Russia: Weak Activity Is Starting To Affect Budget Policy

Industrial output growth of 0.9% YoY in May and the structure of 0.5% YoY GDP growth in 1Q19 confirm weakness in economic activity and support our below-consensus 1.0% GDP growth expectations for 2019. As a result, an easing in the budget policy - in the form of investing state savings locally from 2020 - now looms on the horizon.

Industrial output weakens on calendar effect, restricted oil upstream and downstream, limited budget support, recovery possible in 2H

The material slowdown in industrial output from 4.6% YoY in April to just 0.9% YoY in May was mainly due to significant distortions for both months via the calendar effect and did not come as a shock to the market. Still, it was lower than the 1.6% YoY of consensus and close to our pessimistic 0.0-1.0% YoY expectations. The key observations:

- Unlike April statistics, propelled by the additional workday (vs. April 2018), the May figure suffered from the reverse effect, with 2 work days less than May 2018. This effect might have trimmed 1-2 ppts from the growth rate. June, August and November will also suffer from adverse calendar factors. The majority of manufacturing sectors, which account for around 2/3 of the total industrial output volume, are the most affected by this;

- Oil sectors, which should not have been materially affected by the workday factors, have also shown deterioration in dynamics in May: oil extraction growth slowed from 3.5% YoY in 4M19 to just 1.3% YoY in May, and the drop in oil supplied to refineries deepened from -0.6% YoY in 4M19 to -9.2% YoY in May. This could be explained by both Russia's OPEC+ commitments and possibly by disruptions in the oil throughput via the Druzhba pipeline (accounts for 20% of Russia's oil exports);

- The most noticeable deterioration among the manufacturing sectors (that goes beyond the calendar effects) took place in the machinery and equipment segment, including car manufacturing and shipbuilding.

For the near-term June statistics, we expect industrial output to remain under pressure from adverse calendar effects, OPEC+ restrictions and temporary Druzhba-related disruptions. For 2H19 we are more optimistic, as the abovementioned restrictions may prove temporary, and federal budget spending should accelerate, as suggested by the current budget draft. Please see the details on the budget policy below.

1Q19 GDP growth slowdown purely on budget factors: VAT hike, pause in state investments; some recovery possible in 2H19 on faster budget spending

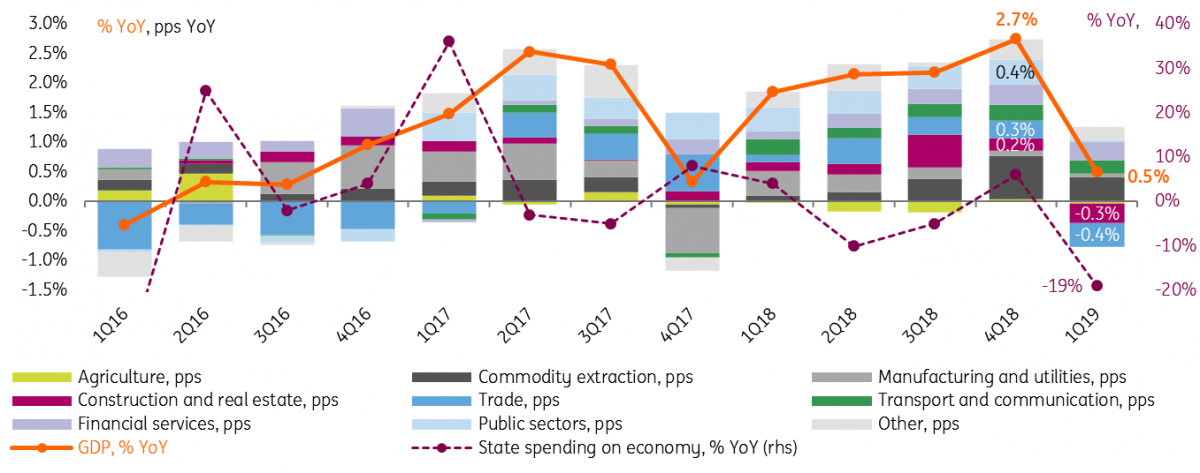

The structure of the disappointing 1Q19 GDP growth by sector released simultaneously with the 5M19 industrial output data suggests that the weakness in economic activity is mainly related to budget policy. The key sectors that were a drag on the GDP performance in 1Q19 were:

- Trade (wholesale and retail), apparently hit by the VAT hike from 18 to 20% and effective from January 1

- Construction and real estate, pressured by the halt in large projects following a number of big-ticket completions in 2018

- Public sectors (state administration, military, education, healthcare, research, and development) amid a temporary halt in financing following electoral 2018

We expect some recovery in the GDP growth going forward as the negative effect of VAT hikes gradually wears off, and state spending on direct support to the economy accelerates from -19% YoY in 1Q19 to the drafted +16% YoY for the full year, as the 'National Projects', which are 70/30 capex/social support, gain traction, and overall budget spending accelerates from 6% YoY in 1Q19 to the drafted 13% YoY for the full-year. At the same time, we still doubt Russia's ability to post overall GDP growth in excess of 1.0% GDP this year, unless there are some backward revisions in the statistical data.

