Russia: FX Purchases More Than Halved On Expected Drop In Oil Exports

The Central Bank of Russia's FX purchases in February will total $0.6bn, down from January's $1.4bn. But this is unlikely to help the ruble given the 15-20% month-on-month cut in oil exports expected for February, and possible country-specific pressure on the capital account.

A worker checks Russian 1,000-ruble banknotes at the Moscow Printing Factory

Cut in FX intervention corresponds to an expected drop in current account surplus

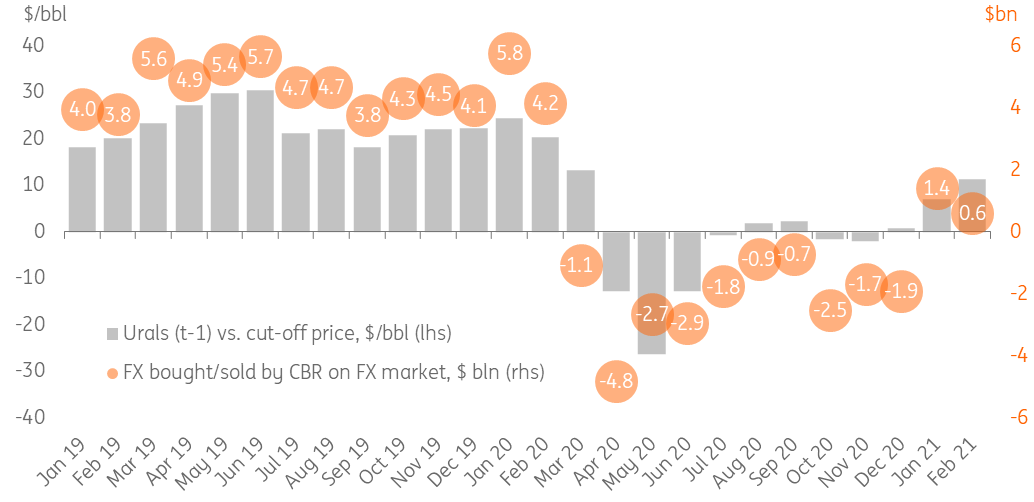

Russia's central bank will buy $0.6bn of FX on the local market this month as a part of a budget rule, which is a noticeable cut from the $1.4bn seen in January (Figure 1). This is significantly lower than our, and the market's, expectation which was centered around RUB110bn, or US$1.4-1.5bn under the current exchange rate, and based on a continued increase in the Urals price year-to-date.

Our explanation for the surprisingly small intervention number is the recently-announced plan to make a 15-20% MoM cut in oil exports in February in order to resupply local oil refineries. Under our estimates, should this plan be fulfilled, Russia's monthly oil export revenues could drop by around $US0.6-0.8bn MoM in February despite the increasingly favorable conditions in the oil market. As a result, the cut in FX purchases should correspond to the expected decline in the monthly current account surplus, being largely neutral for the ruble in the near term.

Figure 1: CBR to cut FX purchases from $1.4bn in January to $0.6bn in February despite higher Urals price

Source: Bank of Russia, Finance Ministry, Reuters, ING

Capital flows remain a key factor of uncertainty for RUB

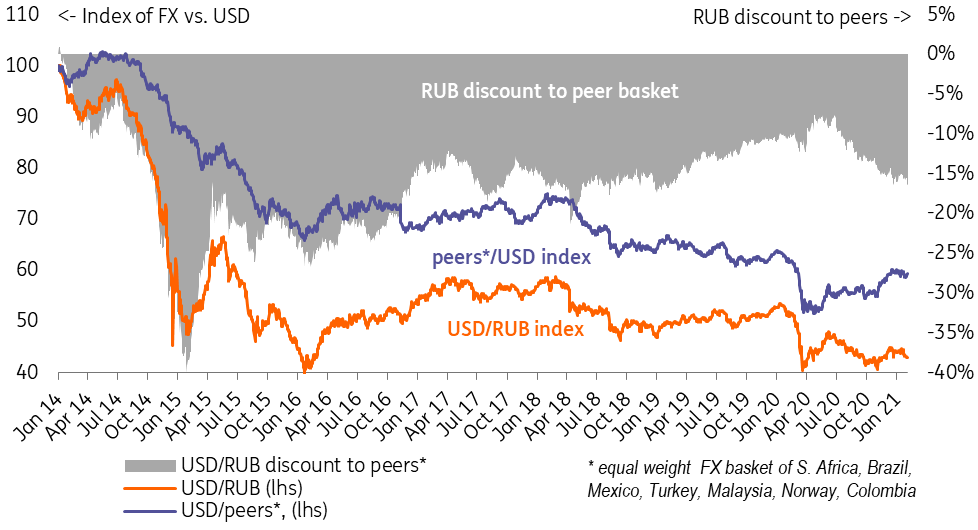

We continue to believe that the capital account is a more important factor determining the ruble's performance in 2021. Since mid-2020, the ruble depreciated against the USD by 6%, while EM/commodity peers gained 8% over the same period, causing the ruble's country-specific discount to double from 8% to 16% (Figure 2) amid increased foreign policy tensions and the perception of higher sanctions risk. Meanwhile, local economic factors, including weak household income and corporate investment, amid limited room for further fiscal and monetary easing, could be a challenge to a recovery in local confidence (and therefore an improvement in the capital flows) in the medium term.

Our constructive expectations of USD/RUB returning to the 70-75 range in 2021 based on moderation of local capital outflows are still realistic (assuming benign external risk appetite) but are facing more pressure from the market sentiment side. The monthly balance of payments data for January, to be released next week, could be indicative of whether foreign investors' caution is shared by local corporates and households. Meanwhile, the commentary to the upcoming CBR key rate decision on 12 February (we expect an unchanged 4.25% rate) will be indicative of whether the recent pick up in inflationary pressure and underperformance of the markets leads to a more hawkish stance.

Figure 2: Ruble has been underperforming peers since mid-2020 on elevated country-specific risk perception

Source: Reuters, ING

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more