Rates Spark: The Real Proportionality Debate

The real question about ECB QE is: would it be enough for the rates market to weather a second covid wave. Our answer is not without modifications. Germany updated its 3Q funding plan – we now estimate total 2020 bond issuance could reach €270bn. In the US, the Fed's corporate bond buying programme remains bigger in name than in practice – we look at the numbers.

.png)

The real proportionality debate

Sentiment is catching up with the rise in Covid-19 cases in the US and in various corners of the world. In Europe, this comes at a time when markets are finding closure with regards to the implications of the German Constitutional Court’s (GCC) ruling on the proportionality of PSPP, one of the ECB’s QE programmes. ECB officials, led by Isabel Schnabel, have been at pains to demonstrate that their decision does indeed pass the proportionality test. These interventions chime with reports that the German finance ministry and the Bundestag concluded that the ECB has fulfilled the GCC's requirements.

Altogether, this should contribute to boosting the credibility of the ECB’s QE response, and serve to maintain its benefits. This is just as well. As this debate is being settled, a new, more important one is about to take place: is the set of measures enough to shield markets and the Eurozone economy from a second wave of covid infections. The second question on the economic impact is outside of our realm of competence, although we suspect the answer has to depend on the magnitude of the fiscal response.

EUR markets would look for longer PEPP reinvestments

On the first question, whether the measures in place can help markets weather another coronavirus onslaught, we are inclined to answer in the negative. In her robust defence of QE, Schnabel stressed the existence of safeguards built in the Pandemic Emergency Purchase Programme. The capital key in particular remains ‘an important compass’ in the allocation of purchases between sovereigns. The implication that the ECB would seek to rebalance its portfolio away from peripheral markets into core is no surprise but raises the question of whether it is possible in the timeframe currently highlighted: by end-2022.

The ECB has left the door open to easing further, something our economics team thinks is a distinct possibility. Greater purchases, and presumably further capital key deviation, should probably include an extension of the reinvestment horizon to prevent markets from assuming a quick reversion to the capital key allocation. The suggestion by other officials that the whole PEPP €1.35tn ‘envelope’ might not be spent if its goals are reached has long been a bugbear of ours. We think the improvement in sovereign and money market conditions have been achieved because investors are convinced that the ECB will use its tools to their full potential, casting to one side the safeguards if necessary.

We expect these points will need clarifying if Covid-19 gains a firmer foothold in Europe again. For now, we stick to our view that peripheral spreads have room to tighten but we would guard against any display of confidence by ECB members. For core and swap rates, we see the near-term outlook as skewed to the downside.

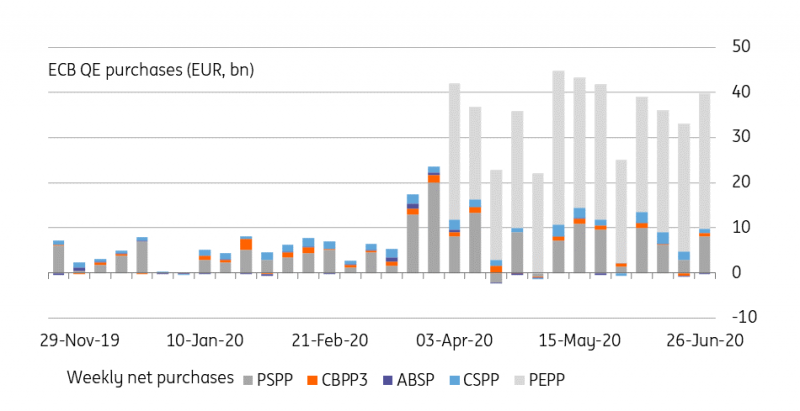

ECB purchases maintain a strong pace

Source: ECB, ING

Updated funding plans for Germany and the Netherlands

Germany approved its €130bn additional stimulus package yesterday, alongside an increase in this year’s net borrowing to €218bn. With the release of the debt agency’s 3Q issuance calendar, investors got more clarity on how this debt will be financed: As has been the case in the second quarter, bills issuance in the third quarter is ramped up noticeably, increasing by €56.5bn from initial plans to €72bn. In bonds the agency plans to raise €74bn via regular bond auctions, up €33bn from the initial plan. The plan is also to issue Germany’s first green bond via syndication, a 10Y maturity with an initial volume of at least €4bn designed as a green “twin” to the exiting bond maturing in August 2030.

Taking into account a rough guidance that 4Q issuance would be in the similar range as 2Q/3Q we believe total gross bond issuance for 2020 could reach up to €270bn. This includes a 5Y green bond that has been flagged for the fourth quarter with further maturities to be added to the green curve next year. Recall that Germany had started 2020 with a bond issuance target of €155bn.

The Netherlands provided an updated funding guidance at the end of last week. Following new budget figures including a €3bn deficit increase, the bond issuance target for the year was upped to a minimum of €40bn. The launch of a new 30Y bond was penciled in for September/October.

Fed's corporate buying programme light but expansive

Details of the Fed's buying of corporates show some USD428m in corporate bonds have been bought so far - miniscule relative to a USD10tr corporate bond market capitalisation. Still, the notion that the Fed is "buying direct" has a positive qualitative effect on the market mindset. The breakout shows a 35% weighting in consumers, 10% in technology and some 9% in utilities.

But in any case the stretch is across the corporate bond space to reflect a broad market index, with the object of showing neither favour nor disfavor. The stated weightings are more reflective of market volumes than of market capitalisation. Press headlines questioning the Fed's buying in big household names that don't need help should be contextualised against this.

Market impact is not dramatic at all. The rates market remains unimpressed, and the Fed's programme has not prevented credit spreads from re-widening in the past month.

Details of the ETF buying programme show some USD6.8bn spent so far, and of this some 12% has been in high yield. This marks a slight easing in buying in high yield, as it had been running at 17%. High yield buying in the direct bond buying programme is lower, at 3.6%. And the average maturity in the bond buying programme is 3.3 years, slightly above the 2.8 year average laid out in the broad market index. Holdings will of course roll down the curve towards 2.8 years. The high yield bond component weighting is also slightly above the broad market index (2.8%).

In terms of the size done in ETFs, it is quite minor relative the the USD ETF bond market at around USD900bn, but is still proportionally more important than the bond buying done so far in terms of impact. The market impact is not dramatic at all. The rates market remains unimpressed, and the Fed's programme has not prevented credit spreads from re-widening in the past month.

Today's events: Central bank speakers, EZ inflation and US consumer confidence

The focus is on central bank speakers. This side of the Atlantic ECB's Schnabel as well as BoE's Cunliffe and Chief Economist Haldane will speak today. In the US the Fed's Powell will appear before the House financial panel together with Treasury Secretary Mnuchin. In data the calendars feature US consumer confidence and Eurozone flash inflation releases.

Primary markes see Italy (5Y, 10Y and floater taps) and Germany (7Y tap) being active.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more