Russia Key Rate Preview: CPI Pressure Leaves No More Room For Cuts

With CPI spiking 5.2% YoY in January and near-term context still pro-inflationary, further cuts in the 4.25% key rate are now unlikely. But as long as year-end CPI expectations are within the current 3.5-4.0%, and CPI risks in the EM space are under control, the Russian real rate is high enough for the central bank to avoid a key rate increase in 2021.

The Central Bank of Russia headquarters in Moscow

1Q21 CPI to reach 5.3-5.5% YoY before returning to 3.5-4.0% by the year-end

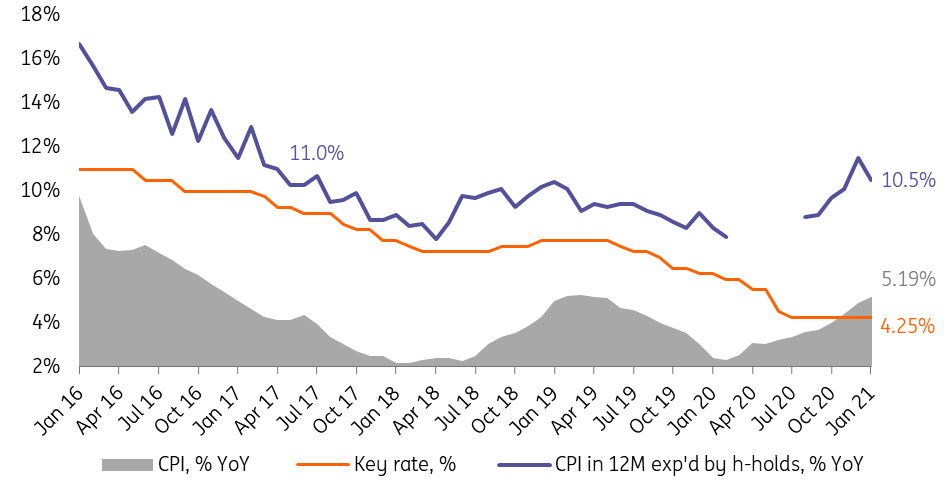

Acceleration in the Russian CPI from 4.9% year-on-year in December 2020 to 5.2% YoY in January is slightly better than the market consensus of 5.3% YoY and our expectations of 5.3-5.5% YoY, but still this result is likely to call for more caution in the upcoming key rate decision by the Central Bank of Russia on 12 February.

- The overall CPI trajectory trails the upper range of expectations announced by the CBR at its December meeting.

- The households' inflationary expectations remain at elevated levels despite recent moderation in January (Figure 1).

