of Investor Hour Podcast.

In the podcast, Ajit also talks about the Covid-19 situation around the world, specific investment opportunities as well as his personal asset allocation strategy.

You can also check Ajit's latest article on the best way to start a strong Indian economic recovery here: How India's Economy Can Grow at 10% p.a.

In news from the automobile sector, Tata Motors was among the top buzzing stocks today.

Shares of the company rose over 5% today after the United Kingdom (UK) and the European Union negotiators finalized their historic post-Brexit trade agreement.

The European Union so far has been a single market for the Tata Motors-owned Jaguar Land Rover (JLR) but this is set to change after the UK's exit from the European Union.

Post the deal, JLR can now continue to export and import between the UK and the EU without any restriction and additional overheads.

JLR accounts for over 80% of Tata Motors revenues.

Reports state that the deal will also help consolidate the recovery seen in JLR sales in the second quarter. JLR retail sales were up 53% sequentially in Q2.

In the past two trading days, shares of Tata Motors gained 9% after the company maintained profitability guidance for its luxury car maker JLR.

Jaguar Land Rover has not seen any impact so far from issues at UK ports, Tata Motors said on Thursday, even as many countries cut transport ties with Britain due to a fast-spreading new variant of the coronavirus.

"Jaguar Land Rover has comprehensive contingency planning and actions in place to respond to ongoing COVID challenges and disruption. This is subject to constant review," Tata Motors said in a media statement.

Tata Motors' share price ended the day up by 5.7%.

Speaking of the automobile sector, note that the sector has rebounded sharply from its March lows.

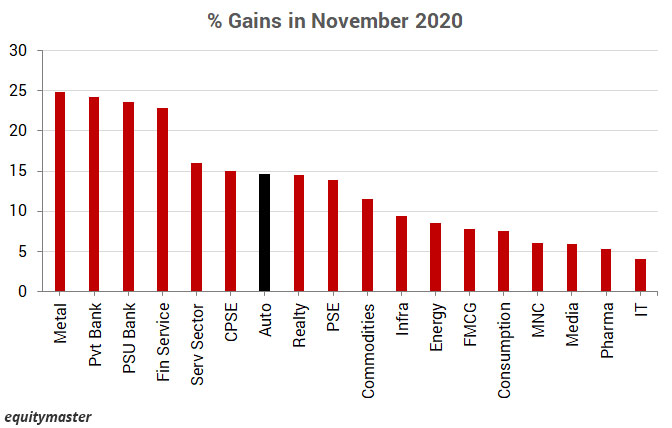

The Nifty Auto index gained as much as 15% last month.

The auto index entered the greed phase in September 2019 and will stay there until December 2021. This means there is still a lot of fuel left for auto stocks.

How automobile stocks perform in the coming months remains to be seen.

In news from the finance sector, Paisalo Digital's share price soared 20% today after SBI Life Insurance acquired a 9% stake in the finance company via open market.

Last week on Thursday, SBI Life Insurance Company had purchased 3.8 million equity shares, representing 8.99% equity of Paisalo Digital, for Rs 1.9 billion via bulk deal on the NSE at Rs 490 per share, exchange data show.

Reportedly, Paisalo Digital has also entered in to an arrangement with a prominent PSU bank, wherein it would originate loans under its income generation loans extended to both individuals and under its group lending schemes, of which 80% would be funded by the PSU bank and the balance would be funded by Paisalo Digital.

The company would manage the loan including collections and would earn a fee on the off-book AUM.

Moving on to news from the IT sector, shares of NIIT rose 5% to hit a fresh 52-week high of Rs 209.90 after the company on Thursday said its board has approved an up to Rs 2.4 billion buyback proposal at Rs 240 per equity share.

The buyback price of Rs 240 per share is at a 20% premium to Thursday's closing price.

NIIT's share price ended higher for the fourth straight day, gaining as much as 21% during the period after the company on December 21 announced that its board will meet on December 24 to consider a proposal for buyback of equity shares of the company.

The buyback is subject to shareholders' approval by passing a special resolution through a postal ballot.

The promoters hold a 34.27% stake in NIIT. Foreign portfolio investors have 22.16% holding, followed by individual shareholders (21.81%), mutual funds (8.03%), and corporate bodies (6.8%), data as per the company's pre-buyback shareholding pattern showed.

Speaking of buybacks, as a shareholder in cash-rich companies, you should not only be wary of expensive buybacks. But if possible use it to your advantage to rake in some cash.

As per Rahul Shah, co-head of Research, investors should not assume buybacks are always good. Here's an excerpt of what he wrote in one of the editions of The 5 Minute Wrapup:

- The reason behind the buyback must be investigated. At the end of the day, an increase in earnings should be more a function of the inherent robustness of the business, as that's what will help it continue to grow at a healthy pace.

To know what's moving the Indian stock markets today, check out the most recent more