Russia: FX Purchases Up In April, Largely Neutral For Ruble, But Other Risks Matter

Russian FX purchases will increase to US$2.4bn in April – slightly higher than expected but still modest compared to the current account size. A change in the FX structure of the sovereign fund is also unlikely to affect the local market. Meanwhile, this does not remove risks to the ruble coming from the capital account.

Monthly FX purchases keep growing along with oil prices

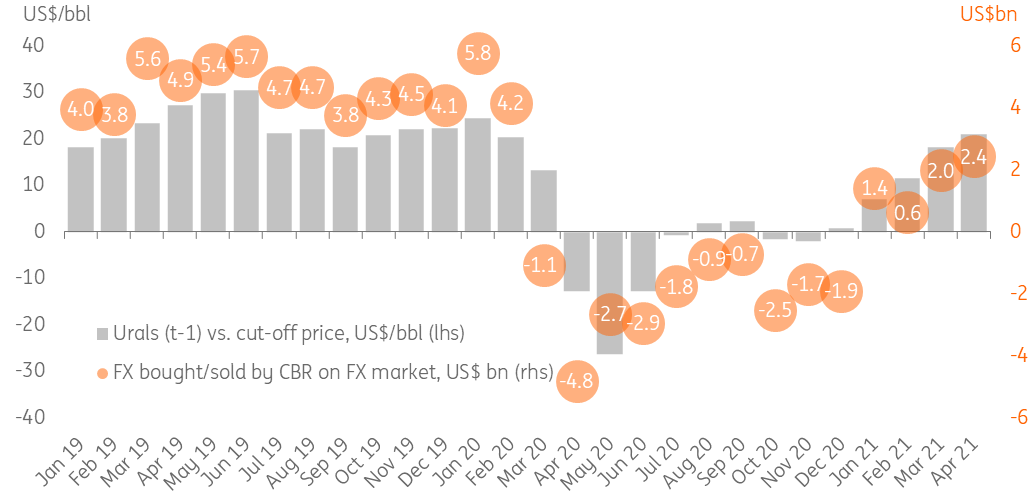

The Russian Finance Ministry announced an increase in monthly FX purchases from US$2.0 billion in March to US$2.4bn in April (Figure 1), higher than the US$2.1bn Reuters consensus, but closer to our expectations of US$2.2bn. The increase in the fiscal-rule FX purchases, which will be conducted by the Central Bank of Russia on the market, is in line with the further US$3/bbl growth in average Ural price in March. Meanwhile, the actual purchases would have been higher but for the downward revision in the March fuel revenues, hinting at a possibility of another negative surprise in terms of current account surplus after the February disappointment. But overall, the April FX intervention announcement is generally in line with the relative neutrality of oil prices for the ruble's performance. Year-to-date, the ruble is down 1% against the US dollar despite a 23% increase in the oil price.

Figure 1: Monthly FX purchases keep growing along with oil prices

Source: Finance Ministry, Refinitiv, ING

Change in FX structure of the sovereign fund is unlikely to affect the local market

In addition to the main announcement, the Finance Ministry reminded in a footnote, that starting from this month, the accumulation of FX according to the fiscal rule will take place in accordance to the new FX structure of the sovereign fund, where shares of USD and EUR were reduced from 45% to 35% each, in order to make way to CNY (15%) and JPY (5%). This, however, does not mean, in our view, that the structure of the CBR's FX operations on the local market will change.

- To remind, Minfin's operations according to the fiscal rule, which are done as internal transactions with the Bank of Russia, should be distinguished from the market transactions conducted by the CBR. Normally, the CBR fully mirrors Minfin's transactions in terms of volumes but has freedom in terms of timing and structure.