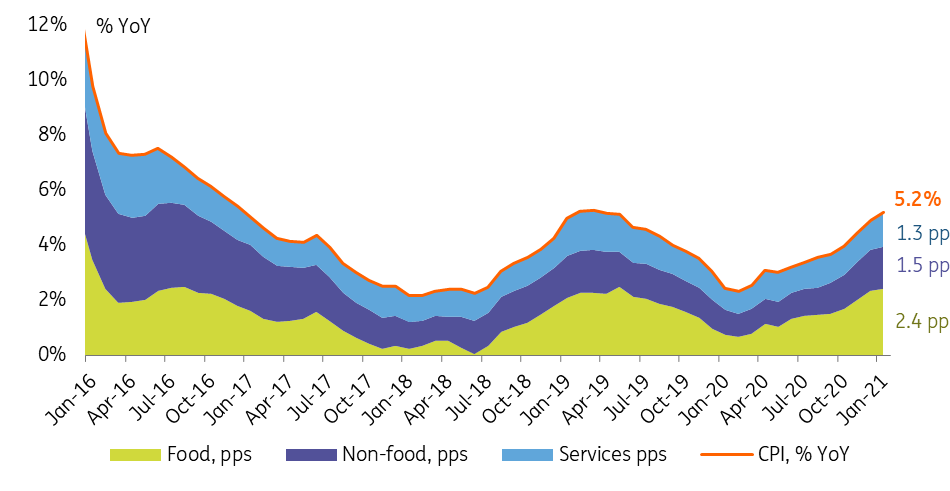

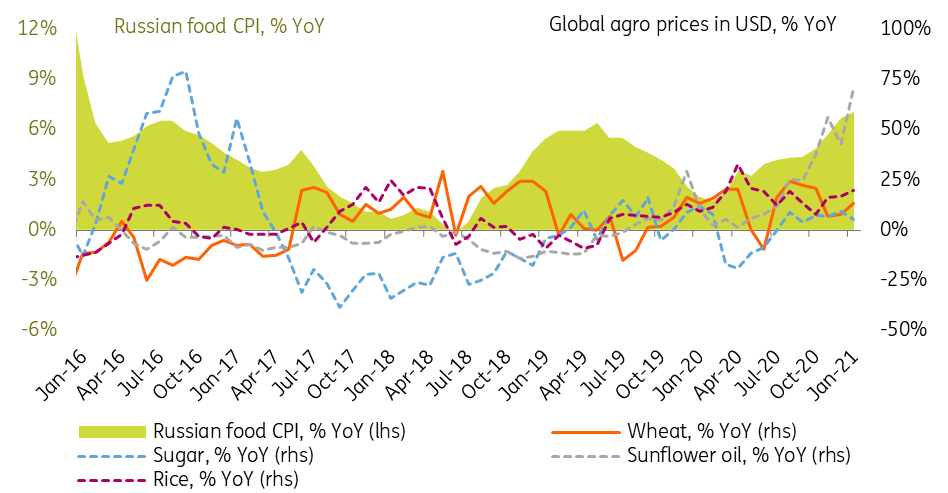

- True, most of the factors contributing to the current pick-up in CPI are temporary, including the statistical base effect and externally-driven increased price pressure in the food segment (Figure 2), amplified by the previous ruble depreciation. However, it appears, that the agro inflation, contrary to our inital expectations, remains strong (Figure 3) and is going to continue pushing up food CPI in 1Q21 (Figure 4). The efficiency of the price shock absorption tools enforced by the government is yet to be seen, while the current local price growth in grains is already having secondary effects on other items such as meat, eggs, and dairy, by CBR's own admission.

- Continued acceleration in price growth for most of the non-food and services confirms our earlier concerns regarding lack of demand-driven disinflation we voiced earlier.

As a result, we see CPI peaking at 5.3-5.5% in 1Q21 and staying above the 4.0% target for the most part of the year, with the possibility of inflation falling into the 3.5-4.0% range only in December. This should be the primary reason for the CBR to remove the option of further key rate cuts from its forward-looking guidance. We no longer see the 25bp downside to the key rate this year.

Figure 1: CPI up 5.2% YoY in January, households' expectations moderated but still elevated

(Click on image to enlarge)

Source: Bank of Russia, Rosstat, ING

Figure 2: Food price growth continues to put upward pressure

(Click on image to enlarge)

Source: Bank of Russia, Rosstat, ING

Figure 3: Global agro inflation appears stronger than expected...

(Click on image to enlarge)

Source: Rosstat, Reuters, ING

Hikes still unlikely in 2021

The current pick-up in the CPI may have created concerns on the market that the 'normalization of the monetary policy', which in the CBR's book means return of the nominal key rate to the 5-6% range amid 4% CPI, may start as early as 2021. We do not share this view at the moment for the following reasons:

- Much like 2020 outperformed the CBR's expectations in terms of GDP (-3.1% vs. -4-5%), household consumption (-8.6% vs. -9.5-10.5%), and fixed investments (-6.2% vs. -7.8-9.8%), 2021 could be a disappointment on downbeat consumer mood amid a weak household income trend and limited fiscal room to address the issue.

- While we do not exclude that actual budget expenditures this year could be up to 1% GDP larger than initially planned (as the spending backlog might have to be powered through), this would not cancel the budget consolidation story this year.

- Ruble's material underperformance vs. peers in 2020 limits the downside in 2021, assuming benign global risk sentiment and favorable oil prices, which are within the base case scenario.

- The market's longer-term (beyond 2021) CPI expectations remain anchored at levels equal or below the 4% target for 2022 and 2023, according to Reuters polls. We remind that the higher base effect of 1Q21 means lower expectations for the beginning of 2022.