Russian GDP growth structure and state spending on the economy, % YoY

(Click on image to enlarge)

Source: State Statistics Service, Finance Ministry, ING

The budget policy may be eased starting 2020 - through investing sovereign wealth fund locally

The policy response to the weak economic growth seems to be now favoring some easing in budget policy, also in line with our expectations. In addition to the the acceleration in direct budget spending growth until this year-end, which is already drafted (see above), the Finance Ministry is now proposing to start investing a portion of the National Wealth Fund (sovereign wealth fund) into local projects starting in 2020, after the liquid portion of it exceeds 7% of GDP. This represents a change in the approach to state savings, as previously the Finance Ministry was against investing any portion of the fund locally. The discussion is not over. Our key thoughts on the matter:

- Given the current budget projections, the NWF may reach 7% GDP ($110 bln) in the middle of this year and around 10% GDP ($140 bln) by mid-2020. This means that up to 3% of GDP (RUB3.5 trln) could be opened up for potential investments locally. Along with further expected growth in NWF, this sum could increase, but most likely will be capped by the current regulation that prevents RUB investments from exceeding 40% of total NWF. We do not assume that the entire limit will be used, but any RUB investments would represent an indirect budget policy easing;

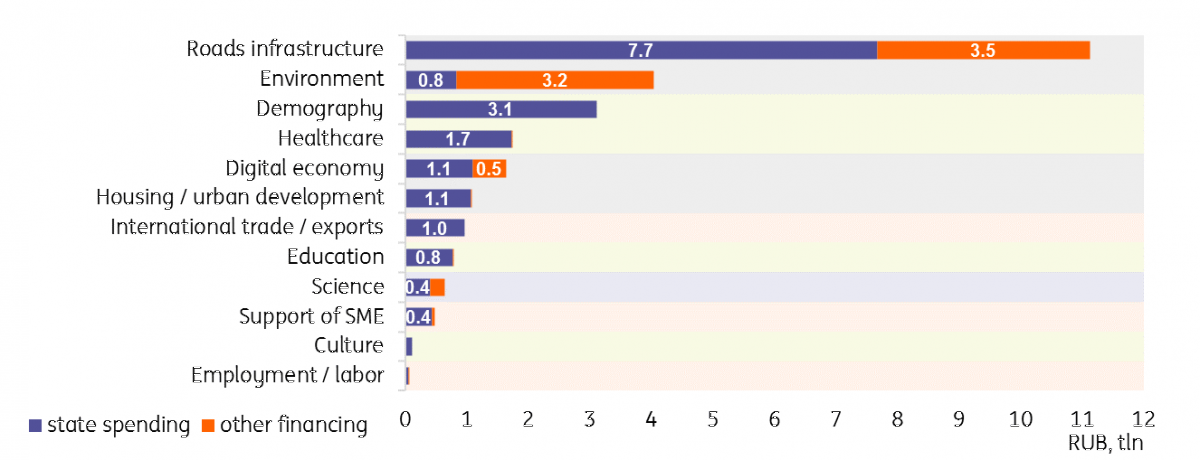

- The push to ease the budget policy might reflects concerns regarding the slow economic growth and possible doubts in the ability to attract private financing for the 'National Projects'. The government expects the total financing for the National Projects at RUB26 trln for 2019-2024 (or 3.6% of GDP per annum), out of which RUB7.5 trln is supposed to be attracted from private investors;

- With the budget breakeven oil price at a decade-low of $50/bbl, CBR international reserves hitting the long-awaited $500 bln, relatively stable RUB exchange rate and declining inflationary risks, it is not a surprise that the government is now more comfortable with some easing in the budget policy approach.

While the desire to use the budget tools to support the economy is understandable, we find it crucial that the government ensures the efficiency of the additional budget injections and accompanies this with systemic measures aimed at boosting private sector participation in investment growth. Otherwise, the additional supply of RUB (we assume that in order to invest RUB Minfin will have to convert part of its FX with CBR, which will buy Minfin’s FX with new rubles) will translate into higher risks to CPI and FX without any noticeable positive effect on GDP growth.

Planned spending on National projects in 2019-2024

(Click on image to enlarge)

Source: Government, media, ING

We believe that until there is more clarity on the budget discussion, the Central Bank will prefer to maintain a cautious approach to the key rate, i.e. will be biased to the upper range of the 6.0-7.0% nominal rate target. For now, we see an opportunity for a couple of 25 bp cuts in the near term. Our 12M forecast stays cautious at 6.75%

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more