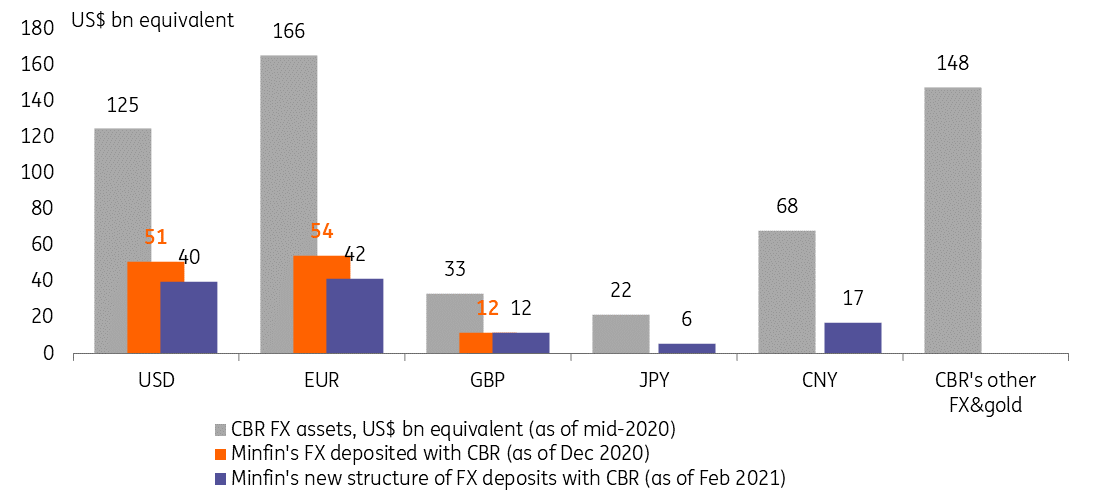

- The change in the FX structure of the sovereign fund is not a surprise, it has been guided for since last November. As we mentioned back then, the FX rebalancing of fiscal savings (which in reality are held of FX deposits with the central bank) will not require additional market transactions, as the Minfin's needs are fully covered by the large and diversified balance sheet of the central bank. The actual rebalancing that took place in February this year (Figure 2) confirms this view.

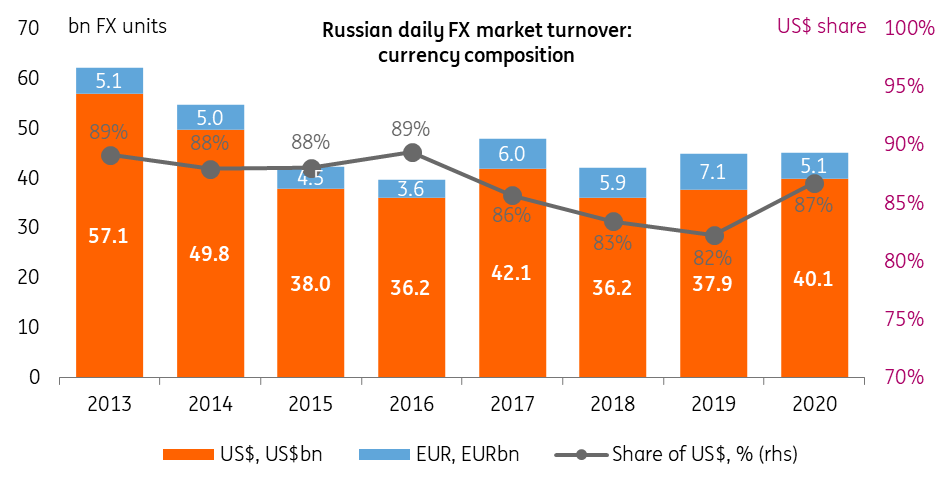

- In terms of upcoming FX purchases, it is unlikely that the FX structure of the CBR's local market purchases/sales will be proportional to the Minfin's appetite, given the constraints of the local market. According to Bank of Russia data, as of 2020, 87% of the local FX market turnover was in USD, with EUR taking second place with a huge gap (Figure 3). This means that the ruble side of the budget rule FX transactions will remain unchanged in order to maintain RUB-oil neutrality, while the composition of the FX side will be determined by the capacity of the local market. We believe that the targeted FX structure of the Minfin's FX savings will be achieved through FX conversions of USD on external markets.

Figure 2: CBR's FX reserves are large and diversified enough to accommodate the Minfin's needs

Source: Finance Ministry, Bank of Russia, Refinitiv, ING

Figure 3: Russian FX market dominated by USD, unlikely to have a capacity for CNY and JPY proportional to the Minfin's needs

Source: Bank of Russia, Refinitiv, ING

Capital account remains a watch factor

We take the FX purchases announcements as largely neutral for RUB performance in 1H21, as the former is driven by oil price movements and has a low size relative to the expected current account – 20% of the 1Q21F current account and around 30% of 2Q21F, according to our estimates.

Meanwhile, it does not mean that our constructive view on the ruble has no risks. The 1Q21 balance of payments, to be reported on Friday, will be a gauge of fundamental support to the rouble. We expect a current account surplus of US$20bn, down from the initial expectations of US$25bn on higher-than-expected import growth and lower-than-expected export volumes. Most importantly, the capital account remains the least predictable factor to watch, as in addition to portfolio outflows for OFZ, which have picked up from US$1bn in February to US$1.6bn in March, corporates and households have restarted the accumulation of foreign assets at a rate of US$4-8bn per month in the first two months of 1Q21, which is a more important constraint to the ruble's appreciation than the foreign policy themes that the market has been focused on recently.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more