Russia Balance Of Payments: Current Account Stable, Capital Flows Volatile

Russia's current account was stable in 3Q19 and is set to increase in 4Q19 on seasonality, providing some insulation for the ruble in 4Q19. The longer-term trend remains fragile as the private sector is showing persistent interest in the accumulation of foreign assets.

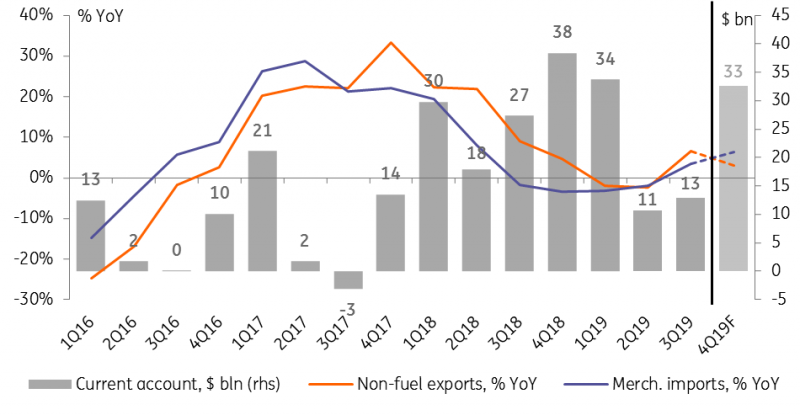

Non-oil exports and imports picked up in 3Q

Russia's current account surplus in 3Q19 totaled US$12.9 bn, fully in line with the consensus forecast and slightly higher than our US$12.0 bn expectations.

- The key positive development was the improvement in non-oil exports, which showed a 7% year-on-year growth in 3Q19 after a 2% YoY decline in 1H19. Although the positive financial effect from this was offset by a pick-up of merchandise imports to 4% YoY after a 3% YoY drop respectively, we attribute both to higher industrial activity.

- Oil exports moved in line with oil prices, suggesting little visible effect from the temporary cut in throughput on the Druzhba pipeline (accounts for 20% of Russia's oil exports).

The current account composition removes some of our near-term concerns about the non-oil current account performance. Based on seasonality of the trade balance, we expect the current account to expand to US$33 bn in 4Q19 in case of an oil price recovery according to ING's house view or to US$26 bn if oil prices stay at the current level. The expected FX purchases by the Central Bank of Russia/Ministry of Finance will offset only 30-40% of the current account in 4Q19 vs over 100% in 2-3Q. This could provide better insulation to RUB in 4Q19 than in the previous months depending on the capital flow dynamics.

Key current account parameters: surplus, non-oil exports, imports

(Click on image to enlarge)

Source: Bank of Russia, ING

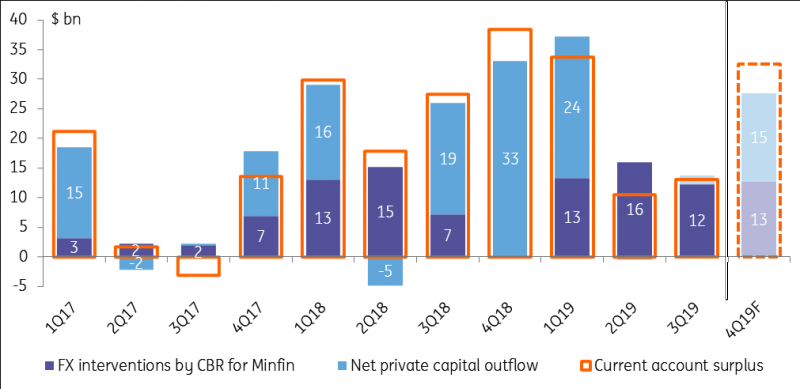

Net private capital flows remain a concern

The private capital account continues to show weakness. At first glance, the headline US$1.4 bn net private capital outflow for 3Q19 may seem like a small number and suggests a decline in the cumulative 4-quarter outflow from US$75 bn as of mid-2019 to US$58 bn as of 1 October 2019. However, it mirrors the decline in the cumulative current account from US$110 bn to US$96 bn respectively. Also, to remind, the large US$19 bn net private capital outflow seen in 3Q18 was a reaction to the spike in sanction risks last year and therefore does not qualify as an adequate frame of reference for 3Q19.

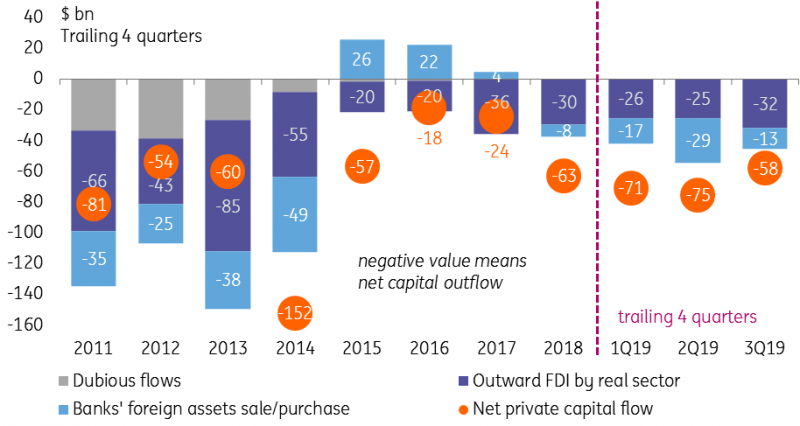

The structure of the private capital account does not show signs of sustainable improvement as well. While the Bank of Russia has yet to release the foreign debt data, some preliminary conclusions on the foreign asset side can already be made.

- We note that the banking sector reduced its foreign asset position by US$7 bn in 3Q19 following 4 straight quarters of accumulation, being the primary source of improvement in the cumulative 4-quarter capital outflow by the private sector. However, it remains unclear whether this change represents a sustainable improvement, and historical performance suggests high volatility of this component depending on the global market mood and other factors.

- The non-financial sector, on the contrary, is showing consistently high interest to accumulation of direct foreign assets, with another US$8 bn purchased in 3Q19, in line with the multi-year quarterly average. We take it as a sign that there is still no improvement in local private investment demand.

Based on the capital account trends, we expect most of the residual current account surplus in 4Q19 (left after FX purchases) to be used to finance further accumulation of foreign assets. With US$25 bn net private capital outflow in 9M19, we find Bank of Russia's US$40 bn expectations for the full year to be realistic. We do not see it as an obstacle to our year-end USDRUB expectations of 64.0, but for the longer-term perspective, the capital account trend can be a risk factor.

Current account surplus vs. FX interventions and net private capital outflow

(Click on image to enlarge)

Source: Bank of Russia, Finance Ministry, ING

Net private capital outflow: related to accumulation of foreign assets and total

(Click on image to enlarge)

Source: Bank of Russia, ING

The 3Q19 removes some of our concerns regarding the strength of the current account and supports a constructive view on RUB for 4Q19 we expressed earlier this month. However, the continued accumulation of foreign assets by the private sector highlights the lack of local investment demand by the private sector. If left unaddressed, it will leave RUB vulnerable to swings in the volatile portfolio inflows.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more