Sensex Ends Flat; Maruti Suzuki Rallies 7.5%

After opening the day at record high levels, Indian share markets erased gains as the session progressed and ended on a flat note, led by a decline in IT stocks and index heavyweight HDFC Bank.

HDFC Bank's share price slipped over 1.5% after the Reserve Bank of India (RBI) imposed strictures on the bank after recent outages on internet banking, mobile banking.

At the closing bell, the BSE Sensex stood higher by 15 points. Meanwhile, the NSE Nifty ended up by 20 points.

In early trade, the Sensex rallied over 300 points to hit fresh record high tracking gains in index heavyweights HDFC Bank, Reliance Industries, and Maruti Suzuki amid largely positive cues from global markets.

ONGC was among the top gainers today. HDFC Bank, on the other hand, was among the top losers today.

SGX Nifty was trading at 13,206, up by 44 points, at the time of writing.

The BSE Mid Cap index ended up by 0.9%. The BSE Small Cap index ended higher by 0.7%.

Sectoral indices ended on a mixed note with stocks in the oil & gas sector and metal sector witnessing buying interest.

IT stocks, on the other hand, witnessed selling pressure.

Asian stock markets ended on a positive note as major countries moved closer to rolling out coronavirus vaccines, while hopes of more stimulus also boosted sentiment.

Japanese shares closed to a 29-1/2-year high as Japan's government committed to more fiscal spending and US President-elect Joe Biden pledged to act swiftly on stimulus measures.

The Nikkei ended up a modest 0.1% at 26,809.37 but settled near its highest since April 1991. The Shanghai Composite ended down by 0.2% and the Hang Seng ended up by 0.6%.

US stock futures are trading flat. Nasdaq Futures are trading up by 8 points, while Dow Futures are trading down by 93 points (down 0.3%).

The rupee is trading at 73.90 against the US$.

Gold prices for the latest contract on MCX are trading up by 1.1% at Rs 49,189 per 10 grams.

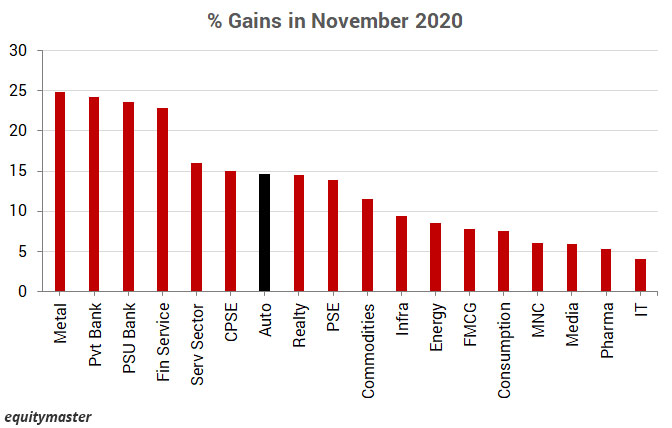

Speaking of stock markets, the past month was a staggering one. Benchmark indices saw huge buying interest and went on to touch record-high levels.

The BSE smallcap index was up 13% in November.

The BSE smallcap index has risen more than 10% in a month only 6 times in the last decade.

Foreign investors (FIIs) invested a net amount of around Rs 650 bn in November. This is the biggest purchase by FIIs by a big margin so far.

Services Sector Grows for 2nd Straight Month

In news from the economic space, India's services sector expanded for the second month in a row in November though at a slower pace than the previous month and witnessed a rise in employment for the first time in nine months.

The IHS Markit India Services Business Activity Index was 53.7 in November, lower than 54.1 in October, and above the critical 50 mark that separates growth from contraction.

Services firms hired additional workers in November, ending an eight-month sequence of job shedding.

The upturn in total new work was driven by the domestic market, with new export orders decreasing sharply again in November. The latest fall in international sales, the ninth in consecutive months, was attributed to subdued global demand and travel restrictions.

Earlier this week on Tuesday, a survey showed PMI manufacturing falling to a three-month low of 56.3 in November from an over 12-year high of 58.9 in October.

Put together, Indian private sector activity rose for the third straight month in November, but the pace of growth softened from October's near nine-year high. The Composite PMI Output Index was down to 56.3 from 58 in October.

Note that India's economy recovered faster than expected in the September quarter as a pick-up in manufacturing helped the gross domestic product (GDP) clock a lower contraction of 7.5%.

The GDP had contracted by a record 23.9% in the first quarter of the 2020-21 fiscal (April 2020 to March 2021).

What effects the above developments have on the Indian stock market remains to be seen.

Moving on to stock-specific news...

Maruti Suzuki was among the top buzzing stocks today.

Shares of Maruti Suzuki hit an over 11-month high of Rs 7,777, up 7.5% on the BSE.

The stock of the passenger vehicles (PV) bellwether was trading higher for the fourth straight day, rising as much as 7% during the period, even as the company's volumes in November rose at a modest pace by 1.1% to 153,223 units, dragged by a 5% decline in the core mini and compact portfolio.

In an interview with Bloomberg Television on Wednesday, the company's Chairman R.C. Bhargava said Maruti is expecting retail sales in December to be "pretty good" as there are pending orders with its dealerships and the rate of inquiries has sustained even after the festive season.

"The pending demand has been very much in the forefront of what is causing the increase in sales," said Bhargava. "2020 hasn't been a good year. We lost the first quarter, so I definitely expect 2021 to be much better than in 2020."

Despite the pandemic, Bhargava was a "little bit" surprised that demand has continued as many expected a drop after the end of the festival period.

The inventories at the dealerships are probably at the lowest they have had for years, he said.

Note that India's automakers, which were grappling with a slowdown even before the pandemic, saw a recovery after the nation restarted most activities to revive sentiment and growth in the aftermath of one of the world's strictest coronavirus lockdowns.

The pandemic had stalled production and led to a washout in the initial months of the lockdown. Sales slowly picked up from July, mostly led by first-time buyers as people opted for personal mobility over public transport.

Speaking of the automobile sector, note that the sector has rebounded sharply from its March lows.

The Nifty Auto index gained as much as 15% last month.

The auto index entered the greed phase in September 2019 and will stay there until December 2021. This means there is still a lot of fuel left for auto stocks.

How automobile stocks perform in the coming months remains to be seen.

Moving on to news from the pharma sector, shares of Fermenta Biotech jumped over 8% intraday today after the company's US arm acquired membership interest in AGD Nutrition.

Fermenta Biotech USA, LLC, a wholly-owned subsidiary of the company, has acquired a membership interest in AGD Nutrition, LLC.

AGD Nutrition LLC is in a similar line of business as that of the company and Fermenta Biotech USA, LLC. The main purpose of the acquisition is to facilitate exports and enhance the company's footprint in North America, the company said in an exchange filing.

As per reports, the aggregate consideration for the purchase of membership interest is US$ 1,260,500.

Fermenta Biotech's share price ended the day up by 6.4%.

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more