Rates Spark: Waiting Game

Thursday's events loom large. US inflation data will test the strong footing of US rates, but in the meantime, treasury supply could bring along some curve steepening. A 10Y Italy deal today will test sentiment for EUR rates ahead of the ECB meeting, where the bar for a dovish surprise has been set high.

US rates eye treasury supply ahead of inflation data

US Treasuries remain firm at the start of the week. The prospect of treasury supply, starting with a 3Y sale today, 10Y tomorrow and 30Y on Thursday could start to exert some steepening pressure. But if there is anything that at least has the potential to materially change the picture, it is the inflation data on Thursday. Indeed we find the firm footing of US rates heading into a week that could see inflation flirting with 5% quite remarkable.

But then there are other factors contend with, some more technical, like the huge amount of excess reserves flushing the market, and others more relative value, where treasuries still look attractive in the global (currency hedged) context, that can help explain where US rates currently are.

Italy tests the waters ahead of the ECB

The consensus ahead of the ECB meeting on Thursday has pretty much settled on the view that the Governing Council will keep the faster pace of asset purchases via the pandemic emergency purchase programme for another quarter. In terms of the overall programme envelope left there is room enough to maintain the current PEPP pace even until year end, though that would leave little wiggle room thereafter

Italy is cashing in on the ECB's pre-meeting expectations management

(Click on image to enlarge)

Refinitiv, ING

There is room enough to maintain the current PEPP pace even until year end

Still, it sets a high bar for a dovish surprise, which might have played a role in the decision of the Italian treasury to announce the syndicated sale of a new 10Y benchmark. The market reacted by widening the 10Y spread over Bunds by around 2bp in a clear break of its recent tightening trend. But at 111bp it is still well off its May peak around 122bp which reflects the more dovish perception of the central bank since then.

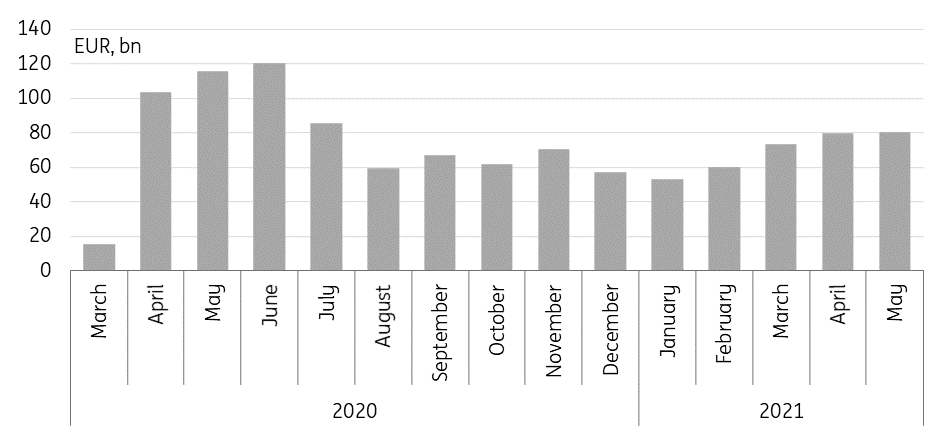

ECB monthly PEPP purchases hit €80bn target in May

(Click on image to enlarge)

ECB, ING

The ECB kept PEPP purchases at €80bn in May

ECB data on monthly PEPP purchases in May hit €80.7bn, as was to be expected under the accelerated pace announced in March. The ECB also released its more detailed bi-monthly data set for April and May combined, but not that it told a whole new story this time around. Public sector assets account for the bulk of net PEPP purchases with €165bn bought over the past two months compared to €4bn in corporate bonds over the same time horizon. Commercial paper holdings continued to roll off with the ECB now only having €4.6bn left on its books.

Public sector assets account for the bulk of net PEPP purchases

Within the public sector the ECB largely stuck to the capital key subscription when distributing purchases across jurisdictions. There was a continued, albeit subtle, overbuying in the more liquid bond markets as the ECB appears to have difficulties in sourcing paper from very small Eurozone countries. The share of Italian paper bought did increase slightly, but we would argue that the ECB reserves any larger deviation from the capital key for emergencies, rather than trying to micro-manage bond spreads via this lever. While that provides an implicit cap, the near term positive impact on Italian bond spreads versus Bunds comes via the overall pace of asset purchases to be decided this week again.

Today’s events and market view

Data calendars do not feature any top tier data today and central bankers are in their communications black-out period. That will leave the focus on supply where the highlight is the 10Y deal from Italy. It will be a bit of a test also for the broader eurozone rates market and whether it can withstand upward pressure, not least as the deal will be accompanied today by supply in the same maturity bucket from the Netherlands and Austria (alongside a 4Y). Germany will also tap a 7Y bond.

In the broader supply context, eyes are also on the EU, ahead of an anticipated 10Y sale next week as a first financing transaction for the NGEU. Today the EU will hold investor calls for the transaction as well as this year’s funding plan which sees €80bn of bond issuance.

The US treasury kicks off this week’s supply with a US$58bn 3Y note sale today.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more