Russian CPI: A Priced-In Slowdown

Inflation in Russia posted a broad-based deceleration in October, reinforcing near-term expectations of CPI falling to 2.5% year-on-year in 1Q20. Meanwhile, the scope for recovery by year-end 2020 remains a question, as disinflationary effects of a high statistical base and budget underspending wear off.

A man making a choice in a Russian supermarket

CPI remains on a downward trend, in line with expectations

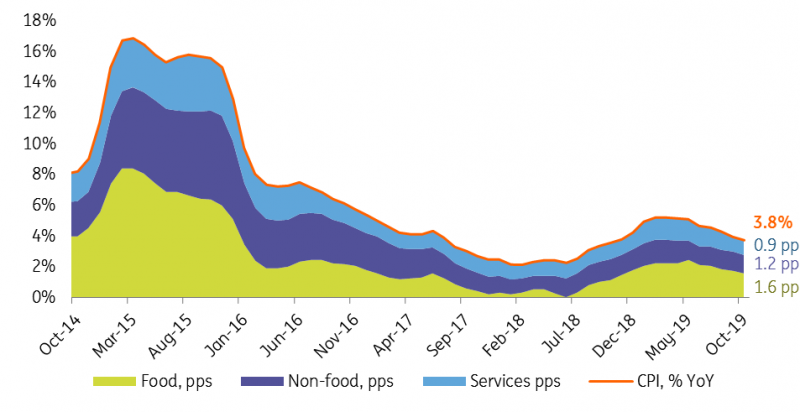

Russian CPI continued to decelerate, reaching 3.8% YoY in October (vs. 4.0% YoY in September), in line with expectations. As in September, the slowdown was observed in all key segments.

- Food (c.38% of the CPI basket) was the main contributor to the overall slowdown, with the price growth rate declining from 4.6% YoY to 4.2% YoY on base effects and lack of pro-inflationary pressure from global agriculture prices.

- Non-food products (c.35% of the basket) showed a subtle deceleration from 3.4% YoY to 3.2% YoY, mostly thanks to deceleration of price growth for consumer electronics (RUB FX rate-driven) and gasoline.

- Services price growth slowed from 4.0% YoY to 3.8% YoY on a broad range of items.

The CPI performance observed in October suggests a likely further deceleration to 3.4% YoY by year-end 2019 and 2.5% YoY in 1Q20. This represents a 0.3-0.5 percentage point downgrade in our previous expectations, as in addition to the high base effect we see a higher impact of demand-driven constraints following signs that Russian households are returning back to a savings mode as seen from the macro statistics for August and September.

Russian CPI growth by components (contribution to total, in pps)

(Click on image to enlarge)

CPI remains on a downward trend, in line with expectations

Russian CPI continued to decelerate, reaching 3.8% YoY in October (vs. 4.0% YoY in September), in line with expectations. As in September, the slowdown was observed in all key segments.

- Food (c.38% of the CPI basket) was the main contributor to the overall slowdown, with the price growth rate declining from 4.6% YoY to 4.2% YoY on base effects and lack of pro-inflationary pressure from global agriculture prices.

- Non-food products (c.35% of the basket) showed a subtle deceleration from 3.4% YoY to 3.2% YoY, mostly thanks to deceleration of price growth for consumer electronics (RUB FX rate-driven) and gasoline.

- Services price growth slowed from 4.0% YoY to 3.8% YoY on a broad range of items.

The CPI performance observed in October suggests a likely further deceleration to 3.4% YoY by year-end 2019 and 2.5% YoY in 1Q20. This represents a 0.3-0.5 percentage point downgrade in our previous expectations, as in addition to the high base effect we see a higher impact of demand-driven constraints following signs that Russian households are returning back to a savings mode as seen from the macro statistics for August and September.

Russian CPI growth by components (contribution to total, in pps)

(Click on image to enlarge)

