Russian Consumers Running Out Of Steam While Producers Outperform

Russian activity and banking data for November confirm the deterioration of consumer sentiment but producers seem to have become more upbeat. With limited room for further fiscal and monetary support, GDP recovery prospects for 2021 appear modest.

People wearing masks as a preventative measure against Covid-19 in Moscow, Russia Source: Shutterstock

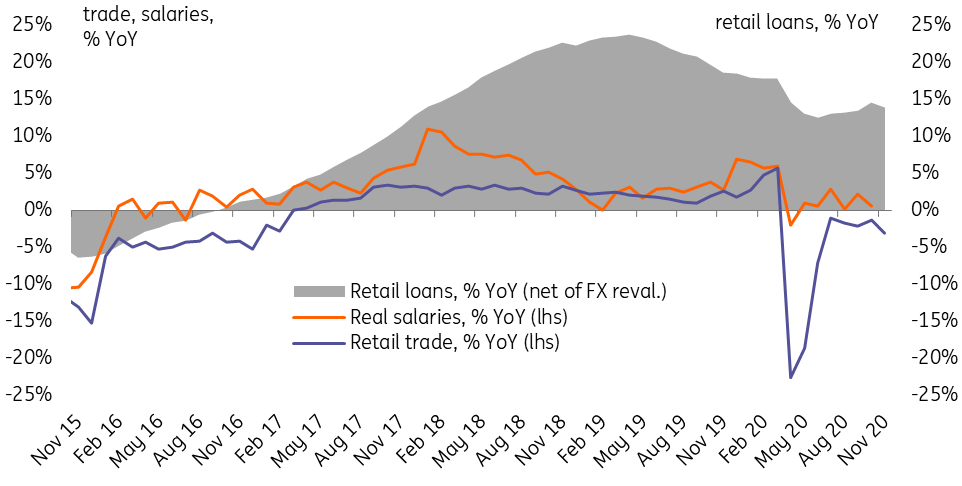

A hiccup in consumer recovery?

Retail trade in Russia dropped to -3.1% year-on-year in November following the 1-2% YoY drop seen between July- October. Although these numbers are better than our expectations and consensus, they still point towards a hiccup in consumer recovery.

The substantial drop took place amid accelerating CPI, mainly due to higher food prices and a slowdown in nominal and real salary growth despite falling unemployment.

We are particularly concerned that banking sector data shows a continued slow down in retail deposit growth to 5.6% YoY (net of FX revaluation) in November from 6-7% in October, while retail lending growth also continues to slow down after a brief spike in October, but remains in double-digits. This suggests that a deterioration in consumption is taking place amid a declining savings rate and partly explains the recent announcement of additional social support measures.

For 2021, we remain cautious about household activity and ahead of parliamentary elections will be closely watching social support measures and the inflation trajectory.

Consumer recovery stalls in November

Source: Bank of Russia, Rosstat, ING

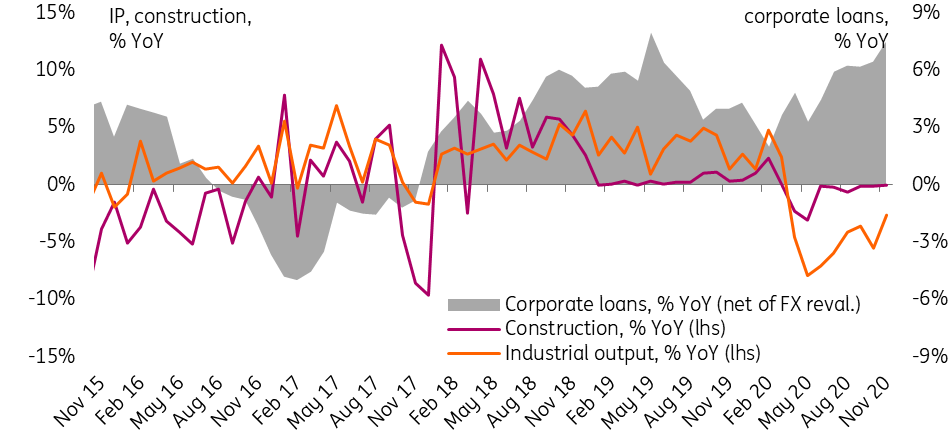

Producer trend shows a noticeable recovery

On the positive side, the producer trend showed a noticeable recovery, especially on the industrial output side, with the drop narrowing materially from -5.5% YoY in October to -2.6% YoY in November.

The banking sector data also seems positive at first glance, with corporate loan growth continuing to increase in November despite the active placement of the government bonds, but we have two reservations.

First, we do not exclude that abandoned expectations of a part further drop in interest rate could be part of the reason for faster corporate lending. Second, the improvement in industrial output (especially in construction-focused manufacturing) seems heavily correlated with the year-end budget spending, which picked up from +25% YoY in 10M20 to +56% YoY in November on a +156% YoY increase in the 'national economy' item representing state support to the industrial sectors.

This raises questions on the longevity of the industrial recovery trend following the upcoming tightening of the budget policy and its likely repositioning in favor of social support.

Producer trend received support from the budget

Source: Bank of Russia, Rosstat, ING

2020 GDP will be shallower than expected, but 2021 may disappoint

The preliminary estimate of -3.5% YoY GDP drop in 11M20 and the likely upward revisions put the 2020 number close to above-consensus expectations, which is encouraging, however, we remain cautious for 2021 and don't expect a recovery beyond the base effect.

The risk factors for growth include tightening budget policy, accelerating inflation, lack of clarity on vaccination and restriction measures, and an end to the monetary easing cycle

The risk factors for growth include tightening budget policy (even though it is unlikely to be as strict as the federal budget draft suggests), accelerating inflation, ending of the monetary easing cycle, lack of clarity on vaccination and restriction measures, and foreign policy uncertainties.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more