Russia: Consumption Recovery Supports Hawkish Central Bank Stance For Now

Consumer activity improved unexpectedly in January, presumably driven by year-end bonuses, longer holidays, lower foreign travel, and elevated inflationary expectations. This supports the Bank of Russia's recent hawkish guidance and challenges our view on an unchanged key rate in 2021. But the declining savings rate, upcoming relaxation of foreign travel, fiscal consolidation, and uncertainties around household income are still watch factors.

Retail trade drop narrows to -0.1% YoY in January, beating expectations

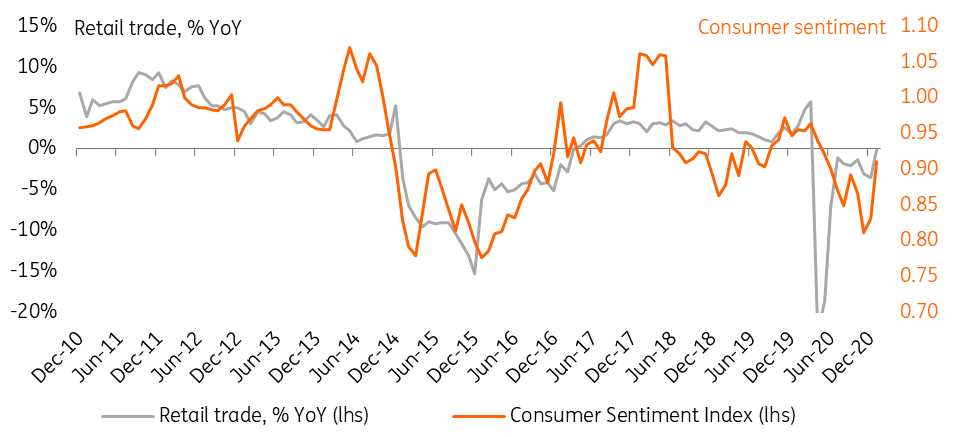

Russian retail trade posted a material improvement in retail trade dynamics from -3.6% year-on-year in December 2020 (and -4.1% YoY in FY20) to -0.1% YoY in January (Figure 1), i.e. came back to pre-Covid levels. This is considerably better than the -3.0% YoY Reuters consensus and our more conservative expectations of -4.0%. We see several possible reasons for the positive surprise:

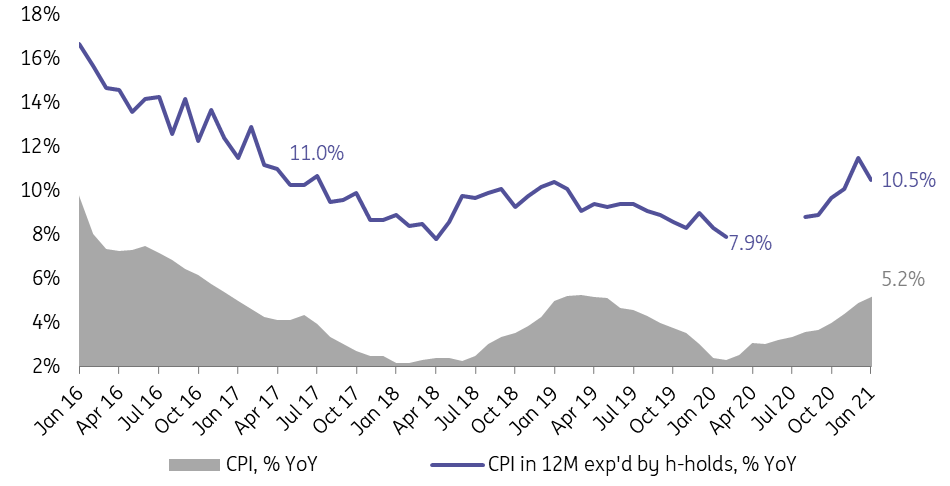

- Elevated inflationary expectations (Figure 2) due to ruble depreciation and higher agricultural prices, combined with news on skyrocketing shipping costs may have propelled pre-emptive purchases, especially in the non-food segment, where growth turned positive 0.9% YoY in January.

- Longer holidays (this year's New Year's 'blackout' lasted 10 days vs. 8 days a year ago) combined with foreign travel restrictions and lower availability of local leisure activities may have led to extra demand for food products: food retail dynamics improved from -4.5% YoY in December to -1.0% YoY in January.