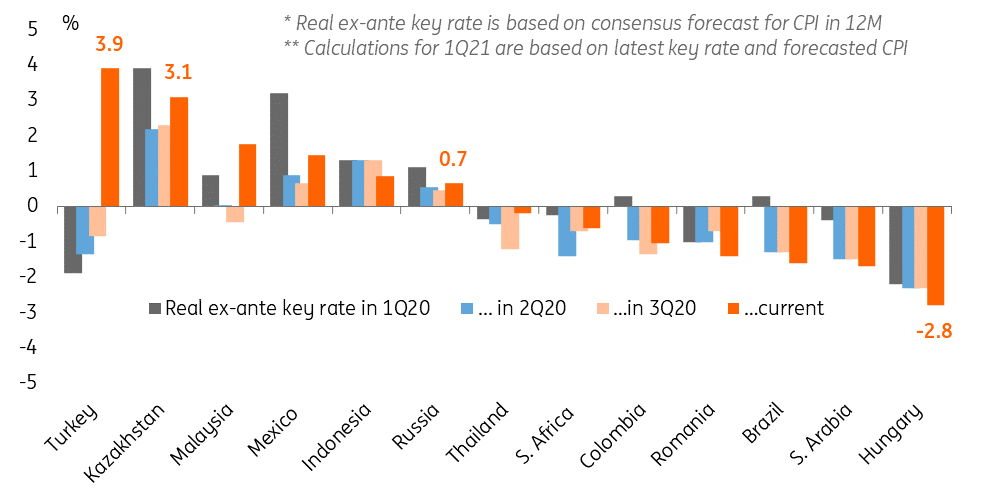

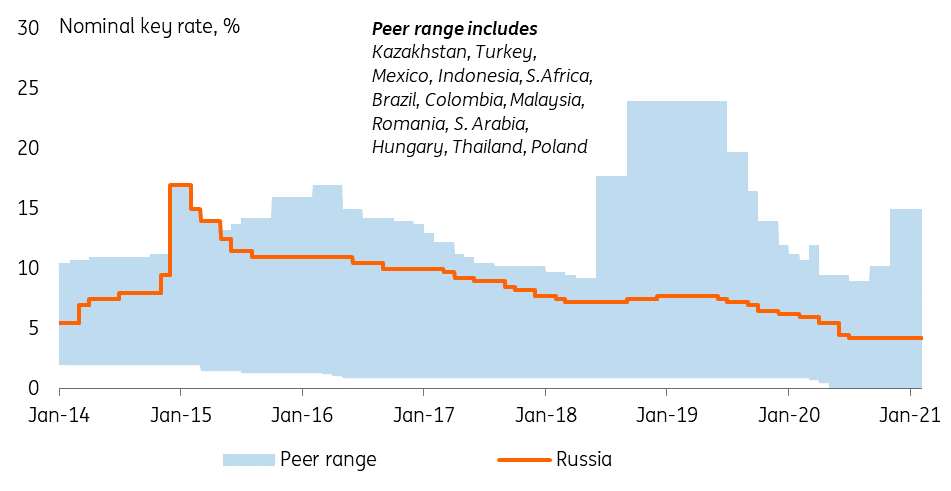

- As long as 12-month expected CPI by the market is in the 3.5-4.0% range, Russia's real ex-ante key rate remains in the 0.5-1.0% range, in the middle of peers (Figure 5), as was the case since 2020. As long as peers' CPI and nominal key rate expectations remain flat (which seems to be the case), the current real rate situation should comfortable for the CBR in the near-to-medium term from the capital account perspective.

Figure 5: As long as 12M CPI expectations stay under 4.0%, Russia's real rate is high enough

(Click on image to enlarge)

Source: National sources, Reuters, FocusEconomics, ING

Figure 6: Russia remains mid-range on peers in terms of nominal key rate

(Click on image to enlarge)

Source: Reuters, ING

Expecting unchanged key rate in 2021

We see the key rate unchanged for 2021, which is a change compared to our previous expectations of a cut to 4.0% in 2Q21. The risks to this expected trajectory are still tilted upwards, with potential triggers including looser-than-expected fiscal policy, acceleration in the capital outflow and extended ruble weakness, continued external agro inflation, as well as material deterioration of inflationary expectations and monetary tightening in the EM space.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more