Rates Spark: Europtimism

While difficult to pinpoint the exact triggers of yesterday's rates-sell off in the Eurozone, it did happen against a backdrop of growing optimism and an accelerating vaccine roll out. The tightening UST-Bund spread showed EUR rates had some catching-up to do, but in our bearish rates view this dynamic is unlikely to be sustained.

The backdrop justifies higher rates, but yesterday's trigger is hard to pinpoint

Yesterday saw 10Y Bunds selling off by 6bp in the peak, reaching a yield high of 0.22%, and thus levels not seen since end of February. Bunds have also underperformed versus swap rates by more than one basis point.

Fingers have been pointed to a number of possible triggers for the move, including political developments in Germany which have underscored the growing importance of the Green party while the CDU/CSU struggled over its top candidate for the upcoming elections. Prospects of at least a Green finance minister in a future coalition government let markets speculate on larger deficit spending, pro-growth policies, and further European integration, further down the road.

We find it difficult to pin it down to specific triggers, but note that yesterday’s move happened against a backdrop of growing optimism over the accelerating vaccine roll out in the Eurozone. The risk is that even the ECB later this week could acknowledge this during its press conference, although we think the central bank’s aim should rather be to bridge the time until the June meeting, when the pace of its asset purchases is up for reassessment, without causing too much of a hiccup.

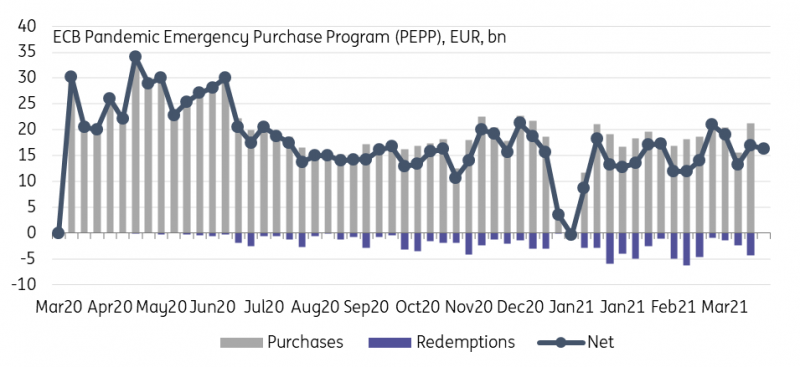

Net PEPP buying by the ECB slows slightly

ECB net buying under the Pandemic Emergency Purchase Programme (PEPP) has slowed compared to the previous week. The net figure might again be distorted to the downside by larger bond redemptions so we could actually see a larger gross figure today. Nonetheless we think that slower net buying in light of rates creeping higher underscores the ECB's reluctance to micromanage markets and even let rates rise if that is deemed justifiable by an improving backdrop.

Our bearish rates view leaves little room for extended UST-Bund retightening

EUR rates did have their moment in the sun in April with the 10Y UST-Bund spread tightening toward 180bp as Europe finally emerged from the gloom of the third Covid wave to catch up again with developments in the US. We would point out that the 10Y UST-Bund, before retreating this month, had rewidened to its pre-pandemic level of around 200bp. This might have been a natural first target for many players in that spread. The US rates markets themselves might have entered a phase of taking stock, not just of domestic developments surrounding the legislative process surrounding the government’s infrastructure plans but perhaps also of more global developments and risks. On a weekly basis global new infections have reached a pandemic record and new variants are gaining traction.

Overall, we think that the backdrop provided by US economic outlook, validated again by recent strong data, should see rates rising further. In our bearish base case scenario for rates, we also see little room for an extended retightening of the UST-Bund spread. We see a wider spread as US rates should again lead the increase.

Today's events and market view

With little on the data calendars and central bank officials turning quiet ahead of their respective policy setting meetings EUR and US rates will have to look for other triggers to determine immediate direction. We think the overarching theme remains that of further rising rates.

The EU has yesterday mandated a new 15Y bond which should be today’s business. This comes on top of Germany reopening a 2Y bond for €5bn and Finland tapping a 20Y bond for €1bn.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more