Friday, March 19, 2021 12:10 PM EDT

The Bank of Russia has decided to front-load the normalization of monetary policy, driven by the increase in near-term risks related to global markets, foreign policy, and the local fiscal stance. A further 25 basis point hike on 23 April appears to be a done deal. But the longer-term prospects are less certain, with various factors to watch.

Russian central bank governor, Elvira Nabiullina Source: Shutterstock

The Russian key rate is up by 25bp to 4.50%. Consensus expectations had been for no change, but following the recent pick up in CPI to 5.8% year-on-year at the beginning of March and the recent deterioration in the foreign policy backdrop, it was more of a 50/50 call. The action itself should not come as a surprise to us or to the market.

More importantly, the tone of the commentary has become more hawkish:

- The CBR holds "open the prospect of further increases in the key rate at its upcoming meetings", meaning most likely another hike in April.

- The bank expressed more confidence in the economic recovery, with local demand likely supported by extended travel restrictions.

- It also acknowledged higher foreign policy risks.

- And it pointed to additional inflationary risks from a potential flattening in the budget consolidation curve.

It appears that the CBR has indeed decided to front-load the normalization of monetary policy, driven by various market developments including global bond market volatility, a deterioration in the foreign policy backdrop, and higher uncertainty regarding the local fiscal side following a pick up in budget spending in the first two months of 2021 and indications by the Finance Ministry that they consider additional investment from the National Wealth Fund into local projects in the amout of US$12-15bn in 2021-23.

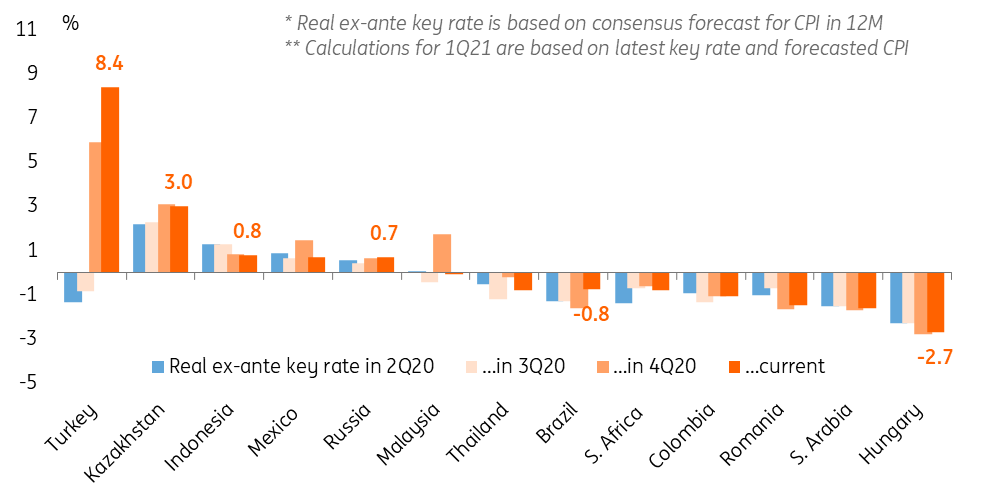

Based on all the above, another 25bp hike on 23 April appears to be a done deal. However, we are looking forward to Governor Elvira Nabiullina's press-conference later today in order to see longer-term guidance. We note that following today's hike, Russia's real key rate, based on expected CPI in 12 months, is around +0.7%, which is higher than the mid-range of Russia's peers (from -2.7% in Hungary to +3.0% in Kazakhstan, with Turkey's +8.4% taken as a special case), and already close to the 1-2% level the CBR is willing to reach in the medium-term. Meanwhile, the strength of the local economic recovery still requires further confirmation, in our view.

Russian real rate remains stable relative to peers, above mid-range

Source: National sources, Refinitiv, FocusEconomics, ING

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.