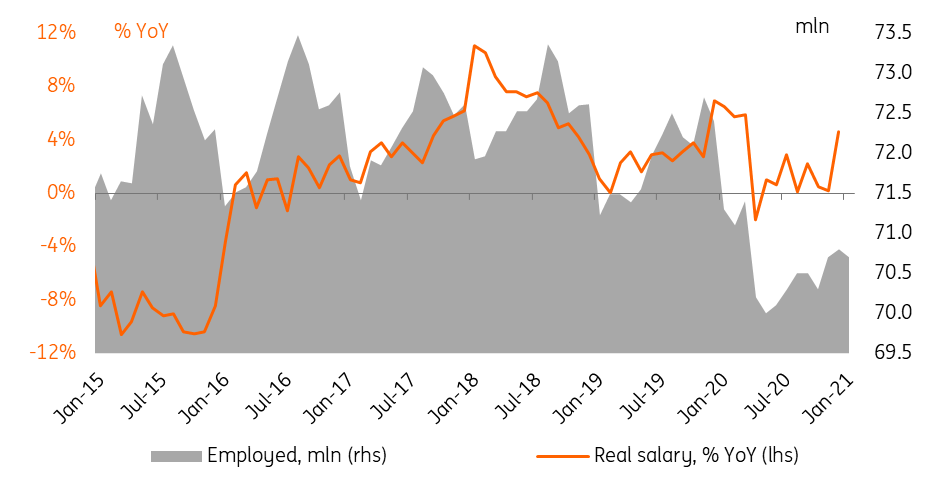

- While the income data for January is not yet available, it has turned out that December's salary performance was significantly higher than expected, with 4.6% YoY growth in real terms, much better than November's 0.2% YoY and market expectations of -1.5% YoY. The growth structure points at improvement across most of the sectors, which is a change vs. the outperformance of public sectors seen for the most of the year. This may reflect year-end bonuses and is the only truly positive income factor that we see from the dataset.

We are still cautious on the consumer trend

Acknowledging the positive surprise in the near term, we still remain cautious on the consumer trend in the medium to long term for several reasons:

- The situation on the labour market remains uncertain. The decline in the headline unemployment rate to 5.8% in January reflects a reduction in the labor force, not the number of the employed (Figure 3). The latter declined by 0.1 million in January to 70.7 million, close to the 2020 average of 70.6 million and much lower than 2019's 71.9 million.

