Sensex Ends 403 Points Higher; Metal And Realty Stocks Witness Buying

Indian share markets witnessed positive trading activity throughout the day today and ended higher.

Benchmark indices scaled fresh peaks today with the BSE Sensex rising over 400 points amid positive investor sentiment over the roll-out of COVID-19 vaccines.

Sentiment also got a boost after S&P Global Ratings on Tuesday raised India's growth projection for the current fiscal to (-)7.7% from an (-)9% estimated earlier.

At the closing bell, the BSE Sensex stood higher by 403 points (up 0.9%).

The NSE Nifty closed higher by 115 points (up 0.9%).

HDFC and ONGC were among the top gainers today.

The SGX Nifty was trading at 13,690, up by 105 points, at the time of writing.

Both, the BSE Mid Cap index and the BSE Small Cap index ended up by 0.9%.

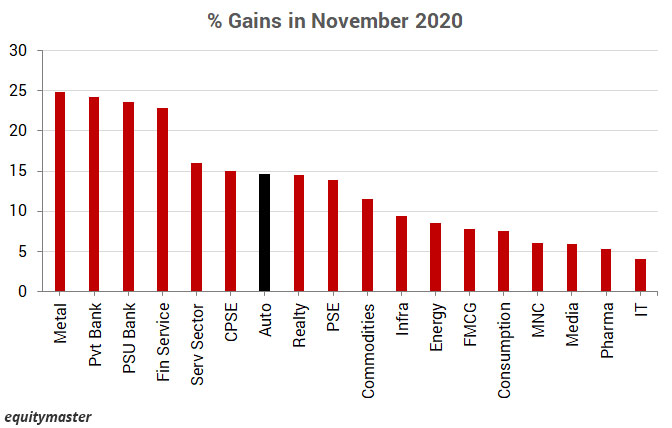

On the sectoral front, gains were largely seen in the realty sector and metal sector.

Shares of real estate companies continued their upward trend, with the Nifty Realty index surging 4% on hopes of a revival in demand.

Shares of Godrej Properties and Nestle India hit their respective 52-week high today.

Asian stock markets ended on a positive note today on account of US economic stimulus optimism.

As of the most recent closing prices, the Hang Seng ended up by 0.9% while the Nikkei ended up by 0.3%.

European shares surged to their highest levels since February, on upbeat business activity data in the region, raising hopes of a Brexit trade deal, and the possible roll-out of a vaccine in the continent before the new year.

US stock futures are trading marginally higher. Nasdaq Futures are trading up by 44 points (up 0.3%), while Dow Futures are trading up by 65 points (up 0.2%).

The rupee is trading at 73.57 against the US$.

Gold prices are trading up by 0.7% at Rs 49,809 per 10 grams.

In news from the commodity space, crude oil prices fell today on a surprise gain in crude oil inventories in the United States and on persistent investor worries about demand for fuel being squeezed amid tighter lockdowns in Europe to counter the coronavirus pandemic.

Crude inventories swelled by 2 million barrels in the week to December 11 to about 495 million barrels, according to industry group API.

The International Energy Agency (IEA) revised down its estimates for oil demand this year by 50,000 barrels per day (bpd) and for next year by 170,000 bpd, citing scarce jet fuel use as fewer people travel by air.

In the previous session, crude oil prices rose above US$ 50 as optimism from the roll-out of coronavirus vaccines balanced out tighter lockdowns in Europe and forecasts of a slower demand recovery.

Crude oil prices have recovered in the past few weeks, with Brent crude reaching US$ 51.06 on December 10, its highest since March, supported by hopes of a recovery in demand.

Note that the coronavirus pandemic, coupled with the collapse of an OPEC-led output pact sent crude oil prices crashing in March.

We are closely tracking this sector and will keep you updated on all the top news from this space. Stay tuned.

Moving on to stock-specific news...

Mahindra & Mahindra (M&M) is among the top buzzing stocks today.

Shares of the company rose 4% in early trade today after it announced that it will increase the price of its passenger vehicles (PVs) and commercial vehicles (CVs) from January 1, 2021, in order to partially offset the impact of rise in input costs.

M&M said the price hike has been necessitated due to the increase in commodity prices and various other input costs.

Details of the price increase across different models will be communicated in due course, the company said.

M&M had reported a 4% rise in its total vehicle sales to 42,731 units in November amid demand for utility vehicles and light commercial vehicles. The company sold 41,235 units in the year-ago period.

Note that earlier this month, the country's largest carmaker Maruti Suzuki had also announced that it will be increasing prices across its model range from January 2021.

The automaker said that the cost of vehicles severely impacted due to various input costs and it's necessary to pass on some of the impacts to customers.

M&M share price ended the day up by 1.8%.

Speaking of the automobile sector, note that the sector has rebounded sharply from its March lows.

The Nifty Auto index gained as much as 15% last month.

The auto index entered the greed phase in September 2019 and will stay there until December 2021. This means there is still a lot of fuel left for auto stocks.

How automobile stocks perform in the coming months remains to be seen.

Moving on, in the latest developments from the IPO space, shares of Burger King India, which made a stellar debut at the bourses on Monday, were locked in the upper circuit band of 20% for the third straight day.

On Monday, the stock closed at Rs 138.40, clocking a 130% premium over its issue price of Rs 60.

With today's gain, the stock has rallied as much as 232% from its issue price.

Foreign portfolio investor Valiant Mauritius Partners Offshore purchased 2.5 million equity shares of BKIL, worth Rs 325.7 million, via a bulk deal on Monday. The foreign portfolio investor bought shares at the price of Rs 130.28 per share, data show.

Meanwhile, the IPO of Mrs Bectors Food Specialities received a good response from investors as the issue was subscribed 8 times on December 16, the second day of bidding.

The Rs 5.4-billion IPO has received bids for 105.8 million equity shares against an offer size of more than 13.2 million equity shares (excluding anchor book).

A strong response was seen from retail investors and employees as their reserved portion was subscribed 13.17 times and 11.78 times, respectively.

As per reports, Mrs Bectors Food Specialities shares were available at a 76% premium over its IPO price, in the grey market, on its first day of bidding.

The trading premium increased significantly to Rs 220 from Rs 170.

Note that the previous IPO to this - Burger King India's IPO - received an overwhelming response from investors, with the public offer being subscribed 157 times. The issue generated bids for 11.7 billion shares, worth Rs 700 billion, as against only 75 million on offer.

That made Burger King India the fourth mainboard IPO this year, which saw bidding of 100 times and more. The other three were Mazagon Dock Shipbuilders (157.41 times), Happiest Minds (156.65 times), and Chemcon Speciality (149.3 times).

While Mazagon got listed at a near 50% premium to its IPO price, Chemcon Speciality saw a 115% surge. Shares of Happiest Minds Technologies rallied 111% at its listing.

How the IPO of Mrs Bectors Food Specialties sails through remains to be seen. Meanwhile, we will keep you updated on the latest developments from this space.

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more