Source: State Statistics Service, Bank of Russia, ING

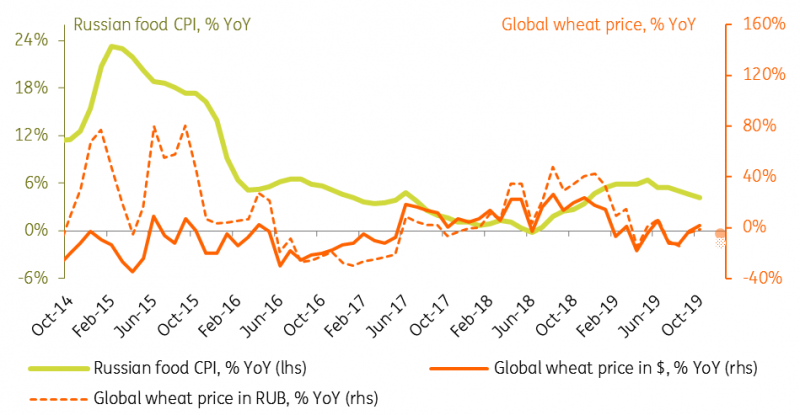

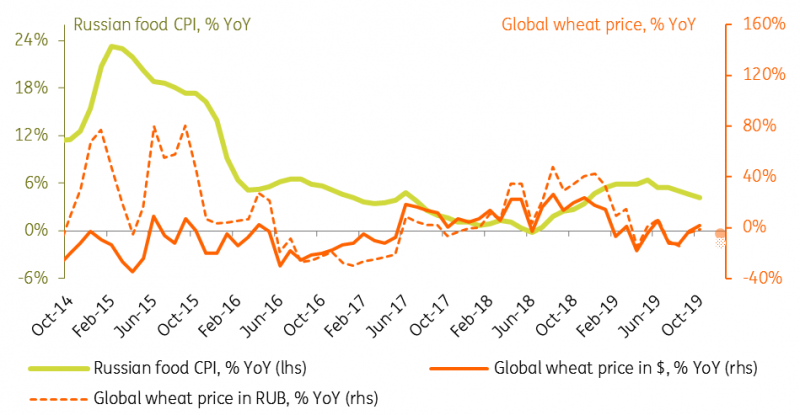

Global wheat price growth and Russian food CPI, % YoY

(Click on image to enlarge)

Source: State Statistics Service, Bloomberg, ING

Scope of CPI recovery following 1Q20 remains under question

It is highly likely that 1Q20 will see the lowest intra-year CPI reading in 2020, as later into the year some of the disinflationary factors worth up to 2.0ppt will be phased out.

- The high base effect created by the VAT hike will peak at around 1.5ppt in 1Q20, after which it will gradually decline.

- The disinflationary effect of budget underspending seen this year, according to the recently released note by the Bank of Russia's research department, totals up to 0.5ppt in the current CPI growth rate. Provided the government puts spending back on track, 2020 CPI will catch up.

We also remind that this year's CPI trend is favorably affected by the harvest-driven stabilization in global agriculture prices following the sharp spike in 2018. According to our estimates, the deceleration in global wheat price growth from 40% YoY (in ruble terms) in 2018 to around zero in 2019 had a positive effect on local CPI growth in the amount of 1.6ppt. That said, it seems that the global agriculture price expectations remain stable, which combined with continued growth in Russia's local production of key meat, grain, and other agricultural products, also mentioned in the Bank of Russia research report, suggest limited pro-inflationary risks from the agricultural sector for 2020.

As a result, accounting for the combination of pro-inflationary and disinflationary factors, we see CPI returning to 3.7% YoY by year-end 2020. The balance of risks to that view is skewed to the downside, especially if local budget spending and consumer demand fail to pick up as expected.

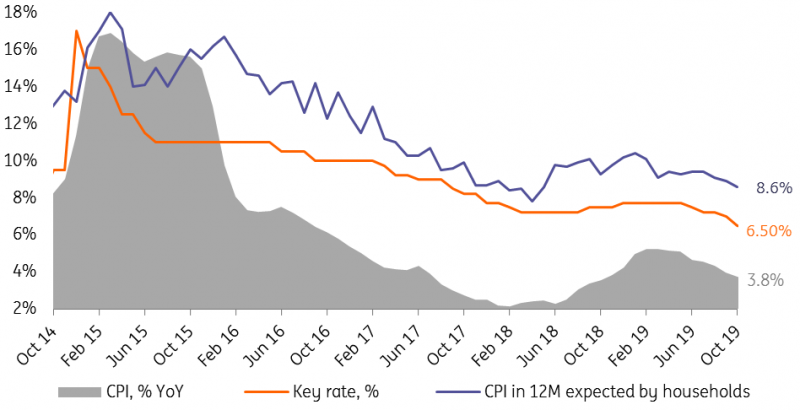

Russian CPI, inflationary expectations and key rate

(Click on image to enlarge)

Source: State Statistics Service, Bank of Russia, ING

The current trends suggest that CPI will have no problem decelerating to 2.5% YoY in 1Q20, after which a moderate recovery is possible as one-off disinflationary factors wear off. In this environment, Bank of Russia will be comfortable with lowering the key rate to the 6.0% level in the coming months, possibly at the upcoming core meetings on 13 December and 7 February 2020. Further cuts are not the base case, but plausible if CPI recovery is hampered by below expected budget execution and consumer demand.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more