Russian GDP Is Likely To Accelerate This Year

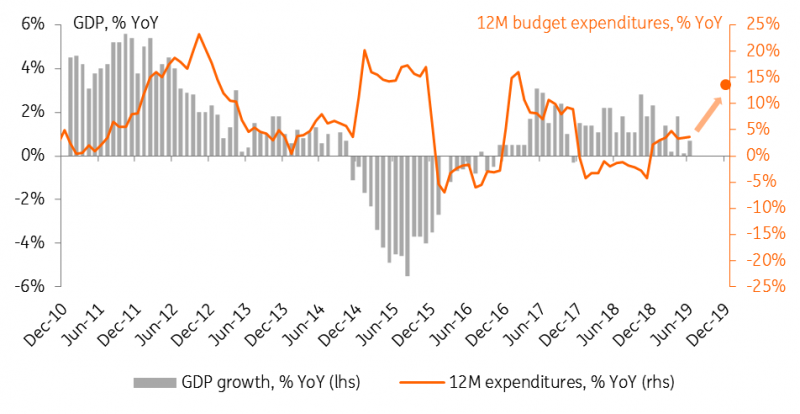

Russian GDP growth accelerated from 0.5% to 0.9% YoY between the first and second quarters, slightly exceeding expectations. A planned rise in budget spending should give a boost to otherwise anaemic GDP in the second half of the year. We reiterate our GDP growth target of 1% for 2019.

Construction of the new Zaryadye Park in Moscow

Russian GDP growth accelerated from 0.5% YoY in 1Q19 to 0.9% YoY in 2Q19, slightly exceeding the consensus and our forecast of 0.8% YoY. That's according to the State Statistics Service (Rosstat). While the structure of 2Q19 GDP won't be released until 9-10 September (by production) and October 2-3 (by usage), we can still make the following preliminary observations:

- The acceleration of industrial output growth from 2.1% YoY in 1Q19 to 3.0% in 2Q19 was the key positive contributor;

- The contribution of household consumption was neutral to slightly negative, as retail trade growth decelerated from 1.9% YoY in 1Q19 to 1.5% YoY in 2Q19;

- The overall weakness in GDP growth in 1H19 relates to the stringent approach to the budget policy as 1H19 federal budget spending growth totalled 4% YoY vs 8-13% drafted in the official budget plan for the full year;

- The planned acceleration in budget spending in 2H19, mainly related to the National Projects gaining traction, should provide a boost to GDP growth in 2019-20, mainly through higher activity in the industrial and construction sectors;

- The current GDP growth trajectory is in line with 1.0-1.5% expectations for 2019 and 1.8-2.3% for 2020, held by the Bank of Russia, Ministry of Economic Development, World Bank, and IMF;

- No extra monetary or budget measures other than those already planned are required to achieve the expected growth rates in 2019-20. Should the state-sponsored infrastructure construction create some synergies in the private sector, our 1.5% GDP growth forecast for 2020 may have scope for upward revision;

- We continue to see little relevance of the GDP growth rate to the policy rate decisions in the mid-term. Our expectations of another 25 bp rate cut to 7.0% in 2019 and another 50 bp cut to 6.5% in 2020 due to a CPI slowdown remain unchanged given the assumption of an eventual calming of the mood on global markets.

Russian GDP growth vs federal budget spending growth, % YoY

(Click on image to enlarge)

Soure: State Statistics Service, Finance Ministry, ING

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more