Russian CPI Exceeds Expectations In 2020 Despite Weakness In Demand

Russian inflation shot up at the end of 2020, exceeding expectations. The good news is that for the most part, it is global agriculture inflation, RUB depreciation, and low base effect, all of which should end soon. But the bad news is that inflationary expectations are shooting up, and the demand-driven disinflation seems nowhere to be found.

Expected trend, unexpected levels

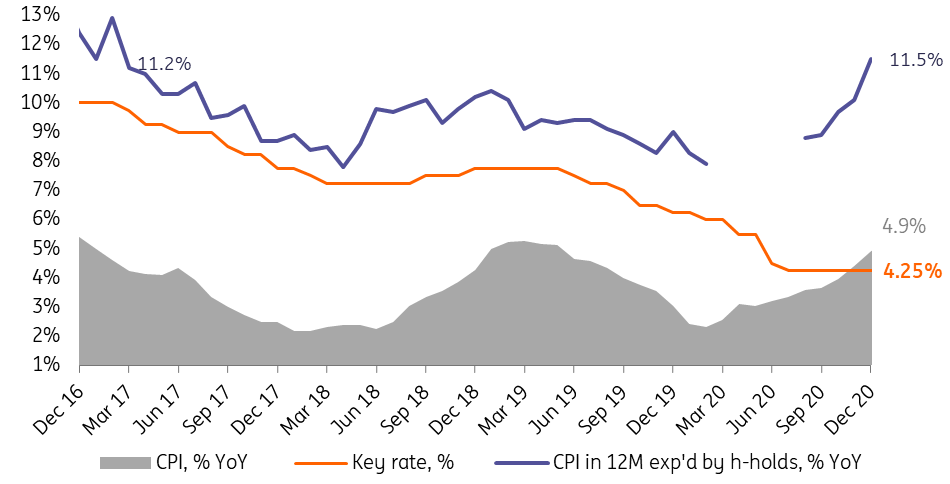

The pick-up in CPI from 4.4% year-on-year in November to 4.9% YoY in December (Figure 1) is not really news, but rather a confirmation of the preliminary estimates available on 31 December last year. Still, the number is worth mentioning, as it exceeds the initial consensus by 0.2 percentage points and is at the upper bound of Bank of Russia's forecast range of 4.6-4.9% YoY made public on 18 December.

The good news is that the trend itself was not unexpected: CPI has been on the upward path since the February 2020 low point of 2.3% YoY, driven by the following:

- USDRUB depreciation by 15% in March, and, after some rebound in 2Q20, by another 8% over 3Q20. Normally, the pass-through effect is 0.3-0.5 extra CPI growth per each 10% depreciation, with the effect lasting for up to two quarters, meaning that the inflationary effect of RUB depreciation should be minimized after 1Q21.