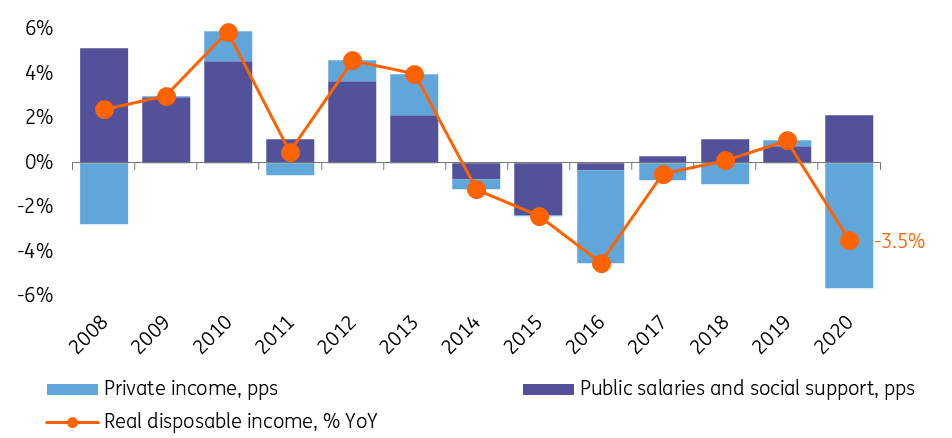

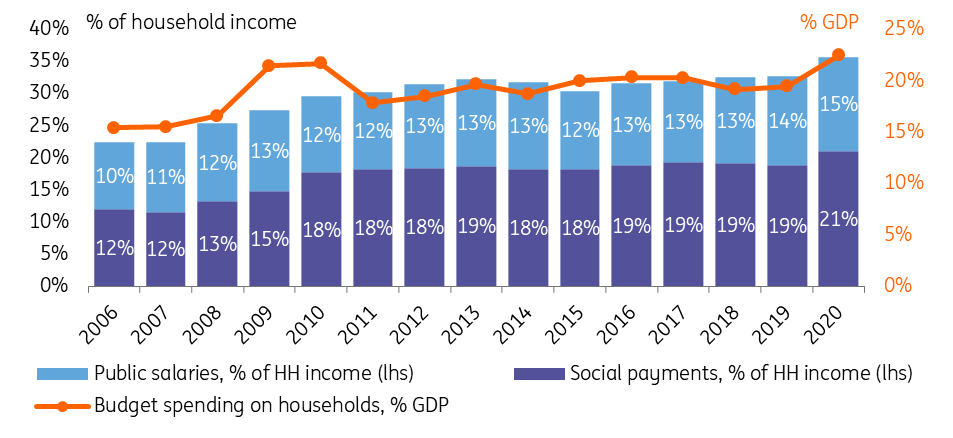

- The overall income structure appears weak. According to our estimates, the 3.5% drop in the real disposable income in 2020 was assured entirely by the 7.5% YoY drop in the private sector (including private sector salaries and other forms of transparent and grey income) and somewhat dampened by a 3.2% YoY increase in state-driven income, including public sector salaries, pensions and other social benefits (Figure 4). As a result, the share of household income directly dependent on the budget has increased to the historical high of 36% in 2020, up from 33% in 2019 and 22% in 2006.

- The fiscal room for additional social support appears limited, with 2020 enlarged budget spending at a post-2009 high of 40% GDP, and household income support measures at a historical high of 22% GDP (Figure 5), while a fiscal consolidation guided for 2021-23.

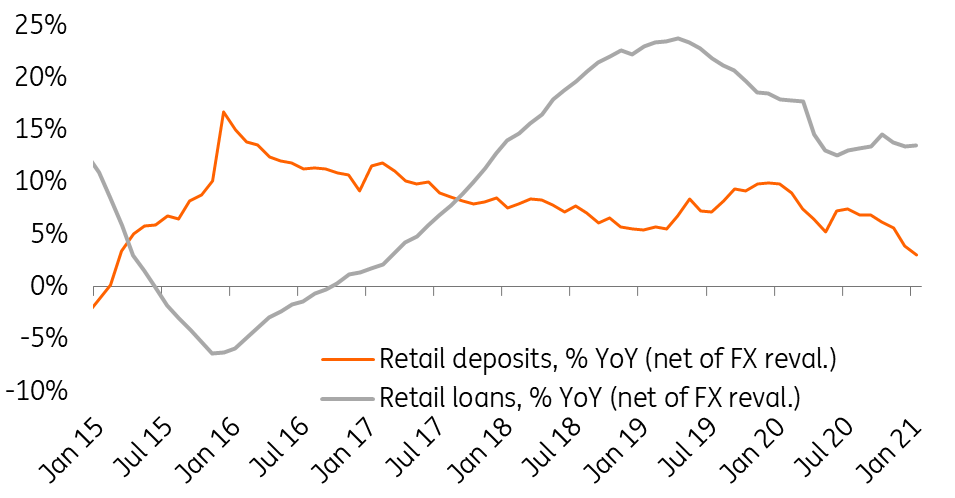

- The bank savings trend, while generally stable in the first half of last year, has eroded towards 2021 (Figure 6), with retail deposit growth dropping to 3.1% YoY in nominal terms (net of FX revaluation effect). While partially this may reflect the redistribution towards cash, real estate, and financial investments, erosion of income is also a potential contributor.

Figure 1: Consumer activity improved materially in January

(Click on image to enlarge)

Source: Bank of Russia, Rosstat, ING

Figure 2: Inflationary concerns could have contributed to higher spending

(Click on image to enlarge)

Source: Bank of Russia, Rosstat, ING

Figure 3: Year-end salary increase is positive, but labor market remains depressed

(Click on image to enlarge)

Source: Rosstat, ING

Figure 4: Income trend in private sector weakened materially in 2020

(Click on image to enlarge)

Source: Rosstat, ING

Figure 5: State support to household income at a historical high

(Click on image to enlarge)

Source: Rosstat, Finance Ministry, ING

Figure 6: Consumption is relying more heavily on lending and savings, rather than income

(Click on image to enlarge)

Source: Bank of Russia, ING

The case for unchanged key rate in 2021 challenged but still stands in the near term

The strong local consumption supports the Bank of Russia's recent hawkish guidance and challenges our view on an unchanged key rate in 2021. Lack of demand-driven disinflation should add to the list of reasons why the market discussion in the next couple of months will be dominated by the expectations of incoming key rate hikes. At the same time, given that the current trends in CPI, consumption, and income are likely to be distorted by a number of temporary factors, it would be premature to expect the Bank of Russia to take action in the near term.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does ...

more