Russia: Corporate Sector Increased Foreign Debt In 2q20

In 2Q20, the Russian corporate sector had the biggest quarterly increase of foreign debt in six years. The still high net private capital outflow over the same period suggests that accumulation of foreign obligations – driven purely by non-financials – was offset by an even more active increase in foreign assets.

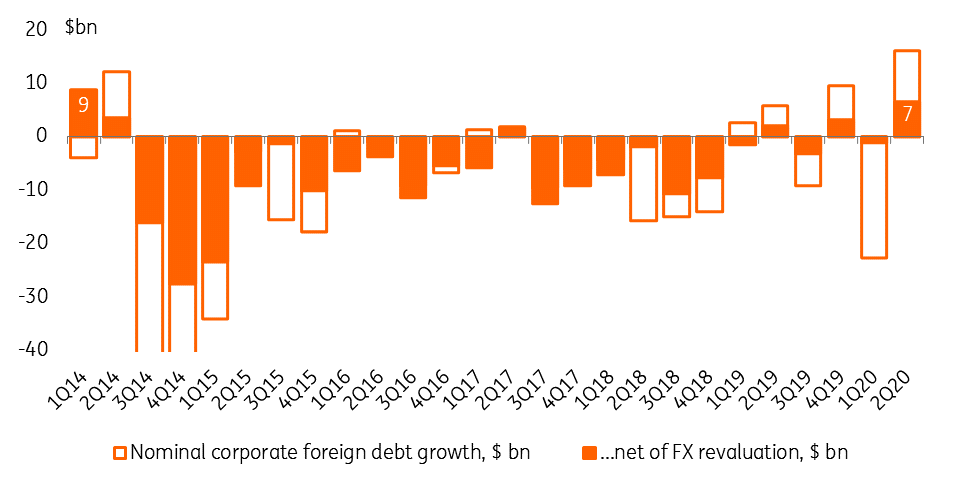

Corporate foreign debt growth in 2Q20 the highest in six years

The Russian foreign debt statistics for 2Q20 provides additional color to the general balance of payments.

- Nominal corporate (of banks and non-financial companies) foreign debt increased by US$16 billion in 2Q20 to US$401bn as of mid-2020. However, as up to 45% of the corporate debt is denominated in EUR and RUB, a significant portion of the 2Q20 nominal growth reflects paper gains due to quarterly appreciation of EURUSD from $1.10 to $1.12 and USDRUB from 77.7 to 70.4. Adjusted for this effect, the actual increase in corporate foreign debt was around US$7bn.

- The estimated US$7bn increase is the highest quarterly growth in over six years. The last significant increase in corporate foreign debt – at US$9bn – was recorded in 1Q14, on the eve of a significant deterioration in the foreign policy backdrop that resulted in 4.5 years of active deleveraging (see Figure 1).

- According to our estimates, the US$7bn increase in corporate foreign debt in 2Q20 was assured purely by the non-financial sector, which net attracted almost US$10bn (also a six-year high), while banks reduced their foreign debt by around US$3bn.

- The composition of the foreign debt increase by the non-financial sector appears to be evenly split between direct investment inflow, which may represent support to companies coming from non-resident shareholders, and regular foreign debt, including loans, trade finance, and other debt liabilities.

Figure 1: 2Q20 corporate foreign debt growth the highest since pre-sancions 1Q14

(Click on image to enlarge)

Source: Bank of Russia, ING

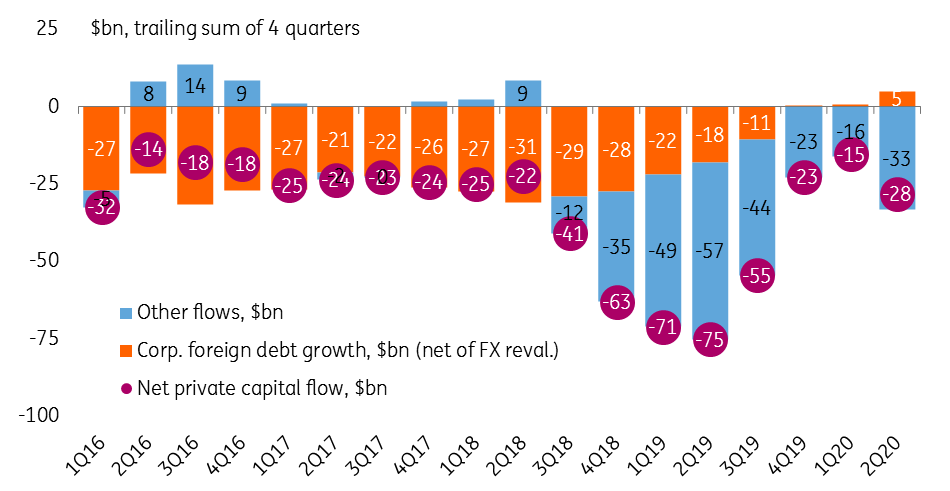

Foreign debt is not a stability concern, but it raises questions on the nature of 2Q20 capital outflows

An estimated US$7bn quarterly increase in the corporate foreign debt in 2Q20 is not a concern in terms of financial stability, especially following the nearly US$170bn net redemption seen since mid-2014 till the end of 1Q20. Meanwhile, taking into account the high US$12bn net capital outflow, also reported for 2Q20, it means that the increase in foreign liabilities has been outperformed by a larger deterioration of other capital flows (Figure 2), mainly the increase in international assets. The nature of this accumulation is unclear at this point. In the best case, the surprising accumulation of foreign assets may be technical and could be related to a shift in the dividend payout schedule due to the pandemic (affecting both current and capital accounts). However, in the worst case, it could reflect negative trends in local confidence.

Figure 2: The role of capital outflow unrelated to foreign debt redemption has increased

(Click on image to enlarge)

Source: Bank of Russia, ING

The surprisingly high US$7bn increase in corporate foreign debt in 2Q20 is no threat to financial stability, however, the fact that it did not prevent a noticeably high net capital outflow of US$12bn confirms the uncertainties regarding the Russian capital account for 2H20.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more