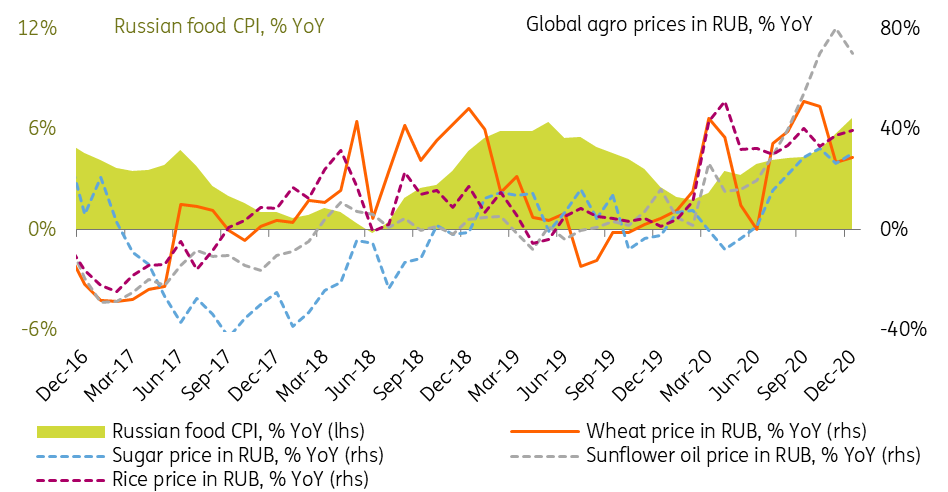

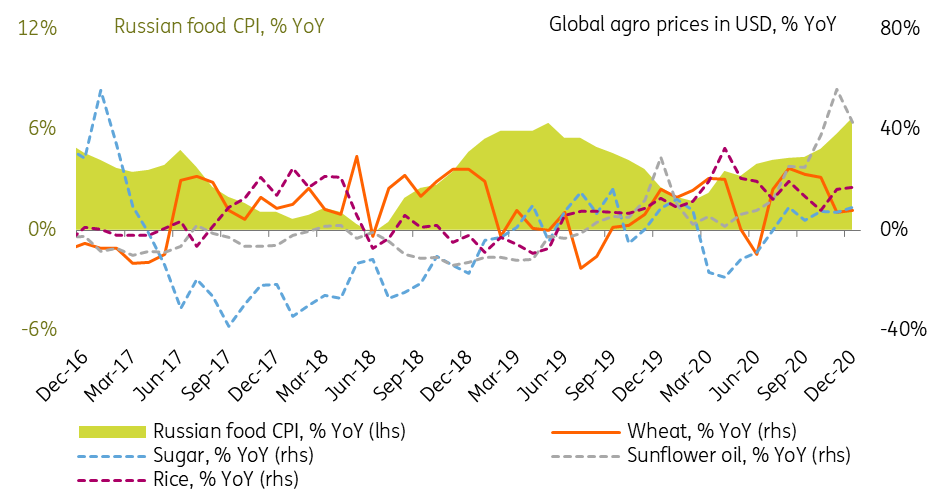

- Global agriculture inflation, with global wheat price growth peaking at around 25% YoY in USD terms in August-September (Figure 3), and by around 50% YoY in RUB terms (Figure 2). Historically, each 10% of global wheat price growth translates into 1ppt of Russian food price growth, fully explaining the spike in local food price growth from the February low of 1.8% YoY to 6.7% YoY by the end of last year. Again, the good news is that global food prices seem to have slowed in 4Q20, and the global outlook for 2021 is currently benign.

- Low statistical base effect of 2H19, during which the local CPI decelerated from 4.7% YoY to 3.0% YoY owing to a combination of the abnormally tight approach to budget spending and a number of one-off cost-input restraints. This effect will continue into 1Q21 (in 1Q20, CPI slowed down by 0.7ppt), suggesting that the local CPI peak is yet to be reached in the coming months before stabilizing.

The bad news is that the scale of the inflation pick-up keeps exceeding expectations, about which we have the following observations and conclusions:

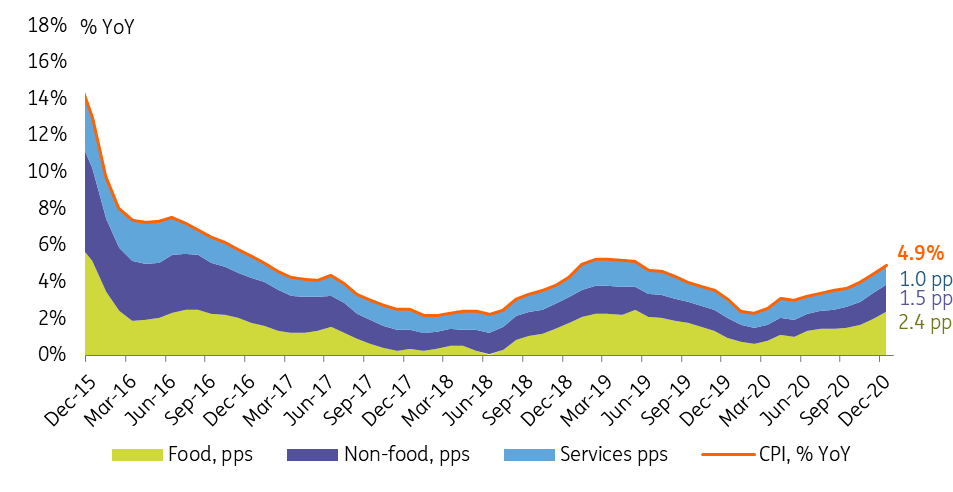

- Higher-than-expected CPI means a lack of disinflationary effect of weak demand. While indeed food inflation is the primary contributor to the overall CPI pick-up (the former accounts for 1.4ppt out of the total 1.9ppt increase of the latter throughout 2020), non-food products inflation also picked up – from 3.1% YoY to 4.8% YoY – and contributed to a 0.4ppt pick-up in CPI (Figure 2). Looking deeper at the composition of the non-food CPI evolution, all items except apparel showed an acceleration in price growth throughout 2020, be they dependent on imports (such as consumer electronics) or not (construction materials, gasoline). The services sector did show a 1.1ppt YoY disinflation throughout 2020 but that did not affect the overall picture due to its relatively low weight of 28%. The lack of disinflation in products despite the 4.1% YoY retail sales drop in 11M20 suggests low sensitivity to the weakness in consumer demand. Meanwhile, it is not guaranteed that the upcoming recovery in consumption amid a c.4% increase of state pensions in February, state sector salaries in October, and possible additional social support ahead of the September Parliamentary elections will not be pro-inflationary.

- The pick-up in CPI seems to be affecting inflationary expectations of households, which have also been on the rise at the end of the year (Figure 1), with producers' price expectations also elevated. The unanchored nature of the local inflationary expectations amid nearly-missed official CPI forecasts are likely to be a cause of concern for the Bank of Russia, requiring a more cautious approach to inflation targeting in the coming months.

Figure 1: CPI jumped to 4.9% YoY in December, pushing up expectations

(Click on image to enlarge)

Source: Bank of Russia, Rosstat, ING

Figure 2: Food remains the key driver of the pick-up

(Click on image to enlarge)

Source: Bank of Russia, Rosstat, ING

Figure 3: Spike in Russian food CPI stems from global agriculture inflation and RUB depreciation...

(Click on image to enlarge)

Source: Rosstat, Reuters, ING

Figure 4: ...both of which seem to be over now

(Click on image to enlarge)

Source; Bank of Russia, Reuters, ING

Year-end forecasts of 3.5% CPI and 4.0% key rate challenged

The recent CPI performance challenges our view that 2021 CPI will peak within 5.0% YoY in 1Q21 and decelerate to 3.5% YoY by the year-end. While we stand by the expected trajectory, the lack of disinflation from the demand side may push the targeted levels by up to 0.5ppt. Concerns regarding the vulnerability of CPI and inflationary expectations suggests that our expectations of one last cut in the key rate (currently 4.25%) in April is also becoming optimistic.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more